See also

29.04.2025 07:00 AM

29.04.2025 07:00 AMVery few macroeconomic events are scheduled for Tuesday, and none are significant. If we set aside all the tertiary reports, such as the GfK Consumer Confidence Index in Germany or consumer sentiment in the Eurozone, only the JOLTS report on job openings in the U.S. remains. It should be noted that this report is published with a significant delay, and therefore cannot be considered reflective of the current economic trend. There is every reason to expect that, following the introduction of large-scale import tariffs, the U.S. will face a slowdown in economic growth and a rise in unemployment. Consequently, the April Nonfarm Payrolls and unemployment reports will be far more important than the March JOLTS data.

There is no point in discussing fundamental events other than Trump's trade war. The dollar's decline may continue indefinitely as long as Trump keeps imposing new tariffs and raising existing ones. Any escalation could lead to another drop in the dollar, while any de-escalation could strengthen it.

The U.S. president has started to soften his rhetoric toward China, but this has not yet resulted in de-escalation. Knowing Trump, it would not be surprising if, after announcing a tariff reduction for China, he raises them again.

Donald Trump stated that he does not intend to maintain tariffs on Chinese goods at the 145% level, which triggered a wave of relief across markets. However, the dollar did not experience any surge in optimism. The market sees no concrete signs of de-escalation and thus is in no hurry to buy the U.S. currency. Even on Monday, when there was no news, and traders were eager to act, the market preferred to continue selling the dollar.

On the second trading day of the new week, both currency pairs could move in either direction, but we will most likely continue to observe flat trading—at least for the euro. The pound sterling still shows a much greater willingness to rise, and it does not need any news.

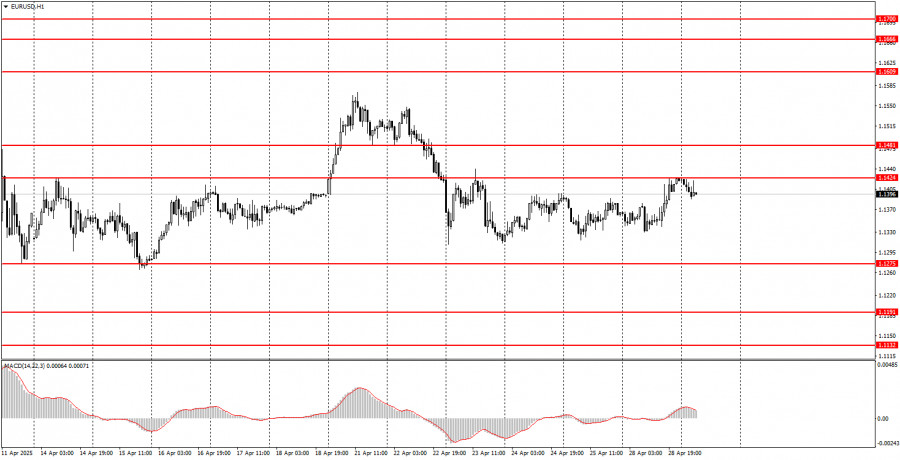

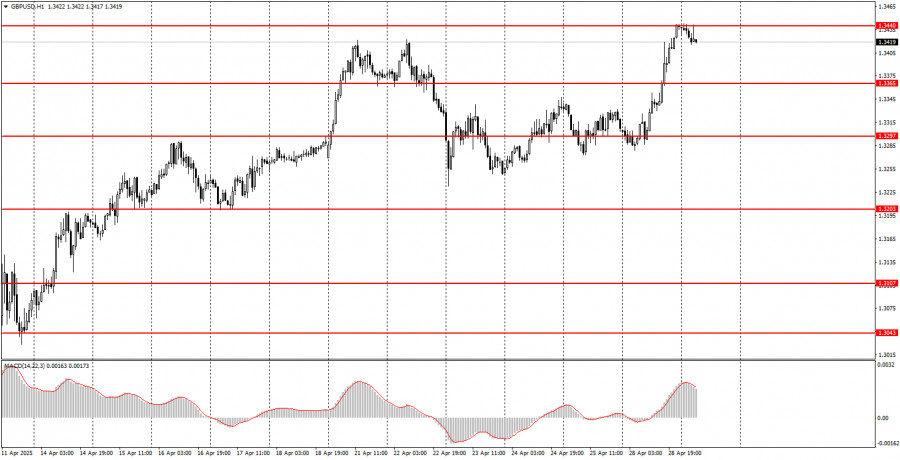

Support and Resistance Levels: These are target levels for opening or closing positions and can also serve as points for placing Take Profit orders.

Red Lines: Channels or trendlines indicating the current trend and the preferred direction for trading.

MACD Indicator (14,22,3): A histogram and signal line used as a supplementary source of trading signals.

Important speeches and reports, which are consistently featured in the news calendar, can significantly influence the movement of a currency pair. Therefore, during their release, it is advisable to trade with caution or consider exiting the market to avoid potential sharp price reversals against the prior trend.

Beginners in the Forex market should understand that not every transaction will be profitable. Developing a clear trading strategy and practicing effective money management are crucial for achieving long-term success in trading.

You have already liked this post today

*The market analysis posted here is meant to increase your awareness, but not to give instructions to make a trade.

Trading on the last day of the week is unfolding positively. News that China is ready to begin negotiations has inspired investors to buy risk assets and weakened the U.S

Only a few macroeconomic events are scheduled for Friday, but some are quite significant. Naturally, the focus is on the U.S. NonFarm Payrolls and unemployment rate, yet it's also important

On Thursday, the GBP/USD currency pair continued to decline. The dollar had strengthened for three consecutive days—despite having no objective reason. U.S. macroeconomic data has been consistently weak; there were

On Thursday, the EUR/USD currency pair once again traded relatively calmly, but the U.S. dollar failed to show any meaningful growth this time. A little bit of good news goes

Our new app for your convenient and fast verification

Our new app for your convenient and fast verification

E-mail/SMS

notifications

Your IP address shows that you are currently located in the USA. If you are a resident of the United States, you are prohibited from using the services of InstaFintech Group including online trading, online transfers, deposit/withdrawal of funds, etc.

If you think you are seeing this message by mistake and your location is not the US, kindly proceed to the website. Otherwise, you must leave the website in order to comply with government restrictions.

Why does your IP address show your location as the USA?

Please confirm whether you are a US resident or not by clicking the relevant button below. If you choose the wrong option, being a US resident, you will not be able to open an account with InstaTrade anyway.

We are sorry for any inconvenience caused by this message.