See also

13.03.2025 10:53 AM

13.03.2025 10:53 AMBuying US stocks is like catching falling knives. It's unpleasant and dangerous for your life — or rather, for your wallet. Nevertheless, pessimism regarding US stock indices has reached such a level that you can't help but start looking at long positions in the S&P 500. When everyone is selling, a wise investor grabs the right moment to buy, doesn't he?

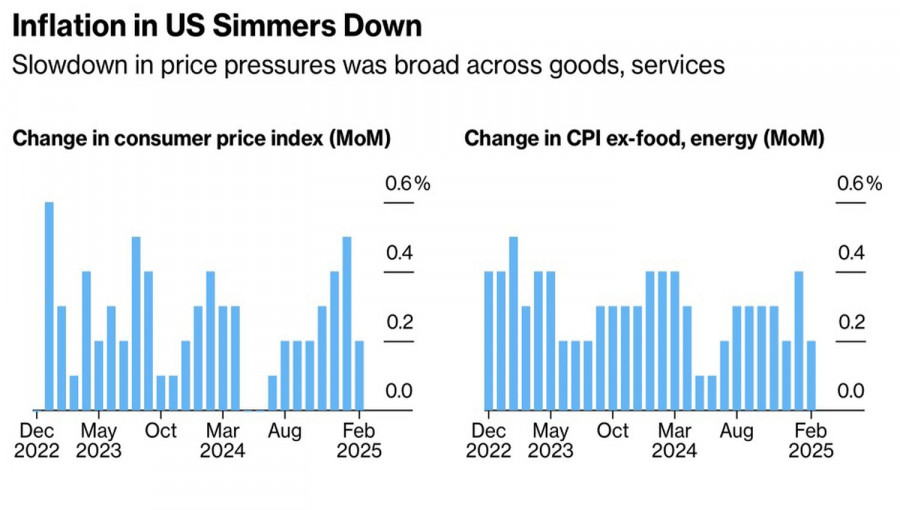

It seemed that US inflation data should have helped the broad stock index find a bottom. Consumer prices and the core indicator increased by a modest 0.2% month-on-month in February. Year-on-year, both indicators fell short of forecasts. Their dynamics signal that the disinflationary trend remains strong, which theoretically should encourage the Federal Reserve to resume the cycle of rate cuts and throw a lifeline to the S&P 500.

US inflation dynamics

In reality, inflation doesn't interest anyone. Investors react to tariff news and get spooked by the so-called looming recession. But what if there isn't one? According to JP Morgan, signals from the credit markets, which have repeatedly proven their validity in recent years, suggest that the chances of a downturn in the US economy in the next 12 months are 9-12%. At the same time, stock and interest rate markets estimate these chances at nearly 50%. Based on this, JP Morgan concludes that the correction in the S&P 500 is nearing its end.

