See also

25.04.2025 07:06 AM

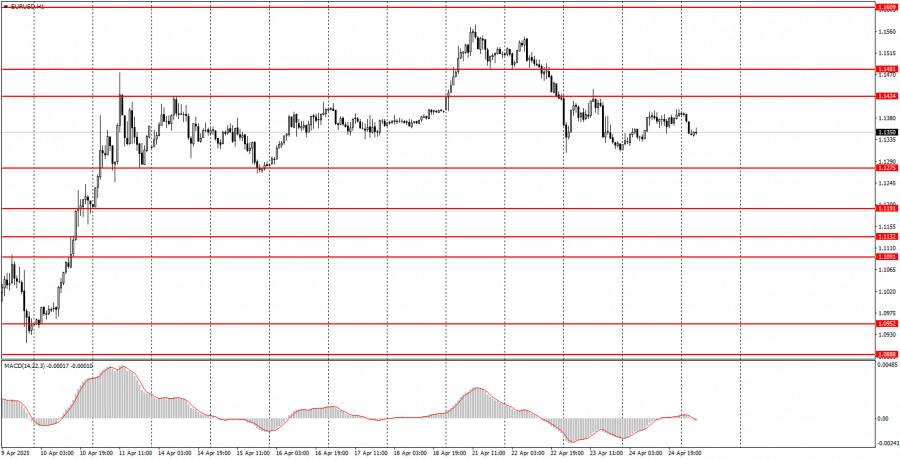

25.04.2025 07:06 AMOn Thursday, the EUR/USD currency pair traded with a slight upward bias, although it would have been more logical to see a decline in the second half of the day. No significant events, reports, or announcements from Trump in the first half impacted the market. However, a fairly significant report on U.S. durable goods orders was released in the second half, showing a 9.2% increase in March versus a forecast of +2.0%. Did anyone see any market reaction or dollar strength? It's a rhetorical question, and the answer confirms that the market currently pays no attention to macroeconomic data. The dollar began to strengthen overnight, but overall, the pair has returned to the sideways channel of 1.1275–1.1424 established earlier in the week. Thus, the dollar may rise freely to 1.1275, but further growth raises serious doubts.

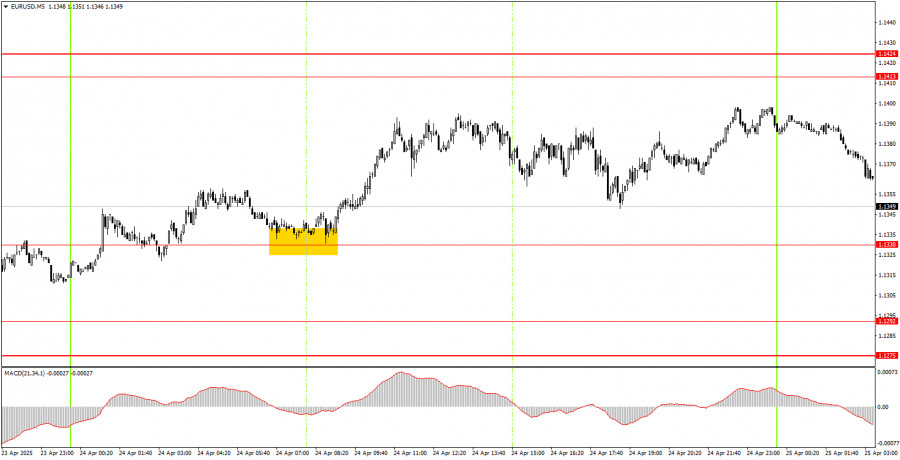

In the 5-minute timeframe, price movements remain far from ideal. One decent trading signal was formed yesterday. At the beginning of the European session, the price bounced off the 1.1330 level and then spent the rest of the day in an uptrend. This buy trade could have been manually closed in the evening, as the target level was not reached. The profit totaled about 35 pips. However, it's worth remembering that market movements remain highly erratic and chaotic. Strong, clean signals are now the exception rather than the rule.

In the hourly timeframe, EUR/USD maintains its upward trend. The new week began with a rally, but by Tuesday, Trump had triggered a decline. The market remains extremely negative toward the U.S. dollar and all things American. However, if Trump shifts toward de-escalating the trade conflict he initiated, the dollar may improve its standing soon.

On Friday, the pair could move in either direction again, as Trump's statements and decisions still drive market moves. No one can predict what the U.S. president will say today, and the market continues to ignore macroeconomic data.

On the 5-minute chart, consider trading levels at 1.0940–1.0952, 1.1011, 1.1091, 1.1132–1.1140, 1.1189–1.1191, 1.1275–1.1292, 1.1330, 1.1413–1.1424, 1.1474–1.1481, 1.1513, 1.1548, 1.1571, 1.1607–1.1622, 1.1666, 1.1689. No news is expected from the Eurozone on Friday. In the U.S., the University of Michigan Consumer Sentiment Index will be released, but we highly doubt the market will pay any attention to this report.

Support and Resistance Levels: These are target levels for opening or closing positions and can also serve as points for placing Take Profit orders.

Red Lines: Channels or trendlines indicating the current trend and the preferred direction for trading.

MACD Indicator (14,22,3): A histogram and signal line used as a supplementary source of trading signals.

Important Events and Reports: Found in the economic calendar, these can heavily influence price movements. Exercise caution or exit the market during their release to avoid sharp reversals.

Note for Beginner Forex Traders: Not every trade can be profitable. Developing a clear strategy and sound money management is key to long-term success in trading.

You have already liked this post today

*The market analysis posted here is meant to increase your awareness, but not to give instructions to make a trade.

In my morning forecast, I highlighted the 1.1337 level and planned to make market entry decisions based on it. Let's look at the 5-minute chart and analyze what happened there

Several entry points into the market were formed yesterday. Let's look at the 5-minute chart and break down what happened. I highlighted the 1.3282 level in my morning forecast

Yesterday, several entry points into the market were formed. Let's look at the 5-minute chart and analyze what happened. In my morning forecast, I highlighted the 1.1320 level

Analysis of Thursday's Trades 1H Chart of GBP/USD On Thursday, the GBP/USD pair continued its downward movement, although the overall picture still closely resembles a sideways range. The British pound

Analysis of Thursday's Trades 1H Chart of EUR/USD On Thursday, the EUR/USD currency pair continued its downward movement and reached the 1.1275 level by the end of the day, which

The GBP/USD currency pair continued to correct downward following Monday's rally and against the broader uptrend. There was no reason to expect the kind of price action that ultimately unfolded

The EUR/USD currency pair continued its mild upward movement on Thursday. The ongoing rise of the U.S. dollar looks strange, but strange price behavior has become the norm in recent

Forex Chart

Web-version

Your IP address shows that you are currently located in the USA. If you are a resident of the United States, you are prohibited from using the services of InstaFintech Group including online trading, online transfers, deposit/withdrawal of funds, etc.

If you think you are seeing this message by mistake and your location is not the US, kindly proceed to the website. Otherwise, you must leave the website in order to comply with government restrictions.

Why does your IP address show your location as the USA?

Please confirm whether you are a US resident or not by clicking the relevant button below. If you choose the wrong option, being a US resident, you will not be able to open an account with InstaTrade anyway.

We are sorry for any inconvenience caused by this message.