CHFCZK (Swiss Franc vs Czech Koruna). Exchange rate and online charts.

Currency converter

19 Jun 2025 07:37

(0.01%)

Closing price, the previous day.

Opening price.

The highest price over the last trading day.

The lowest price over the last trading day

Price range high in the last week

Price range low in the last week

CHF/CZK is not the most popular trading instrument in the forex market. However, this currency pair may well diversify the portfolio of any trader, as well as bring its holder a profit.

CHF/CZK is a cross rate against the US dollar. A cross rate is a forex market price made in two currencies that are both valued against a third currency – USD. In other words, the greenback is not included in the currency pair but its exchange rate is greatly affected by it. For example, if we compare USD/CHF and USD/CZK charts, they can predict a possible movement of CHF/CZK.

Features of CHF/CZK

Switzerland’s economy has been stable for years. For that reason, the Swiss franc is considered one of the world’s most reliable and trustworthy currencies.

The Swiss franc is the safe-haven asset investors turn to at the time of financial upheaval.

Therefore, at the time of crises, when investors rush to transfer their capital to Switzerland, CHF shows an exponential increase against the basket of currencies. Traders should always keep in mind this feature of the Swiss economy when trading the instrument.

The Czech Republic is one of the most developed industrial countries in Central Europe. Its residents enjoy high incomes thanks to the country’s buoyant economy.

The Czech Republic has achieved impressive results in sectors such as mechanical engineering, steel and cast iron production, chemical, electronics, brewing, and agriculture. However, its automotive industry is considered the most developed economic field (cars are mainly exported). Above all else, the Czech Republic is one of the leading exporters of beer and footwear.

Aspects of trading CHF/CZK

Speaking of CHF/CZK, the trading instrument is relatively illiquid compared to the major currency pairs (EUR/USD, USD/CHF, GBP/USD, and USD/JPY). For that reason, to make an accurate forecast for CHF/CZK, it is important to pay attention to the currency pairs where each currency of the instrument is traded against USD.

In addition, it is also essential to analyze the US economic indicators, like interest rates, GDP, unemployment, Nonfarm Payrolls, etc.

Importantly, when trading cross currency pairs, traders should carefully consider the broker’s trading conditions on the given financial instrument. The spread for cross currency pairs is usually higher.

See Also

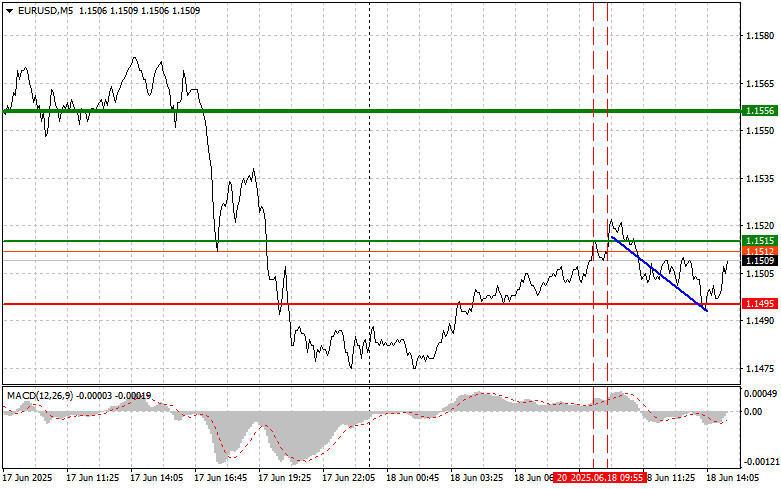

- EUR/USD: Simple Trading Tips for Beginner Traders – June 18th (U.S. Session)

Author: Jakub Novak

19:01 2025-06-18 UTC+2

1258

The GBP/USD exchange rate remained nearly unchanged throughout Wednesday, following a 100-basis-point drop the previous day.Author: Chin Zhao

20:01 2025-06-18 UTC+2

1183

The NZD/USD pair is regaining positive momentum on Wednesday amid moderate U.S. dollar weakness.Author: Irina Yanina

