See also

25.04.2025 08:21 PM

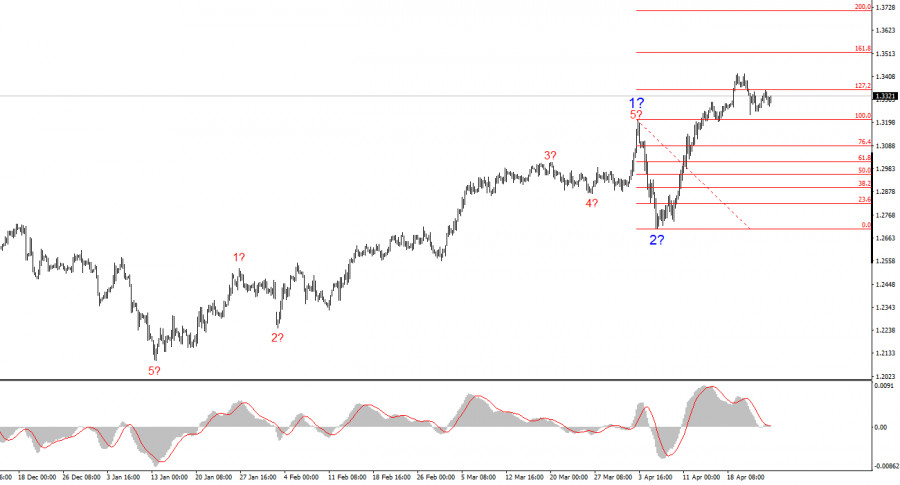

25.04.2025 08:21 PMThe wave pattern on the GBP/USD chart has also transformed into a bullish, impulsive structure—"thanks" to Donald Trump. The wave picture closely resembles that of the EUR/USD pair. Until February 28, we observed the formation of a solid corrective structure that raised no concerns. However, demand for the U.S. dollar began to decline rapidly. As a result, a five-wave upward structure was formed. Wave 2 took the form of a single wave and is now complete. Therefore, a strong rally in the British pound is expected as part of wave 3—something we've been witnessing for the past two weeks.

Considering the fact that UK-related news has had little to no influence on the pound's strong growth, it's clear that exchange rates are currently driven solely by Donald Trump. If Trump's own trade policy shifts direction, it's likely the trend will change as well—possibly to a bearish one. For this reason, all of the White House's actions should be closely monitored over the coming months (or even years).

The GBP/USD pair remained flat on Friday with very limited volatility. Throughout the week, the pound exhibited the same pattern as the euro. Active movement occurred only during the night and morning on Monday and in the second half of the day on Tuesday. The rest of the time saw sideways trading. Despite being near recent highs, the market has not rushed to take profits, which would be necessary to form a corrective wave 2 within the expected wave 3.

Today's UK retail sales report offered a chance for renewed bullish momentum. Retail volumes rose by 0.4% month-over-month and 2.6% year-over-year in March, both beating forecasts. Yet the market showed little interest in conventional economic data. Instead, it remains focused solely on major and sensational developments—not even actual events, but statements, most often delivered by Donald Trump. Essentially, this week played out the same way as recent months: a loud Trump statement triggers a market reaction, while silence from him results in market stagnation.

Thus, as mentioned previously, the future of instruments like EUR/USD and GBP/USD (as well as other USD pairs) currently depends entirely on the U.S. president. If there are no new bombshell statements, market movement is unlikely. If Trump suddenly changes his rhetoric on the trade war, demand for the dollar could surge. That would signal not just a corrective wave within a bullish trend, but potentially a new bearish trend altogether. And it wouldn't matter whether the current bullish wave has completed. In the battle between wave analysis and Trump, the latter is clearly winning.

The wave pattern for GBP/USD has shifted. We are now dealing with a bullish, impulsive trend. Unfortunately, as long as Donald Trump is in office, markets are likely to face many more shocks and reversals that defy technical wave analysis. The presumed wave 2 is complete, as prices have broken above the peak of wave 1. This suggests that an upward wave 3 is now forming, with targets at 1.3345 and 1.3541. Of course, it would be helpful to see a corrective wave 2 within wave 3—but for that to happen, the dollar needs to strengthen... and someone has to be willing to buy it.

On the higher wave scale, the pattern has also turned bullish. We can now assume the formation of a new upward leg. The nearest targets are 1.2782 and 1.2650.

Key Principles of My Analysis:

You have already liked this post today

*The market analysis posted here is meant to increase your awareness, but not to give instructions to make a trade.

GBP/USD Analysis: The 4-hour chart of the British pound shows that a temporary corrective flat is forming within the dominant upward wave observed in recent weeks. The unfinished upward segment

EUR/USD Analysis: The hourly chart of the major euro pair shows a dominant upward wave since early February. The correction forming over the past three weeks is nearing completion

In the upcoming week, the British pound is highly likely to follow a general sideways trajectory. A brief price decline is expected early in the week. Toward the weekend, volatility

At the beginning of the upcoming week, the European currency is expected to continue moving sideways along the calculated counter-trend zones. A downward movement is more likely at the start

Our new app for your convenient and fast verification

Our new app for your convenient and fast verification

Your IP address shows that you are currently located in the USA. If you are a resident of the United States, you are prohibited from using the services of InstaFintech Group including online trading, online transfers, deposit/withdrawal of funds, etc.

If you think you are seeing this message by mistake and your location is not the US, kindly proceed to the website. Otherwise, you must leave the website in order to comply with government restrictions.

Why does your IP address show your location as the USA?

Please confirm whether you are a US resident or not by clicking the relevant button below. If you choose the wrong option, being a US resident, you will not be able to open an account with InstaTrade anyway.

We are sorry for any inconvenience caused by this message.