See also

25.04.2025 08:07 AM

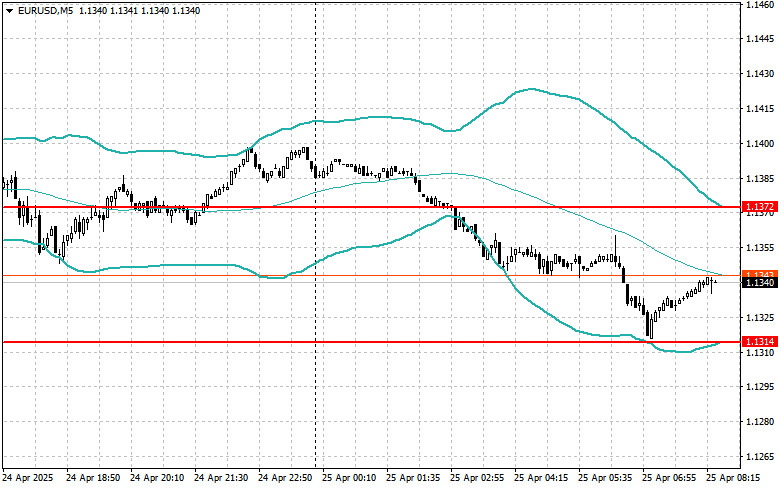

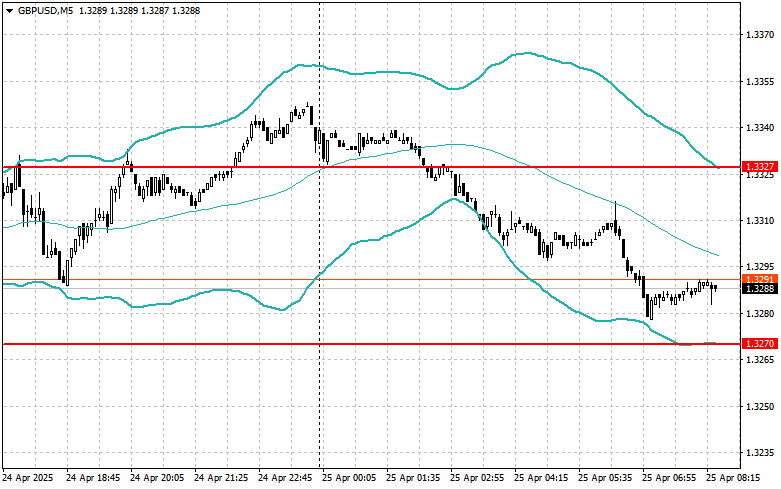

25.04.2025 08:07 AMEUR and GBP managed to withstand yesterday's pressure, but today, the decline in risk assets paired with the dollar has continued.

The data released about the U.S. labor market and strong figures on durable goods orders were overlooked by traders, failing to result in the anticipated strengthening of the U.S. dollar. One possible reason is that the market had already priced in the positive macroeconomic indicators. Traders may have been expecting even stronger results to justify further gains in the dollar. Additionally, market attention may have shifted to other factors, such as U.S. trade tariffs and the potential for their reduction in relation to China.

Given the absence of economic reports from the eurozone today, the EUR/USD pair retains the potential for further strengthening. The lack of macroeconomic data creates a void where market sentiment and speculative activity take the lead. Traders often refer to preceding trends and general risk appetite without concrete economic indicators. Considering the market remains bullish, the chances for EUR/USD to rise are relatively high.

As for the British pound, attention will be focused on the release of retail sales data in the UK for March, which includes fuel expenses. If the actual figures come in below expectations, it could trigger a renewed downward trend for the GBP/USD currency pair. Market participants are closely watching UK macroeconomic data to assess the economy's ability to withstand inflation—especially amid the Bank of England's potential easing of interest rate policy. Retail sales are a key indicator of consumer activity and the economy's overall health. A decline in retail trade volumes may indicate a slowdown in economic growth and, consequently, the possibility of further monetary easing by the Bank of England. This would be negative for the pound and its future gains.

If the data matches economists' expectations, relying on a Mean Reversion strategy is best. The Momentum strategy is most appropriate if the data is much higher or lower than expected.

Buying on a breakout of 1.1358 could lead to a rise in the euro toward 1.1390 and 1.1435.

Selling on a breakout of 1.1315 could lead to a drop in the euro toward 1.1267 and 1.1217.

Buying on a breakout of 1.3310 could lead to a rise in the pound toward 1.3365 and 1.3416.

Selling on a breakout of 1.3250 could lead to a drop in the pound toward 1.3205 and 1.3165.

