See also

30.04.2025 12:42 AM

30.04.2025 12:42 AMTrust is hard to earn and easy to lose. While markets assess Donald Trump's first 100 days in office, believers in historical signs point to an event in late April 1925. One hundred years ago, Winston Churchill made what is widely regarded as the greatest monetary policy mistake in history — he tried to return the British pound to the gold standard. The result? The era of sterling dominance came to an end. Could this be a sign that the U.S. dollar's throne is beginning to shake?

The greenback is used in around 90% of cross-border transactions, significantly more than its share in global central bank reserves or the U.S. share of global GDP. The dollar functions as the "plumbing" of the global financial system, so expecting it to be dethroned outright would be naive.

What is more realistic is the beginning of a long-term downtrend in the USD index. Indeed, the last sustained upward trend began when the U.S. credit rating was downgraded in 2011. Trust gained, and trust lost — these are not empty words!

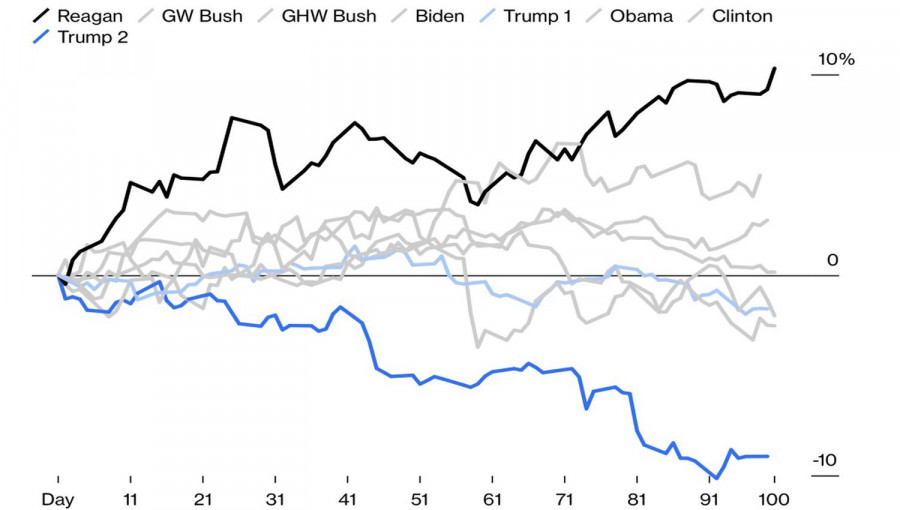

Due to White House policy, doubt surrounding the U.S. dollar and American assets in general have emerged. Former allies have become Washington's arch-enemies, while a long-standing adversary — Russia — is now nearly a close friend. Can one realistically expect China and Japan to keep buying U.S. Treasuries when massive tariffs have been imposed on both nations? Unsurprisingly, investors have turned away, and the USD index has shown the worst performance ever during the first 100 days of any presidency. Under Donald Trump, the dollar has fallen by 10%, a mirror image of events when Ronald Reagan entered the White House.

U.S. stocks are rebounding as April ends, but the dollar refuses to follow suit. According to Danske Bank, it would be naive to think that the peak of political uncertainty is behind us. The current 90-day grace period is only temporary, after which trade conflicts are expected to escalate. Trump is not one to back down. He intends to use tariffs to fill the budget gap caused by extending the tax relief period.

The Tax Foundation believes this is impossible. This conservative group estimates that tariffs will bring in $167 billion in 2025. But in 2022 alone, U.S. households earning less than $179,000 per year paid $600 billion in income tax.

The math shows that Trump's plans are unrealistic — but that doesn't stop the U.S. president.

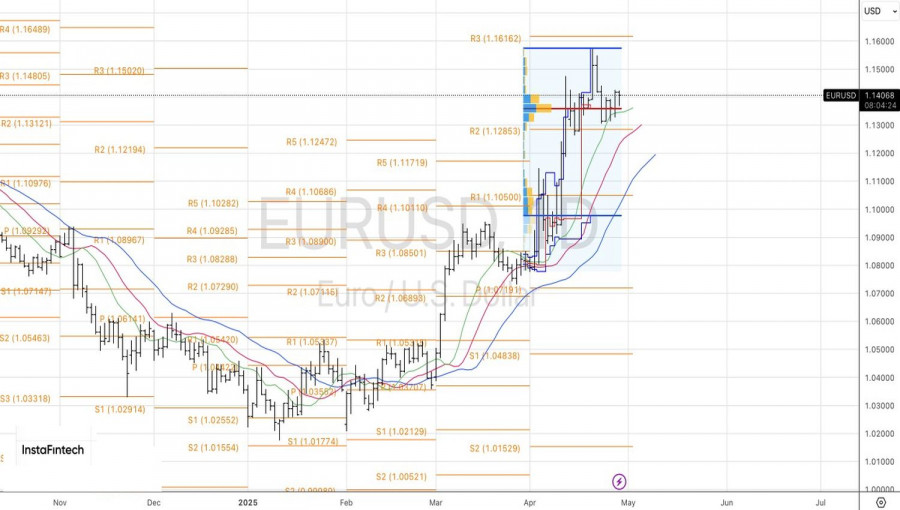

Technically, on the daily chart of EUR/USD, bulls have made a second attempt to break through resistance at 1.14 and push the pair out of its short-term consolidation range. So far, everything is going according to buyers' plans. However, for the rally to continue, the pair needs to break through the local high at 1.1425, which would open the door to further long positions.

You have already liked this post today

*The market analysis posted here is meant to increase your awareness, but not to give instructions to make a trade.

Trading on the last day of the week is unfolding positively. News that China is ready to begin negotiations has inspired investors to buy risk assets and weakened the U.S

Only a few macroeconomic events are scheduled for Friday, but some are quite significant. Naturally, the focus is on the U.S. NonFarm Payrolls and unemployment rate, yet it's also important

On Thursday, the GBP/USD currency pair continued to decline. The dollar had strengthened for three consecutive days—despite having no objective reason. U.S. macroeconomic data has been consistently weak; there were

On Thursday, the EUR/USD currency pair once again traded relatively calmly, but the U.S. dollar failed to show any meaningful growth this time. A little bit of good news goes

Our new app for your convenient and fast verification

Our new app for your convenient and fast verification

E-mail/SMS

notifications

Your IP address shows that you are currently located in the USA. If you are a resident of the United States, you are prohibited from using the services of InstaFintech Group including online trading, online transfers, deposit/withdrawal of funds, etc.

If you think you are seeing this message by mistake and your location is not the US, kindly proceed to the website. Otherwise, you must leave the website in order to comply with government restrictions.

Why does your IP address show your location as the USA?

Please confirm whether you are a US resident or not by clicking the relevant button below. If you choose the wrong option, being a US resident, you will not be able to open an account with InstaTrade anyway.

We are sorry for any inconvenience caused by this message.