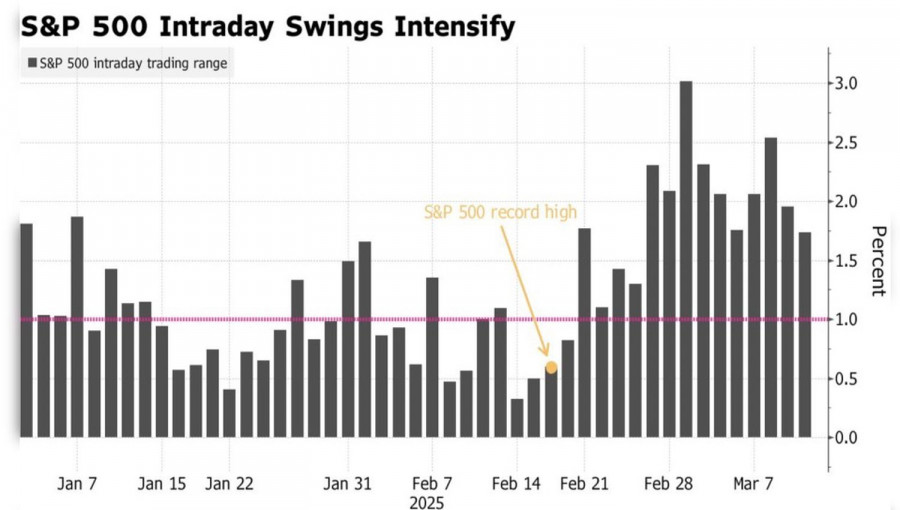

Quite an interesting opinion. The broad stock index has fallen almost 9% from its record high. And while the start of the downtrend was caused by overconfidence, which manifested in narrow trading ranges, the subsequent slump had a different character. Investors who went long at high levels hastily liquidated their positions, which widened the daily trading ranges. Gradually, the situation stabilized and the S&P 500 shed ballast.

S&P 500 daily trading range dynamics

Has the short-term pain for US stocks and the economy, as mentioned by Donald Trump, ended? He said we need to endure to make America great again. I don't think so. Trade wars are just beginning, and they will undoubtedly harm economic growth and spur inflation in the US. A stagflation scenario is not the best option for the S&P 500.

On the other hand, in the short term, excessive pessimism could play a nasty trick on the "bears" in the broad stock index. A retreat from recession fears could encourage growth in the S&P 500. However, the rally potential in the stock market seems limited.

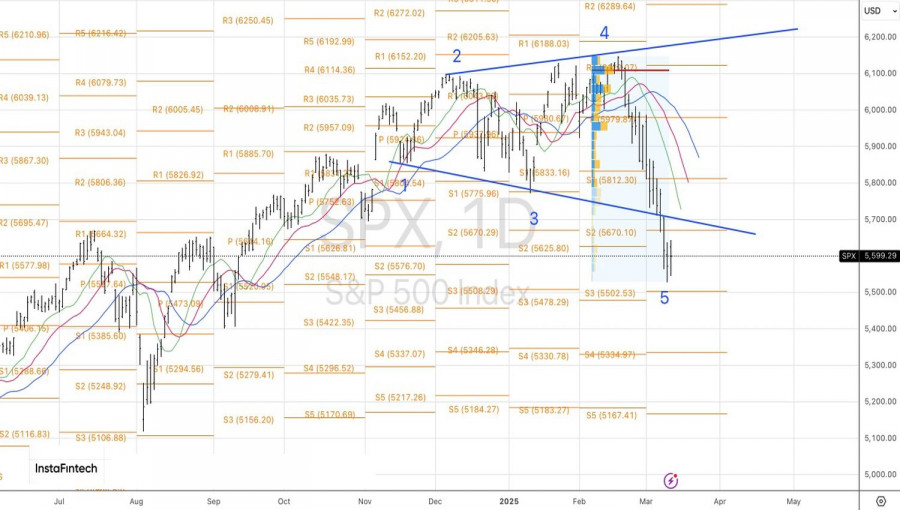

Technically, on the daily chart of the S&P 500, the "bulls" attempted a counterattack. However, the first assault on the resistance in the form of a pivot level at 5,627 was unsuccessful. A repeat attempt, if successful, will enable traders to open short-term long positions. The future of the broad stock index will depend on its ability to break above the previously indicated resistances at 5,670 and 5,750.

You have already liked this post today

*The market analysis posted here is meant to increase your awareness, but not to give instructions to make a trade.

The Federal Reserve remained firm, with its leadership reaffirming a steadfast wait-and-see approach. Interestingly, the Fed did not respond to notable changes in the economy, citing heightened uncertainty

Very few macroeconomic events are scheduled for Thursday, and none are significant. Germany will release its industrial production report for March, and the U.S. will publish weekly jobless claims. These

InstaTrade in figures

Your IP address shows that you are currently located in the USA. If you are a resident of the United States, you are prohibited from using the services of InstaFintech Group including online trading, online transfers, deposit/withdrawal of funds, etc.

If you think you are seeing this message by mistake and your location is not the US, kindly proceed to the website. Otherwise, you must leave the website in order to comply with government restrictions.

Why does your IP address show your location as the USA?

Please confirm whether you are a US resident or not by clicking the relevant button below. If you choose the wrong option, being a US resident, you will not be able to open an account with InstaTrade anyway.

We are sorry for any inconvenience caused by this message.