19:16 2025-06-18 UTC+2

1138

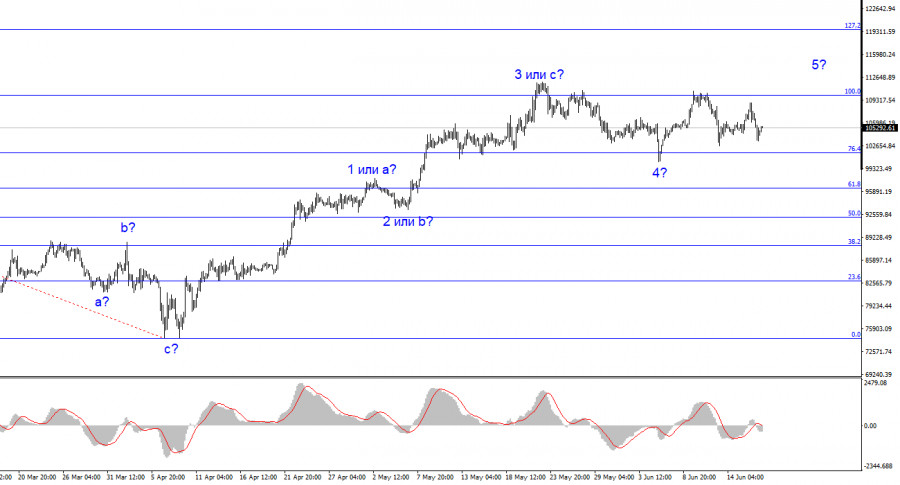

- BTC/USD has considerably gained value over the past two and a half months.

Author: Chin Zhao

15:34 2025-06-18 UTC+2

1138

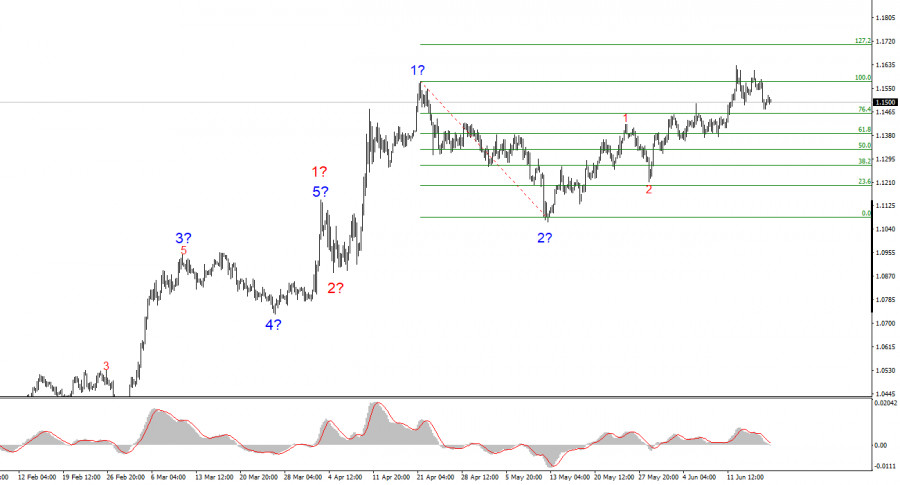

The EUR/USD pair rose by 20 basis points on Wednesday, but the most significant market action is both behind and ahead.Author: Chin Zhao

19:56 2025-06-18 UTC+2

1123

The Bank of Japan has signaled a more cautious approach to unwinding its decade-long monetary stimulus program, citing uncertainty in the country's economic growth.Author: Irina Yanina

19:43 2025-06-18 UTC+2

1123

- Silver enters a bullish consolidation phase

Author: Irina Yanina

19:13 2025-06-18 UTC+2

1108

Technical analysis / Video analyticsForex forecast 18/06/2025: EUR/USD, USD/JPY, USDX, GOLD and Bitcoin

Technical analysis of EUR/USD, USD/JPY, USDX, GOLD and BitcoinAuthor: Sebastian Seliga