Buying on a breakout of 143.80 could lead to a rise in the dollar toward 144.15 and 144.51.

Selling on a breakout of 143.30 could trigger a sell-off in the dollar toward 142.85 and 142.34.

I will look for selling opportunities after a failed breakout above 1.1372, once the price returns below this level.

I will look for buying opportunities after a failed breakout below 1.1314, once the price returns above this level.

I will look for selling opportunities after a failed breakout above 1.3327, once the price returns below this level.

I will look for buying opportunities after a failed breakout below 1.3270, once the price returns above this level.

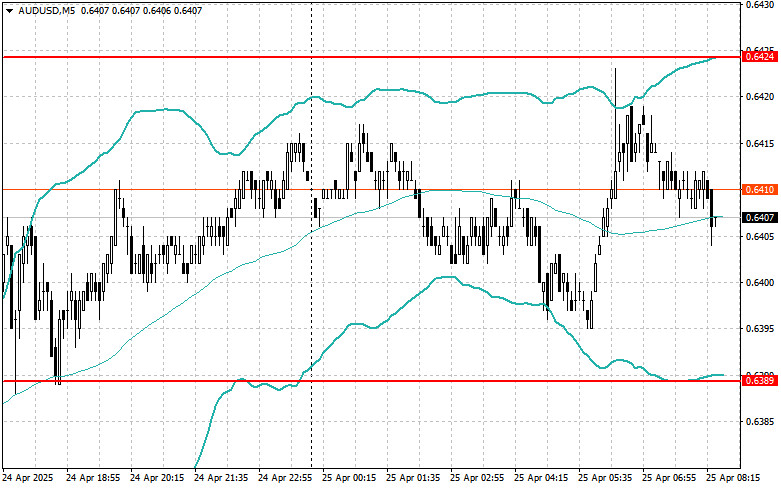

I will look for selling opportunities after a failed breakout above 0.6424, once the price returns below this level.

I will look for buying opportunities after a failed breakout below 0.6389, once the price returns above this level.

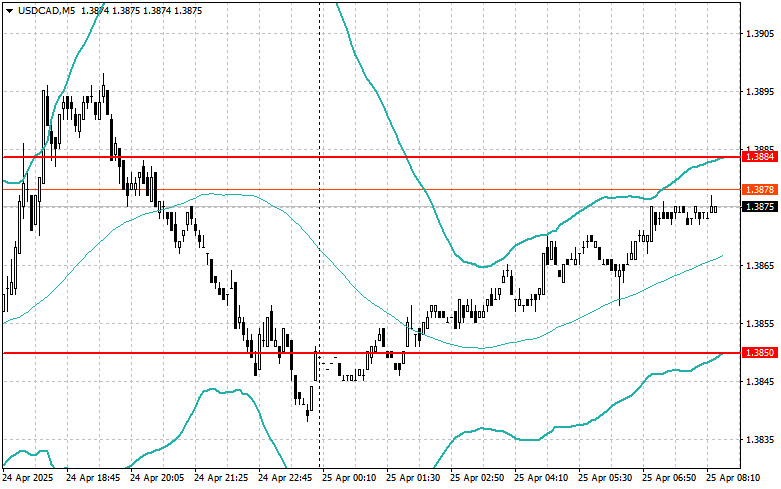

I will look for selling opportunities after a failed breakout above 1.3884, once the price returns below this level.

I will look for buying opportunities after a failed breakout below 1.3850, once the price returns above this level.

You have already liked this post today

*The market analysis posted here is meant to increase your awareness, but not to give instructions to make a trade.

The price test at 142.64 occurred when the MACD indicator had already significantly moved below the zero line, limiting the pair's downward potential. For this reason, I did not sell

The price test at 1.3378 in the second half of the day occurred when the MACD indicator had already advanced significantly above the zero line, which limited the pair's upside

The price test at 1.1339 in the second half of the day coincided with the MACD indicator having already moved significantly above the zero line, which limited the pair's upward

E-mail/SMS

notifications

Your IP address shows that you are currently located in the USA. If you are a resident of the United States, you are prohibited from using the services of InstaFintech Group including online trading, online transfers, deposit/withdrawal of funds, etc.

If you think you are seeing this message by mistake and your location is not the US, kindly proceed to the website. Otherwise, you must leave the website in order to comply with government restrictions.

Why does your IP address show your location as the USA?

Please confirm whether you are a US resident or not by clicking the relevant button below. If you choose the wrong option, being a US resident, you will not be able to open an account with InstaTrade anyway.

We are sorry for any inconvenience caused by this message.