Voir aussi

08.01.2024 02:24 PM

08.01.2024 02:24 PMThe previous trading week ended with minimal bonuses for Bitcoin and significant stress for investors. Due to high levels of volatility, spurred by the anticipation of BTC-ETF approval, the cryptocurrency's price made several severe jumps, leading to substantial liquidations of traders' positions. Despite this, sentiments in the crypto market remain positive, instilling optimism at the start of the new trading week.

Bullish sentiments are also clearly visible on the Bitcoin price chart, where we see a 4.5% increase in quotes over the last seven days. The new trading week also started with a local increase of more than 1.2%, thanks to high buying activity from Asian investors. Given the high level of expectations for BTC, in connection with the potential approval of BTC-ETF, there is every reason to expect sustained bullish sentiments in the current trading week.

Obviously, the main focus of crypto investors will be on the SEC and its decision regarding the approval of a spot BTC-ETF. Investors did not receive the desired response from the regulator at the end of last week, but judging by the fact that Bitcoin's price has recovered above the $44k level, optimism remains. It is quite possible that the Commission will announce the results of the applications review this trading week. The only new news on this matter is the SEC's statement that the agency has no objections to the updated applications for launching BTC-ETF.

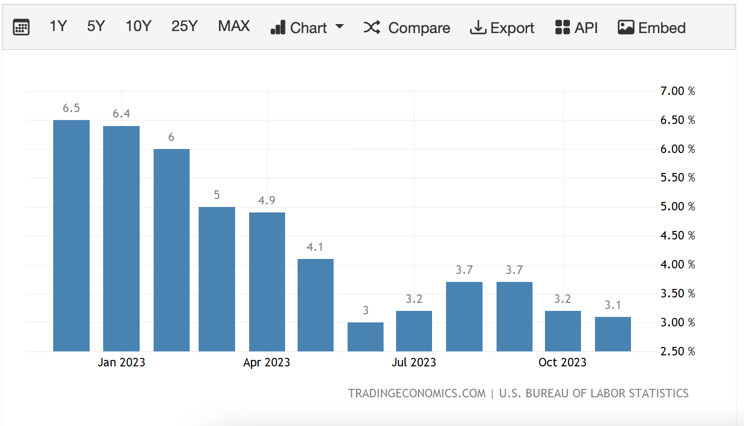

Despite the high level of anticipation for the spot crypto product, the main and more long-term influence on Bitcoin quotes will be inflation data. On Wednesday, January 10th, consumer price index data will be published, giving investors an idea of the Fed's further actions. It should be noted that positive sentiments have been reigning in the financial markets for over a month due to growing confidence that the regulator will begin to relax monetary policy.

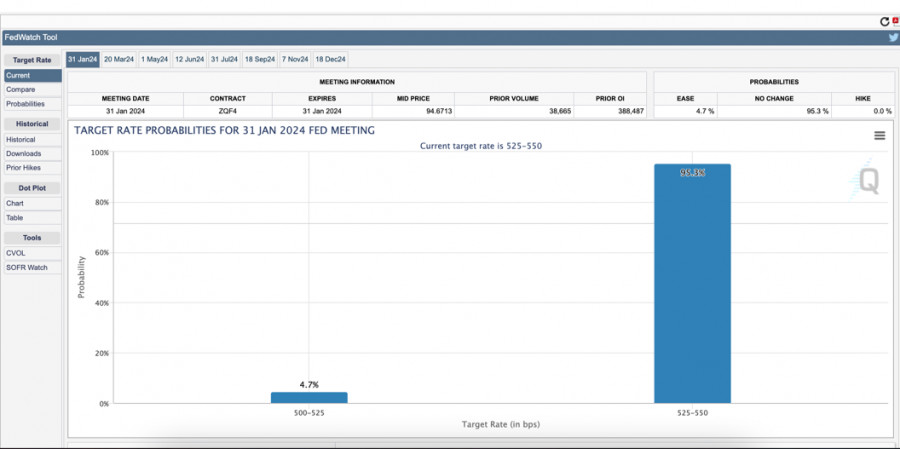

The latest labor market data also indicate that the U.S. economy is starting to contract, and the Fed must take this factor into account. Meanwhile, some members of the agency have stated that there is a possibility of another step in raising the key rate. Representatives of the Fed also noted that the reduction of the rate will not occur before the final quarter of 2024. Despite the tough rhetoric, Fedwatch data indicate that investors expect the first easing of monetary policy as early as the March meeting.

