See also

25.04.2025 08:31 AM

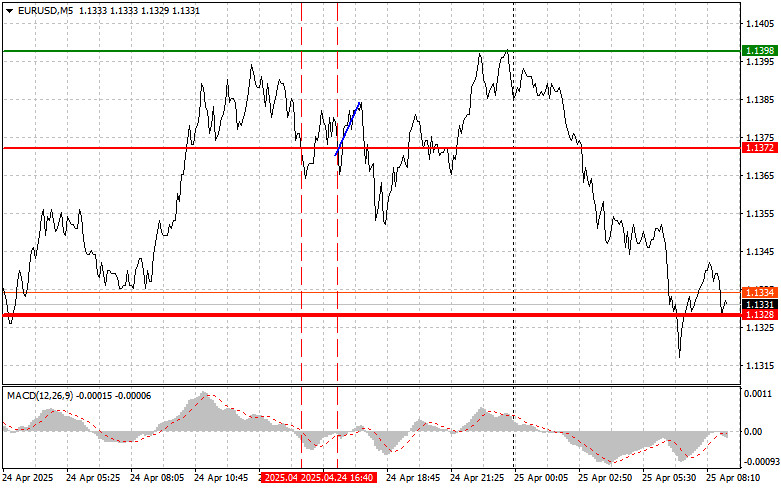

25.04.2025 08:31 AMThe first test of the 1.1372 price level in the second half of the day occurred when the MACD indicator had already moved far below the zero mark, which limited the pair's downside potential. Shortly afterward, the second test of 1.1372 coincided with the MACD returning from the oversold area, which enabled the implementation of Buy Scenario #2. However, after a 15-pip upward move, demand subsided.

The released U.S. labor market data and decent durable goods figures only slightly strengthened the U.S. dollar. Investors appeared to have already priced in this positive news, anticipating further steps from the Federal Reserve. The pair will continue to be influenced by global factors, including U.S. trade policy and the potential for a trade agreement with the EU—if it materializes at all.

It's worth noting that while the U.S. labor market remains resilient, it is still far from perfect. The unemployment rate remains relatively low, but there are signs of slowing job growth. This suggests that the Fed may not be able to act too aggressively moving forward, which limits the dollar's strengthening potential.

Given the lack of eurozone data in the first half of the day, EUR/USD retains its growth potential. The absence of macroeconomic data creates a vacuum in which market sentiment and speculation can play a decisive role. In this context, any positive news—even if not directly related to the eurozone economy—may trigger a wave of euro buying.

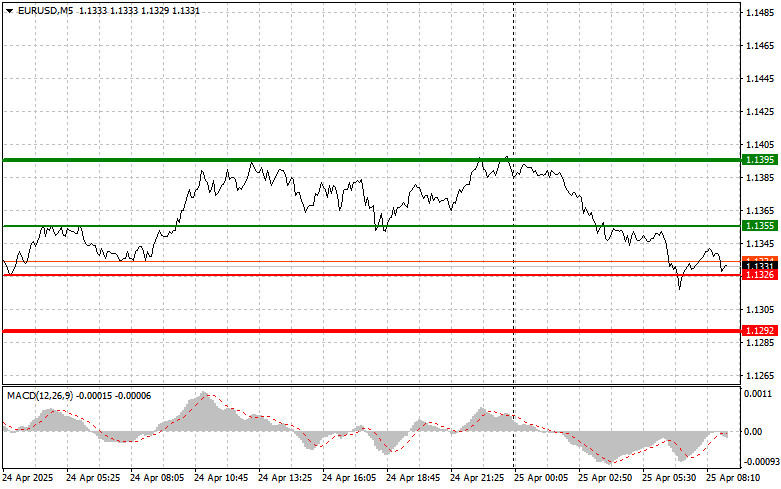

For intraday strategy, I will focus primarily on Scenarios #1 and #2.

Scenario #1: I plan to buy the euro today at the entry point around 1.1355 (green line on the chart), with an upward target of 1.1395. At the 1.1395 mark, I plan to exit the market and sell the euro in the opposite direction, expecting a 30–35 pip reversal from the entry level. Buying the euro in the first half of the day can be considered a continuation of the current trend.

Important: Before buying, ensure the MACD indicator is above the zero mark and beginning to rise.

Scenario #2: I also plan to buy the euro today in case of two consecutive tests of the 1.1326 price level when the MACD indicator is in the oversold zone. This will limit the pair's downside potential and may lead to a market reversal upward. A rise toward the opposite levels, 1.1355 and 1.1395, is expected.

Scenario #1: I plan to sell the euro after it reaches the 1.1326 level (red line on the chart). The target will be 1.1292, where I plan to exit short positions and immediately open long positions (expecting a 20–25-pip move in the opposite direction). Downward pressure may return at any moment today.

Important: Before selling, ensure the MACD indicator is below the zero mark and beginning to decline.

Scenario #2: I also plan to sell the euro today in case of two consecutive tests of the 1.1355 price level when the MACD indicator is in the overbought area. This will limit the pair's upside potential and may lead to a downward market reversal. A decline toward the opposite levels, 1.1326 and 1.1292, is expected.

You have already liked this post today

*The market analysis posted here is meant to increase your awareness, but not to give instructions to make a trade.

The test of the 144.79 level occurred at a time when the MACD indicator had already moved significantly above the zero line, which limited the pair's upside potential. Therefore

Our new app for your convenient and fast verification

Our new app for your convenient and fast verification

Your IP address shows that you are currently located in the USA. If you are a resident of the United States, you are prohibited from using the services of InstaFintech Group including online trading, online transfers, deposit/withdrawal of funds, etc.

If you think you are seeing this message by mistake and your location is not the US, kindly proceed to the website. Otherwise, you must leave the website in order to comply with government restrictions.

Why does your IP address show your location as the USA?

Please confirm whether you are a US resident or not by clicking the relevant button below. If you choose the wrong option, being a US resident, you will not be able to open an account with InstaTrade anyway.

We are sorry for any inconvenience caused by this message.