18:24 2025-06-18 UTC+2

1078

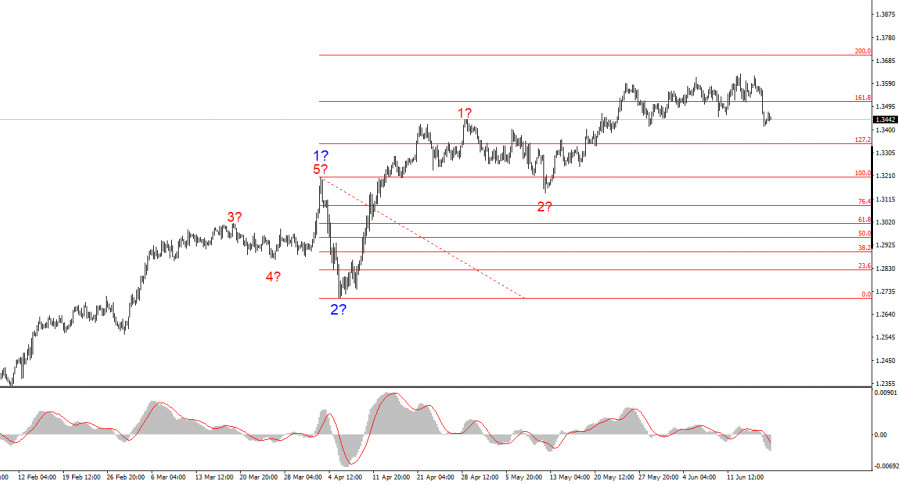

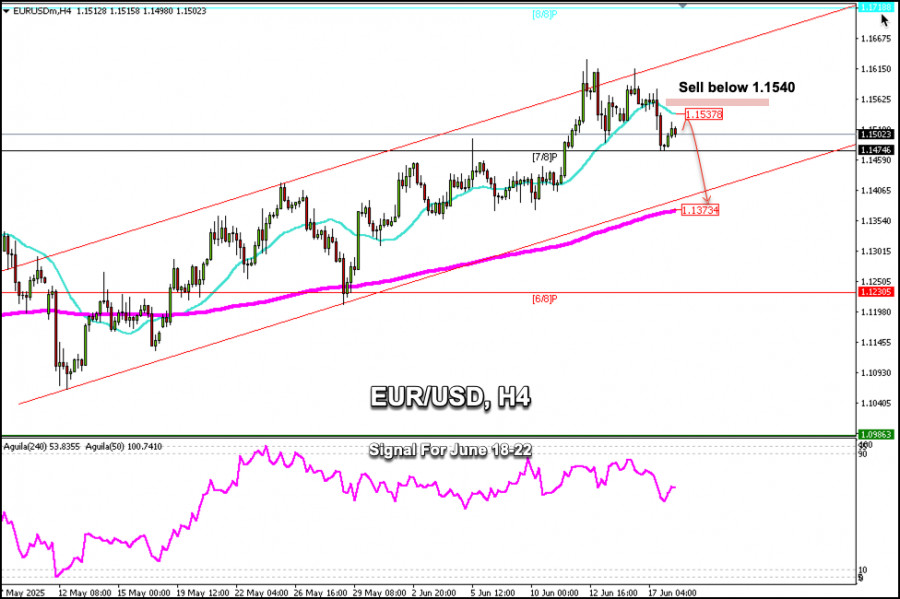

Technical analysisTrading Signals for EUR/USD for June 18-22, 2025: sell below 1.1540 (21 SMA - 7/8 Murray)

Technically, the EUR/USD pair could experience a strong technical correction in the coming days and could even close the gap it left at 1.1140.Author: Dimitrios Zappas

14:16 2025-06-18 UTC+2

703

- EUR/USD: Simple Trading Tips for Beginner Traders – June 18th (U.S. Session)

Author: Jakub Novak

19:01 2025-06-18 UTC+2

1258

- The GBP/USD exchange rate remained nearly unchanged throughout Wednesday, following a 100-basis-point drop the previous day.

Author: Chin Zhao

20:01 2025-06-18 UTC+2

1183

- The NZD/USD pair is regaining positive momentum on Wednesday amid moderate U.S. dollar weakness.

Author: Irina Yanina

19:16 2025-06-18 UTC+2

1138

- BTC/USD has considerably gained value over the past two and a half months.

Author: Chin Zhao

15:34 2025-06-18 UTC+2

1138

- The EUR/USD pair rose by 20 basis points on Wednesday, but the most significant market action is both behind and ahead.

Author: Chin Zhao

19:56 2025-06-18 UTC+2

1123

- The Bank of Japan has signaled a more cautious approach to unwinding its decade-long monetary stimulus program, citing uncertainty in the country's economic growth.

Author: Irina Yanina

19:43 2025-06-18 UTC+2

1123

- Silver enters a bullish consolidation phase

Author: Irina Yanina

19:13 2025-06-18 UTC+2

1108

- Technical analysis / Video analytics

Forex forecast 18/06/2025: EUR/USD, USD/JPY, USDX, GOLD and Bitcoin

Technical analysis of EUR/USD, USD/JPY, USDX, GOLD and BitcoinAuthor: Sebastian Seliga

18:24 2025-06-18 UTC+2

1078

- Technical analysis

Trading Signals for EUR/USD for June 18-22, 2025: sell below 1.1540 (21 SMA - 7/8 Murray)

Technically, the EUR/USD pair could experience a strong technical correction in the coming days and could even close the gap it left at 1.1140.Author: Dimitrios Zappas

14:16 2025-06-18 UTC+2

703