See also

22.04.2025 08:18 AM

22.04.2025 08:18 AMBitcoin Returns to the $88,000 Zone, but Ethereum Is Facing Challenges

Yesterday's sell-off during the U.S. session, once again triggered by a decline in American stock indices, was offset by Bitcoin buyers, while Ethereum saw little interest near its lows. Clearly, amid growing talk of a looming U.S. economic recession and mounting pressure on Federal Reserve Chairman Jerome Powell to continue cutting interest rates, demand for cryptocurrencies remains restrained.

That said, if there was ever a time for Bitcoin to prove its status as "digital gold," it is now. If it succeeds, we may see $150,000 or even $200,000 levels by year-end, as the problems dragging down U.S. stocks and the U.S. dollar are unlikely to be resolved quickly.

Crypto regulation also remains a wildcard. However, the possibility of softer measures from the U.S. government—something increasingly discussed since Trump's return—could positively impact investor sentiment. It's also important to remember that the cryptocurrency market is highly volatile. Prices can skyrocket or crash in an instant. Therefore, when deciding to buy Bitcoin, it's essential to weigh the risks and opportunities carefully—and never invest more than you can afford to lose.

As for the intraday strategy in the crypto market, I will focus on large pullbacks in Bitcoin and Ethereum, anticipating that the medium-term bull market trend remains intact.

For short-term trading, the following scenarios apply:

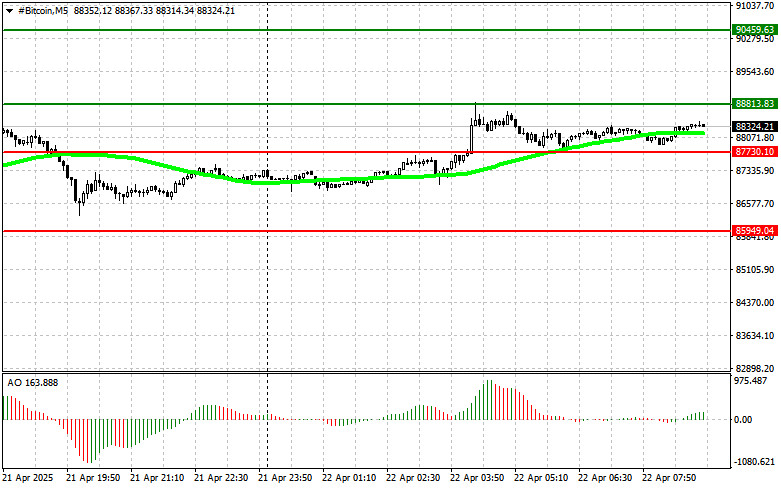

Scenario #1: I plan to buy Bitcoin today upon reaching the entry point around $88,800, targeting a rise to $90,400. I'll exit long positions near $90,400 and open short positions on the pullback. Before entering a breakout buy, ensure the 50-day moving average is below the current price and that the Awesome Oscillator is in the positive zone.

Scenario #2: Bitcoin can also be bought from the lower boundary at $87,700, provided there is no downside breakout and the price rebounds toward $88,800 and $90,400.

Scenario #1: I plan to sell Bitcoin today upon reaching the entry point of around $87,700, targeting a decline to $85,900. I'll exit short positions near $85,900 and open long positions on the bounce. Before entering a breakout sell, ensure the 50-day moving average is above the current price and that the Awesome Oscillator is in the negative zone.

Scenario #2: Bitcoin can also be sold from the upper boundary at $88,800, provided there is no breakout and the price reverses back toward $87,700 and $85,900.

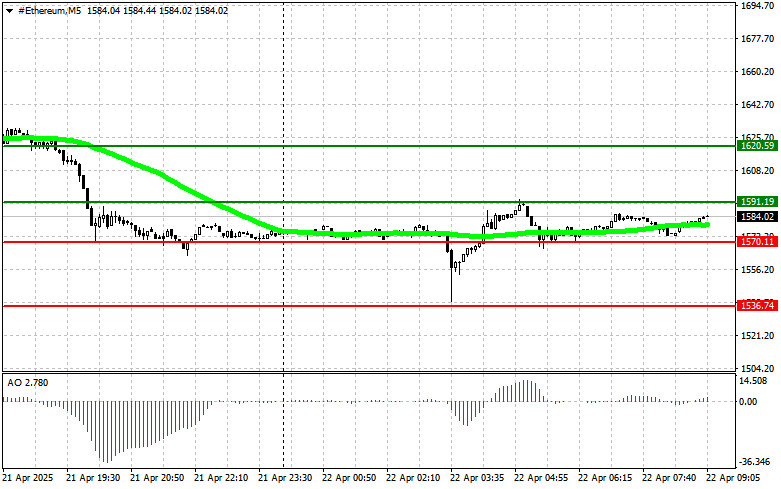

Scenario #1: I plan to buy Ethereum today upon reaching the entry point around $1,591, targeting a rise to $1,620. I'll exit long positions near $1,620 and sell immediately on the pullback. Before entering a breakout buy, ensure the 50-day moving average is below the current price and the Awesome Oscillator is in the positive zone.

Scenario #2: Ethereum can also be bought from the lower boundary at $1,570, provided there is no downside breakout and the price rebounds toward $1,590 and $1,620.

Scenario #1: I plan to sell Ethereum today upon reaching the entry point of around $1,570, targeting a decline to $1,536. I'll exit short positions near $1,536 and open long positions on the bounce. Before entering a breakout sell, ensure the 50-day moving average is above the current price and that the Awesome Oscillator is in the negative zone.

Scenario #2: Ethereum can also be sold from the upper boundary at $1,591, provided there is no breakout and the price reverses back toward $1,570 and $1,536.

You have already liked this post today

*The market analysis posted here is meant to increase your awareness, but not to give instructions to make a trade.

Bitcoin has climbed above $100,000, while Ethereum is trying to consolidate above $2,000. After yesterday's sharp rally, which continued during today's Asian session, Bitcoin is now trading at $103,000, having

On the 4-hour chart of the Bitcoin cryptocurrency, the Stochastic Oscillator indicator can be seen to be in Overbought conditions and is now preparing to Cross SELL and break below

While stock indices remain stagnant, gold consolidates near its highs, and Bitcoin is once again capturing attention. The crypto market's flagship has approached the psychologically important $100,000 level

Bitcoin's price is hovering near a psychologically significant threshold, with market participants bracing for another upward surge or a sudden reversal that could erase short-term bullish expectations. More chart

Ferrari F8 TRIBUTO

from InstaTrade

InstaTrade in figures

Your IP address shows that you are currently located in the USA. If you are a resident of the United States, you are prohibited from using the services of InstaFintech Group including online trading, online transfers, deposit/withdrawal of funds, etc.

If you think you are seeing this message by mistake and your location is not the US, kindly proceed to the website. Otherwise, you must leave the website in order to comply with government restrictions.

Why does your IP address show your location as the USA?

Please confirm whether you are a US resident or not by clicking the relevant button below. If you choose the wrong option, being a US resident, you will not be able to open an account with InstaTrade anyway.

We are sorry for any inconvenience caused by this message.