Bitcoin may have a bullish week if the Consumer Price Index (CPI) continues to decline, signaling the success of the Fed's actions. This, in turn, will provide more reasons to shift towards a policy of interest rate easing and cause a local bullish surge in the crypto market. In this case, even if the SEC does not approve any applications or the launch of BTC-ETF becomes a "sell the news" event, Bitcoin has every chance to continue its upward movement.

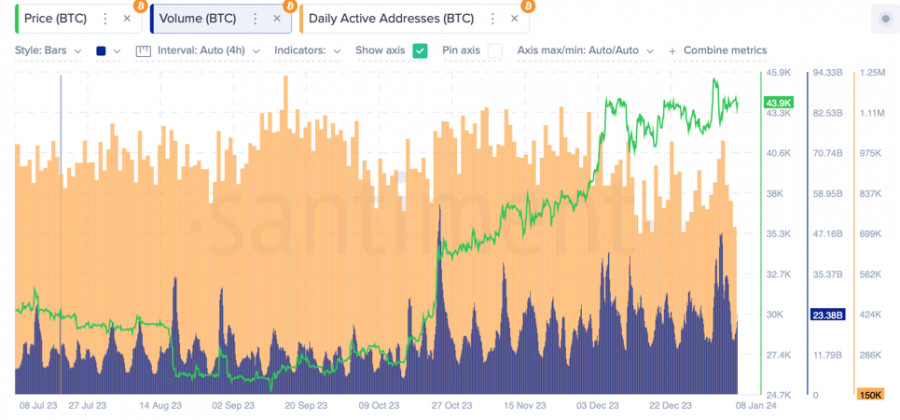

Meanwhile, institutional investors continue to accumulate BTC coins in anticipation of the SEC's decision on ETFs. Thanks to this, Bitcoin recovered above $43.5k over the weekend, and as of January 8th, it is trading near the key level of $44k with daily trading volumes around $23 billion. The fear and greed index is at 67, indicating high buying activity and belief in further growth of BTC/USD.

Most likely, Bitcoin's price will continue its upward movement towards the $45k level, which will be the key target for bulls. If it consolidates above this level, buyers can move towards $46k and higher. Given the presence of strong fundamental factors and high buying activity, Bitcoin is capable of updating its local high above the $46k level.

Bitcoin starts the new trading week with high hopes, as bullish sentiments remain strong. The presence of potentially positive fundamental factors significantly increases the cryptocurrency's chances of a successful upward movement to $45k and higher. Considering these facts, an eventful trading week can be expected with high liquidity in the BTC market, high levels of volatility, and updates of price highs.

You have already liked this post today

*The market analysis posted here is meant to increase your awareness, but not to give instructions to make a trade.

Malgré la correction en cours, le sentiment des investisseurs envers l'achat d'actifs cryptographiques reste positif, comme l'indique le soi-disant indice Fear & Greed, qui, comme nous l'avons noté précédemment

Bitcoin et Ethereum ont poursuivi leurs corrections, chutant de manière significative tout au long de la journée d'hier. La baisse s'est prolongée jusqu'à la session asiatique d'aujourd'hui, Bitcoin actualisant

L'annonce que Cantor Fitzgerald, l'un des plus grands négociants principaux aux États-Unis, lance des prêts adossés au Bitcoin a transformé le marché des cryptomonnaies. Gérant 2 milliards de dollars

Your IP address shows that you are currently located in the USA. If you are a resident of the United States, you are prohibited from using the services of InstaFintech Group including online trading, online transfers, deposit/withdrawal of funds, etc.

If you think you are seeing this message by mistake and your location is not the US, kindly proceed to the website. Otherwise, you must leave the website in order to comply with government restrictions.

Why does your IP address show your location as the USA?

Please confirm whether you are a US resident or not by clicking the relevant button below. If you choose the wrong option, being a US resident, you will not be able to open an account with InstaTrade anyway.

We are sorry for any inconvenience caused by this message.