See also

16.04.2025 05:12 AM

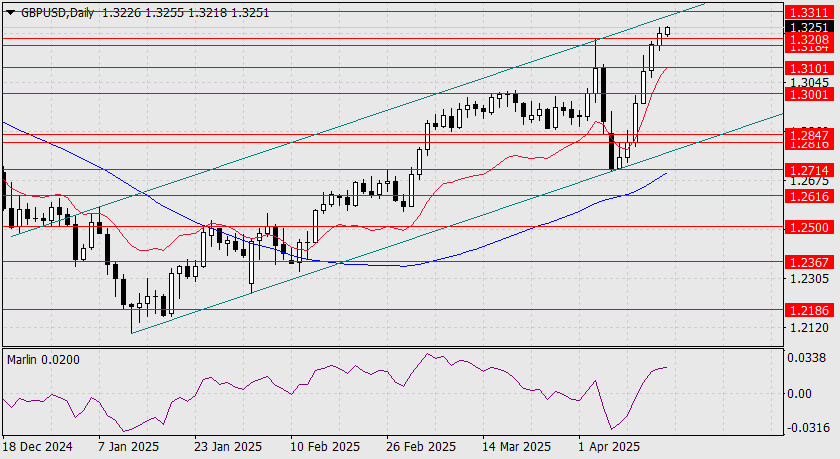

16.04.2025 05:12 AMThe British pound continues to rise according to our previously outlined scenario (see reference), heading toward the magnetic point at 1.3311, which is the intersection with the upper boundary of the ascending price channel on the daily chart.

The target date for reaching this level is April 17, the European Central Bank's rate decision date. This meeting will likely be the week's key event, with a potential surprise from the central bank. We cannot rule out a more aggressive rate cut in the context of the "tariff war."

On the four-hour chart, the price has consolidated above the 1.3184–1.3208 target range. The Marlin oscillator appears to be consolidating, but it has been gently declining over the past two days. Once the price hits the target level, this could form a reversal pattern. We expect a rise to 1.3311 and will then watch how the market reacts to the ECB decision.

You have already liked this post today

*The market analysis posted here is meant to increase your awareness, but not to give instructions to make a trade.

Useful links: My other articles are available in this section InstaForex course for beginners Popular Analytics Open trading account Important: The begginers in forex trading need to be very careful

From what we see on the 4-hour chart of the Nasdaq 100 index, there are several interesting things, namely, first, the price movement is moving below the MA (100), second

Early in the American session, gold is trading around 3,312 with a bullish bias after breaking out of the symmetrical triangle. Gold is now likely to continue rising

Useful links: My other articles are available in this section InstaForex course for beginners Popular Analytics Open trading account Important: The begginers in forex trading need to be very careful

On the 4-hour chart, the USD/CAD commodity currency pair can be seen moving below the EMA (100) and the appearance of a Bearish 123 pattern and the position

With the Stochastic Oscillator condition heading towards the Oversold level (20) on the 4-hour chart of the AUD/JPY cross currency pair, in the near future AUD/JPY has the potential

InstaTrade video

analytics

Daily analytical reviews

Forex Chart

Web-version

Your IP address shows that you are currently located in the USA. If you are a resident of the United States, you are prohibited from using the services of InstaFintech Group including online trading, online transfers, deposit/withdrawal of funds, etc.

If you think you are seeing this message by mistake and your location is not the US, kindly proceed to the website. Otherwise, you must leave the website in order to comply with government restrictions.

Why does your IP address show your location as the USA?

Please confirm whether you are a US resident or not by clicking the relevant button below. If you choose the wrong option, being a US resident, you will not be able to open an account with InstaTrade anyway.

We are sorry for any inconvenience caused by this message.