See also

14.03.2025 08:05 AM

14.03.2025 08:05 AMThere are few macroeconomic events scheduled for Friday, and none of them are significant. The UK will release reports on GDP and industrial production, but strong figures are not expected. Additionally, the GDP report will be monthly rather than quarterly, so the market's reaction is anticipated to be minimal. Germany will also publish an inflation report, which is unlikely to attract much interest from traders. This is primarily because it is the second estimate for February and reflects inflation in just one of the 27 EU countries. Over the past two weeks, the market has overlooked even more important reports. The U.S. will release the University of Michigan Consumer Sentiment Index, but this is also not considered particularly important.

Although there are no significant fundamental events on Friday, the market continues to react primarily to Donald Trump's decisions and statements. Key issues currently on the agenda include tariffs on the European Union, a potential trade war with Canada, and the resolution of the military conflict in Ukraine. As a result, it is impossible to predict what news might emerge regarding these topics.

On the final trading day of the week, both currency pairs may move in any direction, as the market is currently driven by emotions, with Donald Trump as a central influence. If the U.S. president announces new sanctions or tariffs, the dollar could face renewed pressure. Conversely, if there is no news from Trump, both pairs might experience minor corrections. However, the pound, for example, shows no signs of interest in correcting at this time.

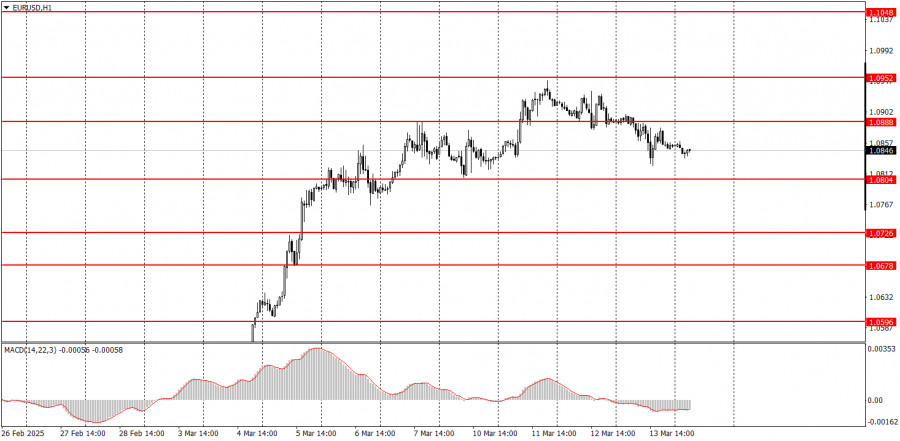

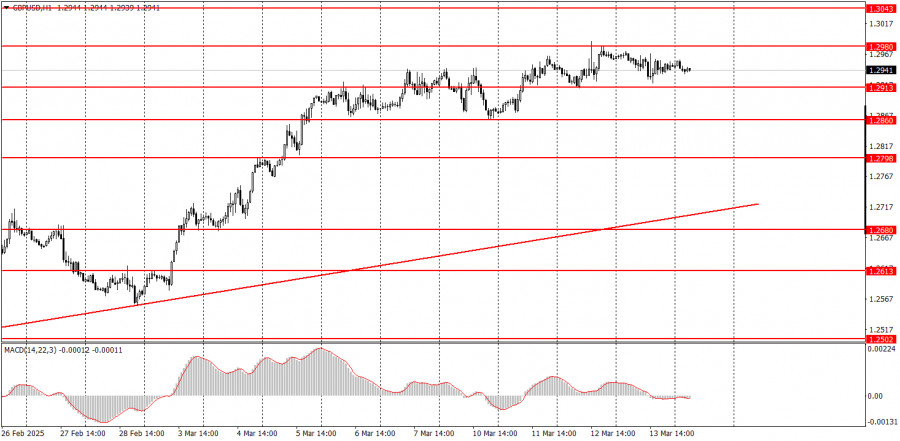

Support and Resistance Levels: These are target levels for opening or closing positions and can also serve as points for placing Take Profit orders.

Red Lines: Channels or trendlines indicating the current trend and the preferred direction for trading.

MACD Indicator (14,22,3): A histogram and signal line used as a supplementary source of trading signals.

Important speeches and reports, which are consistently featured in the news calendar, can significantly influence the movement of a currency pair. Therefore, during their release, it is advisable to trade with caution or consider exiting the market to avoid potential sharp price reversals against the prior trend.

Beginners in the Forex market should understand that not every transaction will be profitable. Developing a clear trading strategy and practicing effective money management are crucial for achieving long-term success in trading.

You have already liked this post today

*The market analysis posted here is meant to increase your awareness, but not to give instructions to make a trade.

A considerable number of macroeconomic reports are scheduled for Friday. In the European Union, Germany, the UK, and the US, indices of business activity in the services and manufacturing sectors

The GBP/USD currency pair traded more actively on Thursday following macroeconomic data from across the Atlantic. In our discussions about the Non-Farm Payrolls and unemployment reports, we emphasize that

The EUR/USD currency pair continued its movement on Thursday, following the trend started the day before. In the second half of the day, the U.S. dollar appreciated again. The word

Finally, after a two-and-a-half-month delay (initially scheduled for October 3), the U.S. Bureau of Labor Statistics released the official labor market data for September. Non-Farm Payrolls are significant in their

Training video

Your IP address shows that you are currently located in the USA. If you are a resident of the United States, you are prohibited from using the services of InstaFintech Group including online trading, online transfers, deposit/withdrawal of funds, etc.

If you think you are seeing this message by mistake and your location is not the US, kindly proceed to the website. Otherwise, you must leave the website in order to comply with government restrictions.

Why does your IP address show your location as the USA?

Please confirm whether you are a US resident or not by clicking the relevant button below. If you choose the wrong option, being a US resident, you will not be able to open an account with InstaTrade anyway.

We are sorry for any inconvenience caused by this message.