See also

16.04.2025 07:06 AM

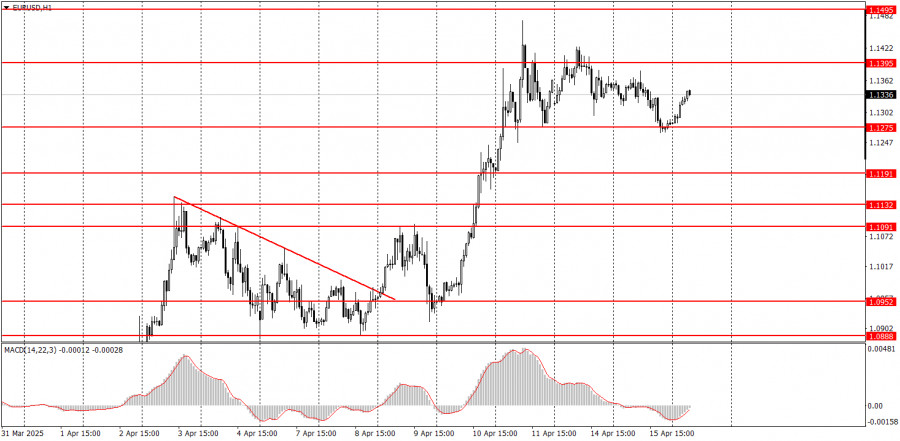

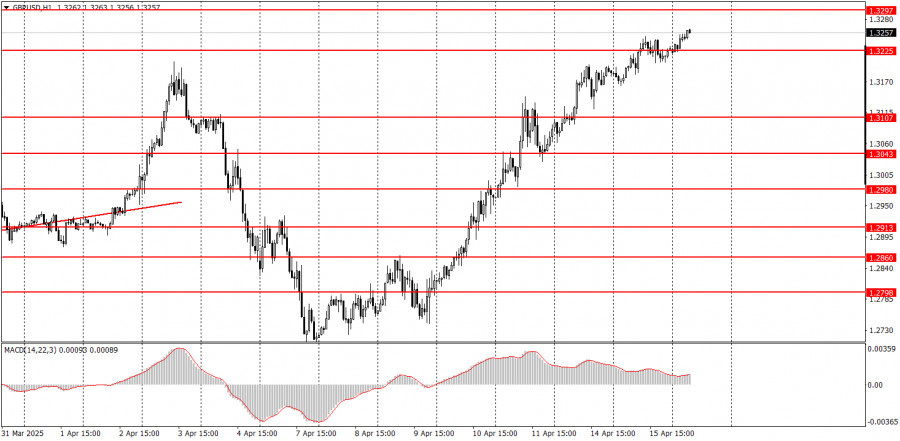

16.04.2025 07:06 AMA few macroeconomic events are scheduled for Wednesday, but some important reports will be released. However, the current key issue is not the reports' significance but how the market will react to them — and whether it will pay any attention. It's no secret that over the past two months, the market has been trading purely based on "Trump news," any announcement related to the escalation of the trade war triggers another sell-off of the U.S. dollar. Thus, today's reports may lead to a slight dollar rebound, but they are unlikely to change the overall trend. Today's most important data includes U.S. retail sales and the UK inflation report.

There's still little point in discussing fundamental topics other than Trump's trade war. The dollar's decline could continue indefinitely. We recommend that traders closely monitor statements from key leaders of major countries and alliances regarding tariffs. In the Eurozone, for example, officials have stated that they've achieved "modest progress" in negotiations with the Trump administration. However, "modest progress" is not enough to support the dollar. Meanwhile, Trump has announced his intention to impose tariffs on semiconductors, which affects many countries globally. The trade standoff with China remains unresolved and continues to be the market's top priority.

On the third trading day of the new week, both currency pairs could move in either direction. The British pound is rising steadily while the euro remains flat. Macroeconomic releases scheduled for today could affect currency movements, but the market's reaction to them is unpredictable. Technical levels are also not being respected consistently and are often ignored altogether.

Support and Resistance Levels: These are target levels for opening or closing positions and can also serve as points for placing Take Profit orders.

Red Lines: Channels or trendlines indicating the current trend and the preferred direction for trading.

MACD Indicator (14,22,3): A histogram and signal line used as a supplementary source of trading signals.

Important speeches and reports, which are consistently featured in the news calendar, can significantly influence the movement of a currency pair. Therefore, during their release, it is advisable to trade with caution or consider exiting the market to avoid potential sharp price reversals against the prior trend.

Beginners in the Forex market should understand that not every transaction will be profitable. Developing a clear trading strategy and practicing effective money management are crucial for achieving long-term success in trading.

You have already liked this post today

*The market analysis posted here is meant to increase your awareness, but not to give instructions to make a trade.

Today is Good Friday, a day Christians observe worldwide across all denominations. Market activity has noticeably decreased ahead of the Easter holiday, but this isn't the main reason for market

There are no macroeconomic events scheduled for Friday—not in the US, the Eurozone, Germany, or the UK. Therefore, even if the market were paying any attention to the macroeconomic backdrop

The GBP/USD currency pair continued to trade relatively calmly on Thursday, showing only a minimal downward bias. We still can't classify the current movement as a "pullback" or "correction."

The EUR/USD currency pair spent most of the day moving sideways. When the European Central Bank meeting results were released, the market saw a small emotional reaction, but nothing fundamentally

Graphical patterns

indicator.

Notices things

you never will!

Your IP address shows that you are currently located in the USA. If you are a resident of the United States, you are prohibited from using the services of InstaFintech Group including online trading, online transfers, deposit/withdrawal of funds, etc.

If you think you are seeing this message by mistake and your location is not the US, kindly proceed to the website. Otherwise, you must leave the website in order to comply with government restrictions.

Why does your IP address show your location as the USA?

Please confirm whether you are a US resident or not by clicking the relevant button below. If you choose the wrong option, being a US resident, you will not be able to open an account with InstaTrade anyway.

We are sorry for any inconvenience caused by this message.