See also

31.03.2025 03:21 AM

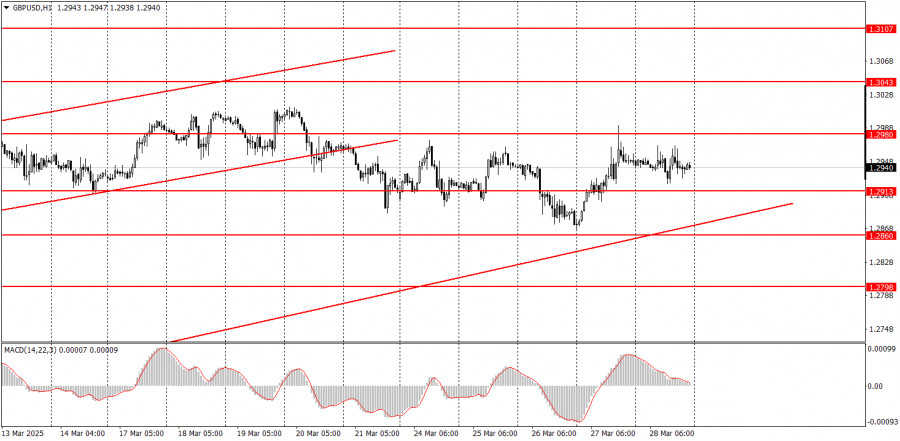

31.03.2025 03:21 AMThe GBP/USD pair traded sideways on Friday, unlike the EUR/USD pair. And that's rather strange. For several weeks now, the British pound has been moving in a flat range without clear boundaries. Nonetheless, the sideways movement is clearly visible. The pound is neither falling nor rising. Interestingly, the euro didn't have enough reasons to rise on Friday, while the pound did. UK GDP for the fourth quarter came in slightly above forecasts (on a year-over-year basis), and retail sales exceeded expectations by 1.3%. So, if any currency should have strengthened on Friday, it was the pound. It's also worth noting that the latest tariff package from Donald Trump impacts the European Union much more than the United Kingdom. Moreover, the EU is under threat of the new U.S. tariffs, while London may be able to strike a deal with Trump. Thus, although we've long said that the pound's growth has been illogical, Friday was when it had valid reasons to rise — unlike the euro, which currently holds very few strong cards.

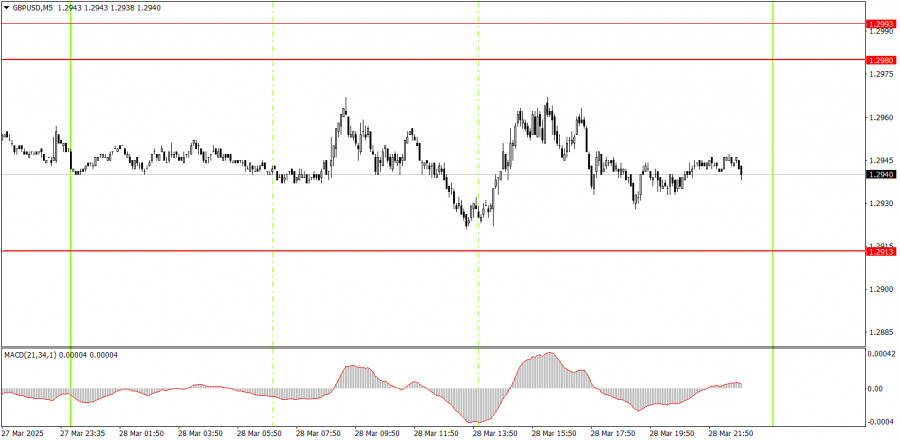

On the 5-minute timeframe, no trading signal was formed on Friday. Recent movements have been erratic and resemble "swings." There are no clear boundaries to the sideways range, so trading on rebounds hasn't worked either. There was no reason to enter the market on Friday.

On the hourly timeframe, the GBP/USD pair should have begun a downtrend long ago, but Trump is doing everything to prevent that. We still expect the pound to fall toward the 1.1800 target in the medium term, but it's unclear how long the dollar's "Trump-driven" collapse will continue. Once that move ends, the technical picture across all timeframes may shift dramatically, but long-term trends still point south. The pound sterling has risen not without cause but again far too strongly and irrationally.

On Monday, the GBP/USD pair may resume its decline, although it would be more accurate to say it might continue its flat movement. The rebound from the 1.2980–1.2993 area indicates a likely drop, but price action remains erratic, and traders are not paying much attention to the macroeconomic backdrop.

On the 5-minute timeframe, the levels to consider for trading are: 1.2301, 1.2372–1.2387, 1.2445, 1.2502–1.2508, 1.2547, 1.2613, 1.2680–1.2685, 1.2723, 1.2791–1.2798, 1.2848–1.2860, 1.2913, 1.2980–1.2993, 1.3043, 1.3102–1.3107. No significant events are scheduled in either the UK or the US on Monday, so the flat market is unlikely to end. However, the rest of the week is packed with significant events in the United States.

Support and Resistance Levels: These are target levels for opening or closing positions and can also serve as points for placing Take Profit orders.

Red Lines: Channels or trendlines indicating the current trend and the preferred direction for trading.

MACD Indicator (14,22,3): A histogram and signal line used as a supplementary source of trading signals.

Important Events and Reports: Found in the economic calendar, these can heavily influence price movements. Exercise caution or exit the market during their release to avoid sharp reversals.

Forex trading beginners should remember that not every trade will be profitable. Developing a clear strategy and practicing proper money management are essential for long-term trading success.

You have already liked this post today

*The market analysis posted here is meant to increase your awareness, but not to give instructions to make a trade.

Analysis of Friday's Trades 1H Chart of GBP/USD On Friday, the GBP/USD pair showed extremely low volatility, yet the British pound steadily crept upward even with such market conditions

Analysis of Friday's Trades 1H Chart of EUR/USD The EUR/USD currency pair showed no movement on Friday. It was Good Friday, and Easter Sunday followed. As a result, many countries

The GBP/USD currency pair traded higher again on Friday, albeit with minimal volatility. Despite the lack of important events in the U.S. or the U.K. that day (unlike earlier

Analysis of Thursday's Trades 1H Chart of GBP/USD The GBP/USD pair continued to trade higher throughout Thursday. Even at its peak levels, the British pound shows no intention of correcting

Analysis of Thursday's Trades 1H Chart of EUR/USD The EUR/USD currency pair continued trading within a sideways channel on Thursday, as shown on the hourly timeframe chart above. The current

The GBP/USD currency pair continued its upward movement on Thursday, trading near multi-year highs. Despite the lack of significant events in the U.S. or the U.K. (unlike Wednesday), the market

The EUR/USD currency pair continued to trade sideways on Thursday. While previously it had been moving within a range between 1.1274 and 1.1391, on Thursday, it was stuck

Forex Chart

Web-version

Your IP address shows that you are currently located in the USA. If you are a resident of the United States, you are prohibited from using the services of InstaFintech Group including online trading, online transfers, deposit/withdrawal of funds, etc.

If you think you are seeing this message by mistake and your location is not the US, kindly proceed to the website. Otherwise, you must leave the website in order to comply with government restrictions.

Why does your IP address show your location as the USA?

Please confirm whether you are a US resident or not by clicking the relevant button below. If you choose the wrong option, being a US resident, you will not be able to open an account with InstaTrade anyway.

We are sorry for any inconvenience caused by this message.