See also

Bitcoin and Ethereum once again struggled to overcome key resistance levels, preventing a short-term upward trend in these assets. Their inability to even hold near weekly highs also points to the challenges facing buyers of risk assets in the current market environment.

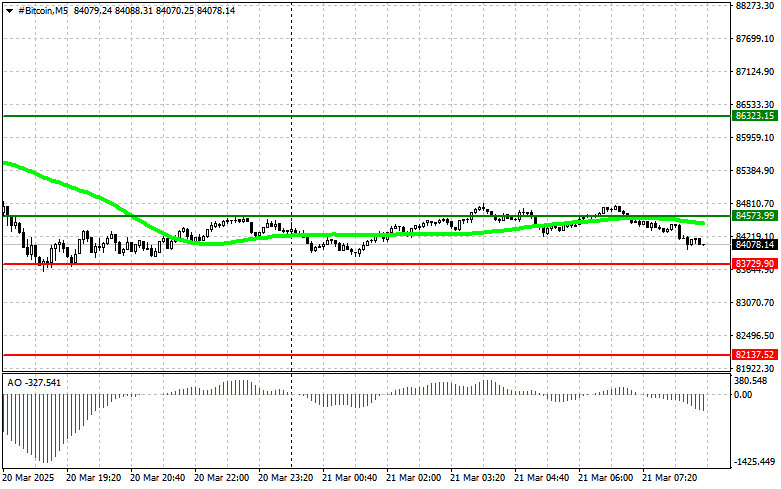

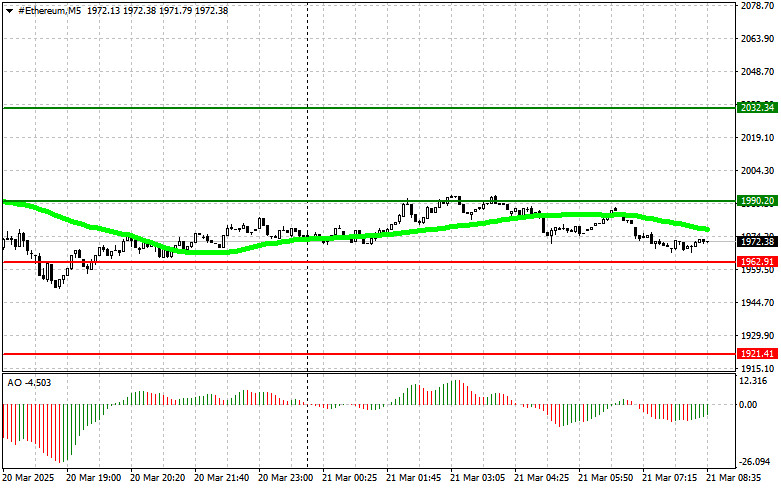

Having updated its low to around $83,770, Bitcoin is trading near $84,100. After dipping to $1,950, Ethereum managed to hold above that level and quickly recovered to the $1,974 area, where it is currently trading.

Yesterday, the crypto community followed Donald Trump's speech at the summit. However, as usual, Trump didn't say anything new. Despite the big statements, we heard nothing of substance from the U.S. president.

Trump noted that his administration would create a cryptocurrency reserve and not sell Bitcoin as Biden did. In his view, this step would provide more stability and predictability to the digital asset market and prevent unwanted pressure on Bitcoin's price.

The Trump administration also plans to create a regulated framework for stablecoins. This approach is intended to ensure transparency and safety for users while encouraging innovation in the space. Clear rules of the game will attract more investors and companies interested in using stablecoins for various purposes.

Trump further stated that the U.S. would become the crypto capital of the world. He said that Achieving this goal would require a favorable regulatory environment, infrastructure development, and talent attraction. "America must become a leader in blockchain and cryptocurrencies to secure a competitive edge in the future," the U.S. leader said. However, as noted earlier, this had little direct impact on the crypto market.

As for intraday strategy in the crypto market, I will continue relying on any significant pullbacks in Bitcoin and Ethereum as opportunities to rejoin the broader medium-term bullish trend, which remains intact.

For short-term trading, the strategy and conditions are outlined below.

Scenario 1: I plan to buy Bitcoin today if the price reaches the entry point around $84,500, targeting a rise to $86,300. Around $86,300, I'll exit long positions and sell immediately on a pullback. Before buying a breakout, ensure the 50-day moving average is below the current price and the Awesome Oscillator is in positive territory.

Scenario 2: Bitcoin can also be bought from the lower boundary at $83,700 if there is no market reaction to a break below it, with targets at $84,500 and $86,300.

Scenario 1: I plan to sell Bitcoin today if the price reaches the entry point around $83,700, targeting a drop to $82,100. Around $82,100, I'll exit short positions and buy immediately on a rebound. Before selling a breakout, ensure the 50-day moving average is above the current price and the Awesome Oscillator is in negative territory.

Scenario 2: Bitcoin can also be sold from the upper boundary at $84,500 if there is no market reaction to a break above it, targeting $83,700 and $82,100.

Scenario 1: I plan to buy Ethereum today if the price reaches the entry point around $1,990, targeting a rise to $2,032. Around $2,032, I'll exit long positions and sell immediately on a pullback. Before buying a breakout, ensure the 50-day moving average is below the current price and the Awesome Oscillator is in positive territory.

Scenario 2: Ethereum can also be bought from the lower boundary at $1,962 if there is no market reaction to a break below it, targeting $1,990 and $2,032.

Scenario 1: I plan to sell Ethereum today if the price reaches the entry point around $1,962, targeting a drop to $1,921. Around $1,921, I'll exit short positions and buy immediately on a rebound. Before selling a breakout, make sure the 50-day moving average is above the current price and the Awesome Oscillator is in negative territory.

Scenario 2: Ethereum can also be sold from the upper boundary at $1,990 if there is no market reaction to a break above it, targeting $1,962 and $1,921.

You have already liked this post today

*The market analysis posted here is meant to increase your awareness, but not to give instructions to make a trade.

Forex Chart

Web-version

Your IP address shows that you are currently located in the USA. If you are a resident of the United States, you are prohibited from using the services of InstaFintech Group including online trading, online transfers, deposit/withdrawal of funds, etc.

If you think you are seeing this message by mistake and your location is not the US, kindly proceed to the website. Otherwise, you must leave the website in order to comply with government restrictions.

Why does your IP address show your location as the USA?

Please confirm whether you are a US resident or not by clicking the relevant button below. If you choose the wrong option, being a US resident, you will not be able to open an account with InstaTrade anyway.

We are sorry for any inconvenience caused by this message.