See also

17.03.2025 12:05 PM

17.03.2025 12:05 PMThe USD/CAD pair begins the new week with caution, fluctuating within a narrow range above 1.4350 and remaining above the 50-day SMA. However, fundamental factors suggest potential downside risks.

Positive developments in U.S.-Canada trade negotiations, along with the recent rise in crude oil prices, support the commodity-dependent Canadian dollar, exerting downward pressure on the pair. Oil prices have reached a two-week high amid escalating tensions in the Red Sea, as the U.S. vowed to continue strikes against Yemen's Houthis until their attacks cease. This situation also impacts the market. Additionally, bearish sentiment surrounding the U.S. dollar creates negative prospects for USD/CAD.

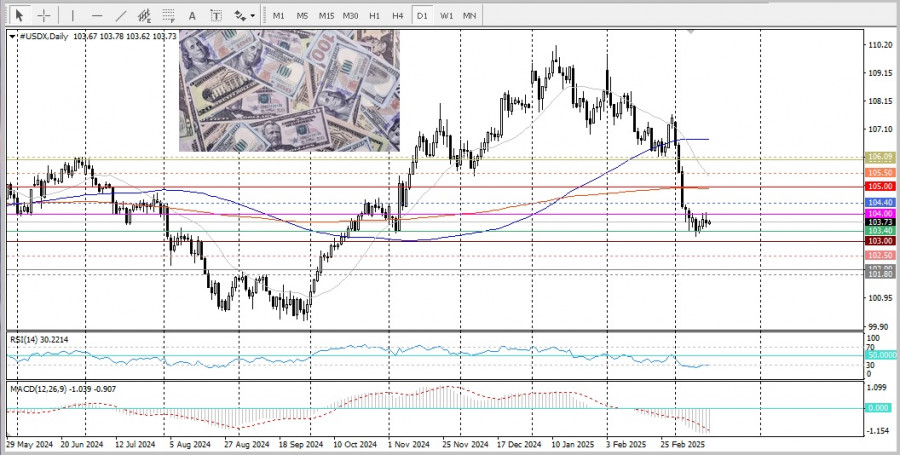

The U.S. Dollar Index remains near multi-month lows due to concerns about the potential negative impact of Trump's tariffs on the economy. Weaker inflation data and signs of labor market cooling may lead to interest rate cuts by the Federal Reserve this year, further restraining dollar bulls.

Traders should closely monitor the release of U.S. economic data, including retail sales figures and the Empire State Manufacturing Index, which could provide some short-term momentum to the pair during the North American session. However, the key event of the week remains the FOMC monetary policy meeting on Wednesday, which will have a significant impact on the U.S. dollar and set the direction for USD/CAD.

From a technical perspective, bears should wait for confirmation of weakness below the 1.4350 support level, where the 50-day SMA is positioned, before initiating new sell positions. Furthermore, daily chart oscillators have yet to shift into negative territory, indicating that further confirmation is required for a clear bearish signal.

You have already liked this post today

*The market analysis posted here is meant to increase your awareness, but not to give instructions to make a trade.

A considerable number of macroeconomic reports are scheduled for Friday. In the European Union, Germany, the UK, and the US, indices of business activity in the services and manufacturing sectors

The GBP/USD currency pair traded more actively on Thursday following macroeconomic data from across the Atlantic. In our discussions about the Non-Farm Payrolls and unemployment reports, we emphasize that

The EUR/USD currency pair continued its movement on Thursday, following the trend started the day before. In the second half of the day, the U.S. dollar appreciated again. The word

Finally, after a two-and-a-half-month delay (initially scheduled for October 3), the U.S. Bureau of Labor Statistics released the official labor market data for September. Non-Farm Payrolls are significant in their

Your IP address shows that you are currently located in the USA. If you are a resident of the United States, you are prohibited from using the services of InstaFintech Group including online trading, online transfers, deposit/withdrawal of funds, etc.

If you think you are seeing this message by mistake and your location is not the US, kindly proceed to the website. Otherwise, you must leave the website in order to comply with government restrictions.

Why does your IP address show your location as the USA?

Please confirm whether you are a US resident or not by clicking the relevant button below. If you choose the wrong option, being a US resident, you will not be able to open an account with InstaTrade anyway.

We are sorry for any inconvenience caused by this message.