See also

28.04.2025 08:19 AM

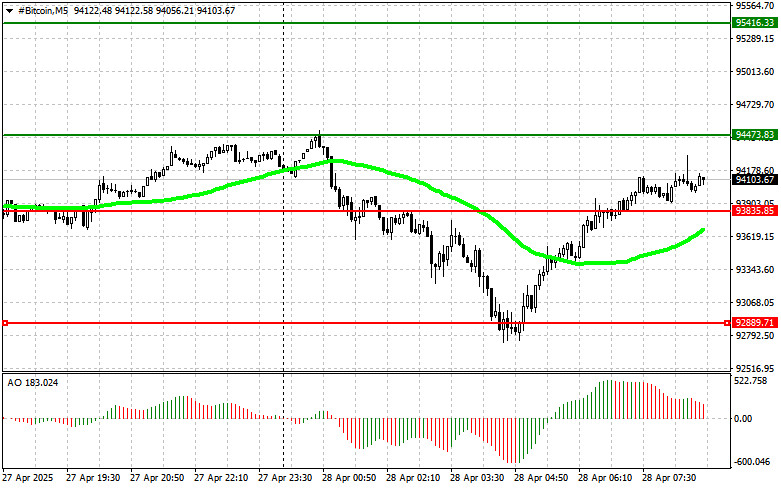

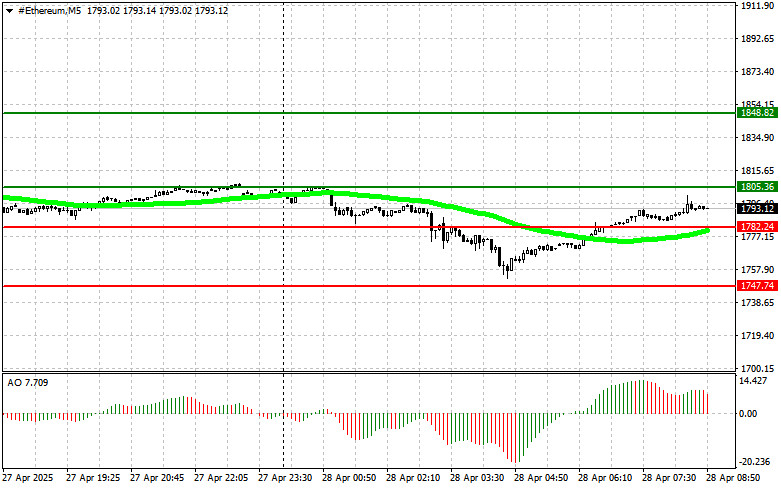

28.04.2025 08:19 AMBitcoin is being pressured, but it still holds up quite confidently. After rebounding from the $92,000 mark, the first cryptocurrency returned to the $94,000 area, maintaining good growth prospects. The situation with Ethereum is more complicated: the observed pressure is leading to much larger sell-offs, although buyers are still managing to hold their ground for now.

Overall, all the corrections that have occurred recently following the significant growth of the cryptocurrency market early last week have been relatively orderly and calm, which preserves the chances for continued upward potential.

According to the latest data, the total net inflow into spot Bitcoin ETFs exceeded $3 billion last week, while the net inflow into spot Ethereum ETFs over the same period was $157 million.

This impressive capital inflow into Bitcoin ETFs reflects growing institutional interest and increasing confidence in cryptocurrency as an asset class. Investors seeking diversification and protection against inflation increasingly view Bitcoin as a promising tool.

Simplified access to Bitcoin via ETFs attracts experienced traders and newcomers who want to enter the crypto world without needing to buy and store digital assets directly. Given the recent strong market growth, this inflow is fueling new discussions about the continuation of the medium-term bullish trend.

The observed capital inflows into spot Bitcoin and Ethereum ETFs indicate sustained investor interest in cryptocurrencies and their growing integration into traditional financial markets.

Regarding the intraday strategy on the cryptocurrency market, I will continue to base my actions on any major pullbacks in Bitcoin and Ethereum, counting on continuing the medium-term bullish trend, which remains intact.

As for short-term trading, the strategy and conditions are described below.

Scenario #1: Today, I plan to buy Bitcoin upon reaching the entry point of around $94,400, with a target growth of $95,400. Around $95,400, I plan to exit purchases and immediately sell on the pullback. Before buying on the breakout, it is important to ensure that the 50-day moving average is below the current price and that the Awesome indicator is in the positive zone.

Scenario #2: If the market does not react to Bitcoin's breakout, it can also be bought from the lower boundary of $93,800, aiming for levels of $94,400 and $95,400.

Scenario #1: Today, I plan to sell Bitcoin upon reaching the entry point of around $93,800, with a target decline of $92,800. Around $92,800, I plan to exit sales and immediately buy on the rebound. Before selling on the breakout, ensuring that the 50-day moving average is above the current price and that the Awesome indicator is in the negative zone is essential.

Scenario #2: Bitcoin can also be sold from the upper boundary of $94,400 if there is no market reaction to its breakout, aiming for $93,800 and $92,800.

Scenario #1: Today, I plan to buy Ethereum upon reaching the entry point around $1805 with a target growth to the $1848 level. Around $1848, I plan to exit purchases and immediately sell on the pullback. Before buying on the breakout, it is important to ensure that the 50-day moving average is below the current price and that the Awesome indicator is in the positive zone.

Scenario #2: If the market does not react to Ethereum's breakout, it can also be bought from the lower boundary of $1782, aiming for levels $1805 and $1848.

Scenario #1: Today, I plan to sell Ethereum upon reaching the entry point around $1782, with a target decline to the $1747 level. Around $1747, I plan to exit sales and immediately buy on the rebound. Before selling on the breakout, ensuring that the 50-day moving average is above the current price and that the Awesome indicator is in the negative zone is important.

Scenario #2: If the market does not react to Ethereum's breakout, it can also be sold from the upper boundary of $1805, aiming for levels $1782 and $1747.

You have already liked this post today

*The market analysis posted here is meant to increase your awareness, but not to give instructions to make a trade.

Bitcoin and Ethereum buyers have achieved new key resistance levels, indicating strong demand. Bitcoin has reached the $97,400 level, while Ethereum has approached the $1,870 mark. Meanwhile, the buzz around

With the appearance of the Bullish 123 pattern followed by the appearance of the Bullish Ross Hook which managed to break the previous downtrend line and the Stochastic Oscillator indicator

Amid a steady outflow of coins from exchanges, renewed futures market activity, and a rise in short-term holders, the world's largest cryptocurrency lays the groundwork for a potential move that

While financial mainstream market participants are mulling over recession risks and interest rates, Bitcoin is steadily gaining ground. April has turned out to be the strongest month for the leading

Your IP address shows that you are currently located in the USA. If you are a resident of the United States, you are prohibited from using the services of InstaFintech Group including online trading, online transfers, deposit/withdrawal of funds, etc.

If you think you are seeing this message by mistake and your location is not the US, kindly proceed to the website. Otherwise, you must leave the website in order to comply with government restrictions.

Why does your IP address show your location as the USA?

Please confirm whether you are a US resident or not by clicking the relevant button below. If you choose the wrong option, being a US resident, you will not be able to open an account with InstaTrade anyway.

We are sorry for any inconvenience caused by this message.