Voir aussi

16.06.2022 02:44 PM

16.06.2022 02:44 PMThe GBP/USD pair showed notable growth yesterday after the US Federal Reserve raised the rate by 75 instead of 50 basis points as was previously expected. Probably, the scenario of a rate hike of 75 basis points has already been priced in by the USD traders. How else can we explain such a sell-off in the US dollar? On the other hand, the same situation happened after the two previous rate hikes. The only difference was that traders were selling the greenback because the rate increase came in line with expectations. Yesterday, however, the Fed made a more aggressive move.

Yet, it seems that the pound bulls won't celebrate this victory for too long. Today, the Bank of England is due to announce its decision on the rate which is likely to be raised by only 25 basis points. However, if the UK regulator hikes the rate by 50 basis points instead of 25, this will definitely prompt the strengthening of the British currency. A lot will depend on the meeting minutes and the rhetoric of BoE's Governor Andrew Bailey. And now let's have a look at the GBP/USD chart.

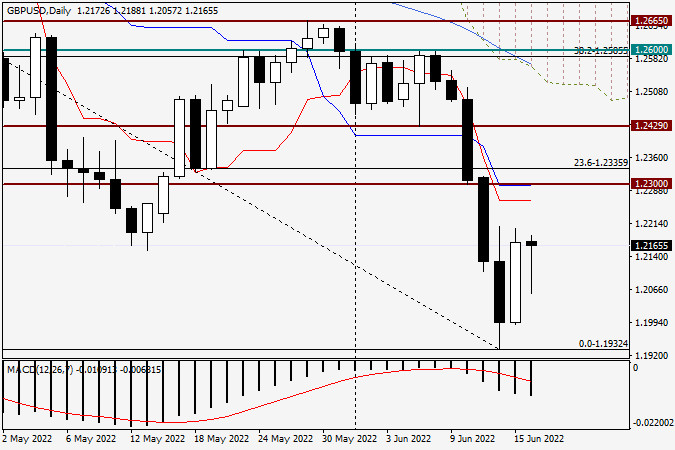

Daily chart

In yesterday's session, the pound/dollar pair notably advanced and closed the day at the level of 1.2172. Therefore, my assumptions about a corrective pullback towards 1.2200 and even 1.2300 made sense. At least, the price closely approached the level of 1.2200. Today, the pair has already pulled back to 1.2057, creating an opportunity to buy the pound. At the moment of writing, the pound/dollar pair is rapidly recovering from recent losses. Moreover, today's daily candlestick has formed a rather long lower shadow. However, when the BoE releases its decision on the rate, the technical picture for GBP/USD may change dramatically. You should keep this in mind and trade accordingly.

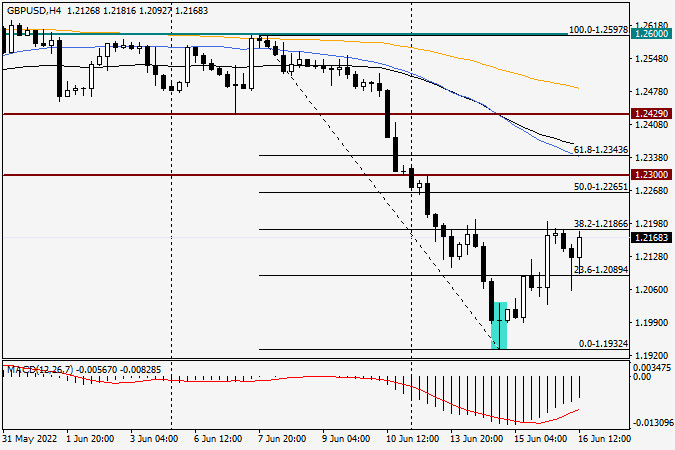

H4 chart

On the 4-hour chart, the reversal candlestick pattern called the Long-legged Doji that I mentioned yesterday has caused the required reaction in the market. In other words, traders took this signal into account, and the price began to rise. According to the Fibonacci grid stretched on a decline between 1.2597 and 1.1932, the pair managed to pull back to the 38.2 Fibonacci retracement. At this point, the price has faced strong resistance from sellers just below the level of 23.6. A very long shadow of the previous candlestick on the 4-hour chart and the current rise give hope that yesterday's uptrend can continue. It is quite obvious, though, that the trajectory of the pair today will mostly depend on the Bank of England's decision. That is why I wouldn't give any specific recommendations on trading the GBP/USD pair. One thing is for sure - today's volatility will be extremely high, so you should be very cautious.

Good luck!

You have already liked this post today

*The market analysis posted here is meant to increase your awareness, but not to give instructions to make a trade.

Liens utiles : Mes autres articles sont disponibles dans cette section Cours InstaForex pour débutants Analytique Populaire Ouvrir un compte de trading Important : Les débutants en trading forex doivent

Avec l'apparition du motif Bullish 123 au milieu des conditions d'affaiblissement de cette paire de devises exotiques, qui a été confirmée par le mouvement du prix USD/IDR évoluant dans

Sur le graphique 4 heures de l'instrument de la matière première du pétrole brut, une divergence apparaît entre le mouvement du prix de #CL et l'indicateur Stochastic Oscillator. Cela indique

Dans le scénario opposé, si l'euro tombe en dessous de 1.1490, il est probable qu'il atteindra la moyenne mobile exponentielle (EMA) de 200, située à 1.1340 et qui coïncide avec

Comptes PAMM

InstaForex

Your IP address shows that you are currently located in the USA. If you are a resident of the United States, you are prohibited from using the services of InstaFintech Group including online trading, online transfers, deposit/withdrawal of funds, etc.

If you think you are seeing this message by mistake and your location is not the US, kindly proceed to the website. Otherwise, you must leave the website in order to comply with government restrictions.

Why does your IP address show your location as the USA?

Please confirm whether you are a US resident or not by clicking the relevant button below. If you choose the wrong option, being a US resident, you will not be able to open an account with InstaTrade anyway.

We are sorry for any inconvenience caused by this message.