See also

28.03.2025 07:05 AM

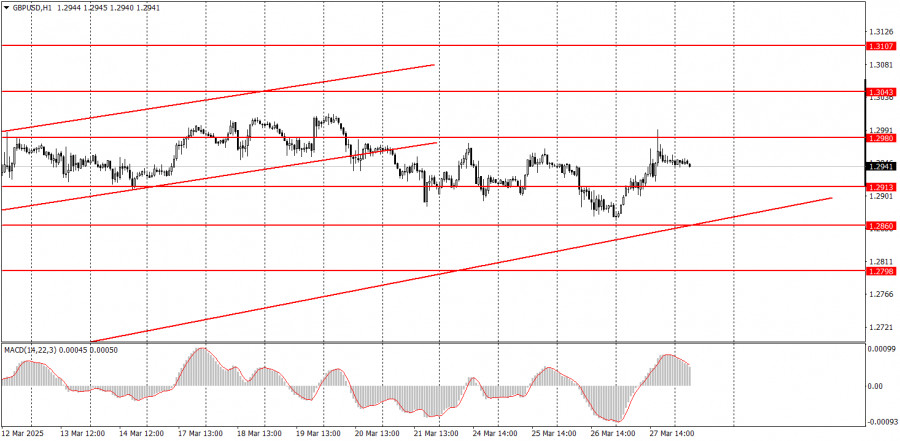

28.03.2025 07:05 AMOn Thursday, the GBP/USD pair also traded higher—and quite strongly. Despite the release of a reasonably solid Q4 GDP report in the U.S., it did little to ease the pressure on the dollar. The reason was that overnight, Donald Trump announced new import tariffs on all countries exporting automobiles to the United States. As a result, the British pound still hasn't begun its anticipated decline, and the upward trend remains intact, as indicated by the trendline. The macroeconomic backdrop continues to be a secondary consideration for traders. The key reasons for the pound's recent resilience are Trump's tariffs and the Bank of England's relatively hawkish stance. If you look closely, a sideways range has formed in recent weeks. The dollar fell yesterday; it might rise today.

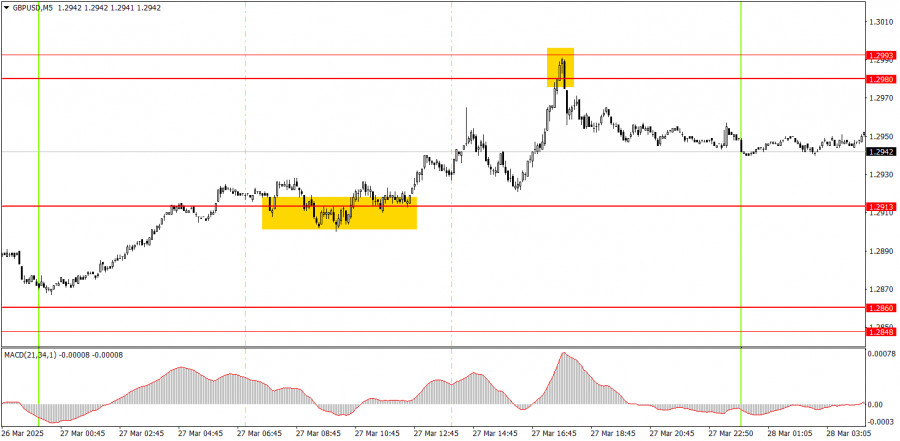

On the 5-minute chart Thursday, two somewhat imprecise signals were formed. The upward move had already begun overnight for apparent reasons and continued throughout the day. Unfortunately, the first buy signal appeared only near the 1.2913 level after the price had risen by 50 pips. The signal itself was unusually inaccurate. However, the rebound from the 1.2980–1.2993 area was excellent. This was a sell signal after a 120-pip rise in the pair. It was tradeable and potentially profitable.

On the 1-hour chart, the GBP/USD pair should have started a downtrend long ago, but Trump is doing everything to prevent that from happening. We still expect the pound to fall toward 1.1800 in the medium term. However, it is uncertain how long the decline of the dollar, influenced by Trump's policies, will last. Once this movement ends, the technical picture across all timeframes could change dramatically, but long-term trends still point south. The British pound hasn't been rising without cause—but again, its rise appears excessive and illogical.

On Friday, the GBP/USD pair may resume its decline, although it's more accurate to say it may continue to trade sideways. The rebound from the 1.2980–1.2993 area already points to a likely drop, and today's macroeconomic background is not expected to be particularly strong.

On the 5-minute chart, trading can focus on the following levels: 1.2301, 1.2372–1.2387, 1.2445, 1.2502–1.2508, 1.2547, 1.2613, 1.2680–1.2685, 1.2723, 1.2791–1.2798, 1.2848–1.2860, 1.2913, 1.2980–1.2993, 1.3043, and 1.3102–1.3107. The UK is scheduled to release Friday's Q4 GDP and retail sales reports. Both reports are not particularly significant at the moment. In the U.S., the data is even less critical, with the PCE index and consumer sentiment index being the most notable, albeit marginally so.

Support and Resistance Levels: These are target levels for opening or closing positions and can also serve as points for placing Take Profit orders.

Red Lines: Channels or trendlines indicating the current trend and the preferred direction for trading.

MACD Indicator (14,22,3): A histogram and signal line used as a supplementary source of trading signals.

Important Events and Reports: Found in the economic calendar, these can heavily influence price movements. Exercise caution or exit the market during their release to avoid sharp reversals.

Forex trading beginners should remember that not every trade will be profitable. Developing a clear strategy and practicing proper money management are essential for long-term trading success.

You have already liked this post today

*The market analysis posted here is meant to increase your awareness, but not to give instructions to make a trade.

Several entry points into the market were formed yesterday. Let's look at the 5-minute chart and break down what happened. I highlighted the 1.3282 level in my morning forecast

Yesterday, several entry points into the market were formed. Let's look at the 5-minute chart and analyze what happened. In my morning forecast, I highlighted the 1.1320 level

Analysis of Thursday's Trades 1H Chart of GBP/USD On Thursday, the GBP/USD pair continued its downward movement, although the overall picture still closely resembles a sideways range. The British pound

Analysis of Thursday's Trades 1H Chart of EUR/USD On Thursday, the EUR/USD currency pair continued its downward movement and reached the 1.1275 level by the end of the day, which

The GBP/USD currency pair continued to correct downward following Monday's rally and against the broader uptrend. There was no reason to expect the kind of price action that ultimately unfolded

The EUR/USD currency pair continued its mild upward movement on Thursday. The ongoing rise of the U.S. dollar looks strange, but strange price behavior has become the norm in recent

The GBP/USD pair also showed a downward movement on Wednesday, for which there were no valid reasons. There were no noteworthy events in the UK yesterday, while the U.S. released

Wednesday's Trade Analysis: 1H chart of the EUR/USD pair. The EUR/USD currency pair continued its downward movement within the sideways channel on the hourly time frame on Wednesday —

E-mail/SMS

notifications

Your IP address shows that you are currently located in the USA. If you are a resident of the United States, you are prohibited from using the services of InstaFintech Group including online trading, online transfers, deposit/withdrawal of funds, etc.

If you think you are seeing this message by mistake and your location is not the US, kindly proceed to the website. Otherwise, you must leave the website in order to comply with government restrictions.

Why does your IP address show your location as the USA?

Please confirm whether you are a US resident or not by clicking the relevant button below. If you choose the wrong option, being a US resident, you will not be able to open an account with InstaTrade anyway.

We are sorry for any inconvenience caused by this message.