See also

29.04.2025 08:51 AM

29.04.2025 08:51 AMBitcoin and Ethereum Buyers Are Trying to Control the Market — and So Far, They're Doing Quite Well

However, it's important to note that the longer we remain below $95,000, repeatedly failing to consolidate above this range, the higher the chances of a larger correction in Bitcoin. The same applies to Ethereum, but the key level is $1,800.

Meanwhile, recent data shows that BTC supply on exchanges has dropped to a 7-year low. This scarcity could trigger a new market rally at any moment, provided new participants have renewed interest. Many experts attribute this trend to several factors. First, an increasing number of institutional investors are accumulating Bitcoin for the long term, withdrawing it from exchanges and storing it in cold wallets. Second, miners generating new blocks are also opting to hold their coins, anticipating further price growth.

Bernstein and Bitwise continue to speak about an impending supply shock driven by declining exchange reserves and rapidly growing institutional demand. This adds another reason to believe in the ongoing medium-term bullish trend in the cryptocurrency market.

As for the intraday strategy, I will continue acting based on any major pullbacks in Bitcoin and Ethereum, expecting the medium-term uptrend — which hasn't gone anywhere — to remain intact.

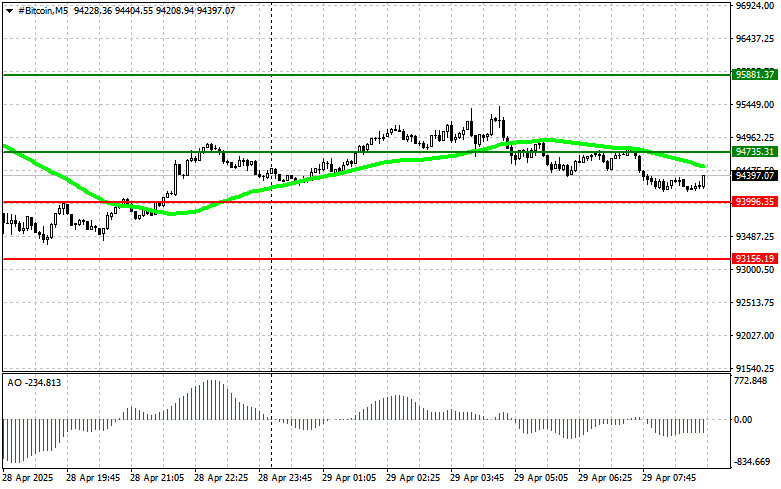

Below are the short-term trading strategy setups:

Scenario #1: I will buy Bitcoin today upon reaching the entry point around $94,700, targeting a rise to $95,800. Around $95,800, I plan to exit the long position and sell on a pullback.

Important: Before buying on a breakout, ensure the 50-day moving average is below the current price and the Awesome Oscillator is above zero.

Scenario #2: Buying from the lower boundary at $93,900 is also possible if there is no market reaction to its breakout — with a bounce back toward $94,700 and $95,800.

Scenario #1: I will sell Bitcoin today upon reaching the entry point of around $93,900, targeting a decline to $93,100. Around $93,100, I plan to exit the short and immediately buy on the rebound.

Important: Before selling on a breakout, ensure the 50-day moving average is above the current price and the Awesome Oscillator is below zero.

Scenario #2: Selling from the upper boundary at $94,700 is also possible if there is no market reaction to its breakout — with a return toward $93,900 and $93,100.

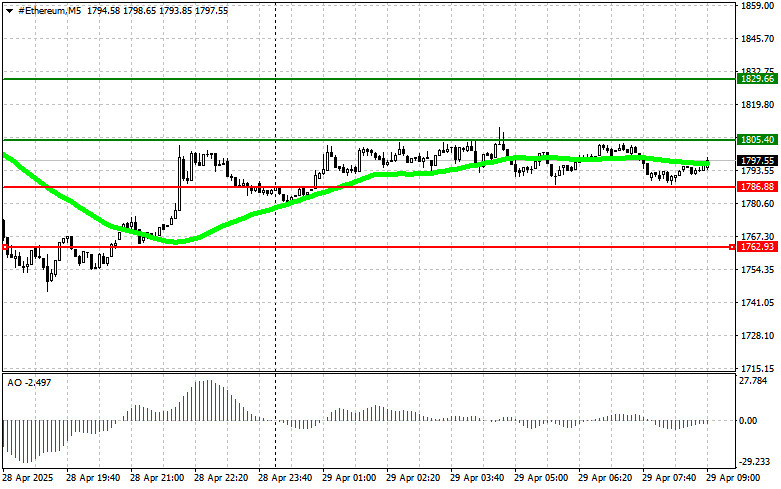

Scenario #1: I will buy Ethereum today upon reaching the entry point around $1,805, targeting a rise to $1,829. Around $1,829, I plan to exit the long and sell on a pullback.

Important: Before buying on a breakout, ensure the 50-day moving average is below the current price and the Awesome Oscillator is above zero.

Scenario #2: Buying from the lower boundary at $1,786 is also an option if there is no market reaction to its breakout — with a bounce back toward $1,805 and $1,829.

Scenario #1: I will sell Ethereum today upon reaching the entry point around $1,786, targeting a drop to $1,762. Around $1,762, I plan to exit the short and buy on the rebound.

Important: Before selling on a breakout, ensure the 50-day moving average is above the current price and the Awesome Oscillator is below zero.

Scenario #2: Selling from the upper boundary at $1,805 is also possible if there is no market reaction to its breakout — with a return toward $1,786 and $1,762.

You have already liked this post today

*The market analysis posted here is meant to increase your awareness, but not to give instructions to make a trade.

Bitcoin and Ethereum buyers have achieved new key resistance levels, indicating strong demand. Bitcoin has reached the $97,400 level, while Ethereum has approached the $1,870 mark. Meanwhile, the buzz around

With the appearance of the Bullish 123 pattern followed by the appearance of the Bullish Ross Hook which managed to break the previous downtrend line and the Stochastic Oscillator indicator

Amid a steady outflow of coins from exchanges, renewed futures market activity, and a rise in short-term holders, the world's largest cryptocurrency lays the groundwork for a potential move that

While financial mainstream market participants are mulling over recession risks and interest rates, Bitcoin is steadily gaining ground. April has turned out to be the strongest month for the leading

InstaFutures

Make money with a new promising instrument!

InstaFutures

Make money with a new promising instrument!

InstaTrade

video analytics

Your IP address shows that you are currently located in the USA. If you are a resident of the United States, you are prohibited from using the services of InstaFintech Group including online trading, online transfers, deposit/withdrawal of funds, etc.

If you think you are seeing this message by mistake and your location is not the US, kindly proceed to the website. Otherwise, you must leave the website in order to comply with government restrictions.

Why does your IP address show your location as the USA?

Please confirm whether you are a US resident or not by clicking the relevant button below. If you choose the wrong option, being a US resident, you will not be able to open an account with InstaTrade anyway.

We are sorry for any inconvenience caused by this message.