See also

13.03.2025 09:05 AM

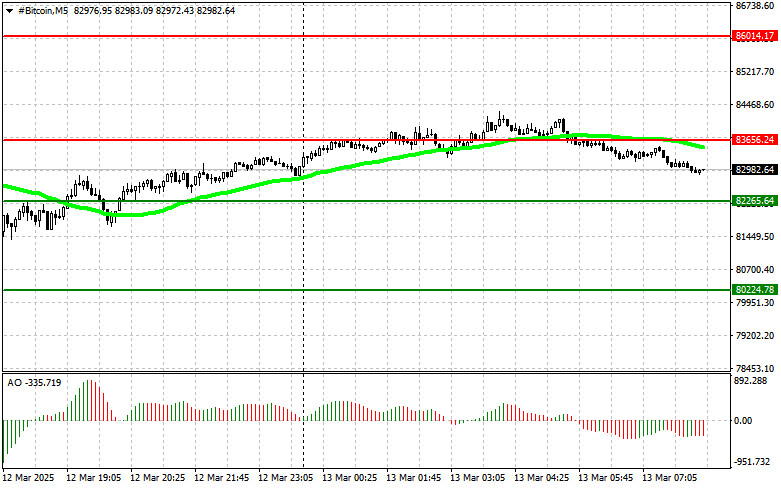

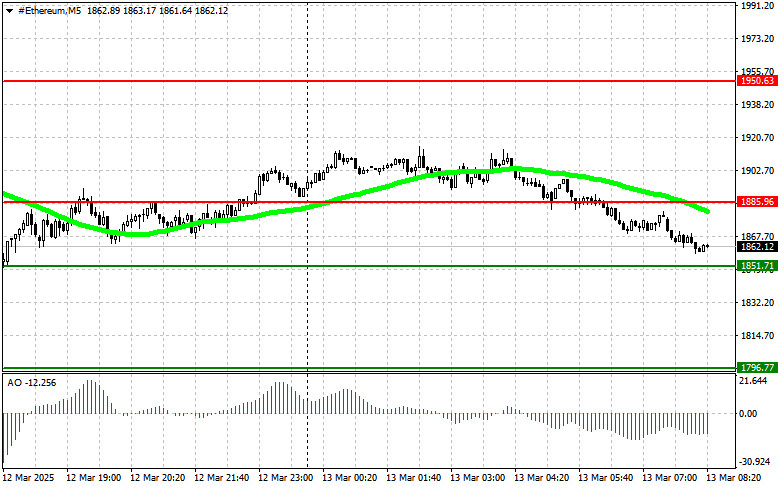

13.03.2025 09:05 AMBitcoin and Ethereum are locked within new channels. On the positive side, the intense selling pressure observed at the beginning of the week has subsided. However, there are concerns about Bitcoin's potential for further growth, as there has been a lack of active buying above $84,000. This suggests that another significant price drop may be necessary.

After reaching a low of around $80,500, Bitcoin is currently trading at $83,000. Ethereum dipped to approximately $1,828 but was quickly bought up, leading to a recovery toward $1,861.

A positive sign comes from a Santiment report, which highlights a sharp increase in network activity for Tether, including a rise in new wallets and transaction volumes. Such activity is typically observed near local market extremes. Given the recent decline in the market, this surge in activity could indicate that traders are preparing to invest in the crypto market.

However, it's important to note that the correlation between Tether activity and subsequent market growth is not always direct. Other factors, such as macroeconomic conditions, regulatory developments, and overall trends in the crypto market, must also be taken into account.

Nonetheless, increased activity in the Tether network may serve as one indicator of a potential reversal of the bearish correction. Traders should pay attention to this signal and conduct their own research before making any decisions. While this could be an early sign of market recovery, it is risky to rely solely on one indicator.

As for the intraday trading strategy, I will focus on significant dips in Bitcoin and Ethereum, anticipating continuing the bullish trend in the medium term.

For short-term trading, the strategy and conditions are outlined below.

Scenario #1: I plan to buy Bitcoin today if it reaches the entry point around $83,600, targeting a rise to $86,000. Around $86,000, I will exit my buy positions and immediately sell on the rebound. Before buying on a breakout, I will ensure that the 50-day moving average is below the current price and that the Awesome Indicator is in positive territory.

Scenario #2: Bitcoin can also be bought from the lower boundary of $82,200 if there is no market reaction to its breakout, with an expected rise toward $83,600 and $86,000.

Scenario #1: I plan to sell Bitcoin today if it reaches the entry point around $82,200, targeting a decline to $80,200. Around $80,200, I will exit my sell positions and immediately buy on the rebound. Before selling on a breakout, I will ensure that the 50-day moving average is above the current price and that the Awesome Indicator is in negative territory.

Scenario #2: Bitcoin can also be sold from the upper boundary of $83,600 if there is no market reaction to its breakout, with an expected decline toward $82,200 and $80,200.

Scenario #1: I plan to buy Ethereum today if it reaches the entry point around $1,885, targeting a rise to $1,950. Around $1,950, I will exit my buy positions and immediately sell on the rebound. Before buying on a breakout, I will ensure that the 50-day moving average is below the current price and that the Awesome Indicator is in positive territory.

Scenario #2: Ethereum can also be bought from the lower boundary of $1,851 if there is no market reaction to its breakout, with an expected rise toward $1,885 and $1,950.

Scenario #1: I plan to sell Ethereum today if it reaches the entry point around $1,851, targeting a decline to $1,796. Around $1,796, I will exit my sell positions and immediately buy on the rebound. Before selling on a breakout, I will ensure that the 50-day moving average is above the current price and that the Awesome Indicator is in negative territory.

Scenario #2: Ethereum can also be sold from the upper boundary of $1,885 if there is no market reaction to its breakout, with an expected decline toward $1,851 and $1,796.

You have already liked this post today

*The market analysis posted here is meant to increase your awareness, but not to give instructions to make a trade.

[Doge] With the appearance of a Bullish Divergence, there is potential for Doge to retrace upward; however, as long as it does not break above 0.16550, Doge will return

Bitcoin has slightly recovered its position; however, the risk of a new wave of sell-offs still prevails. Meanwhile, the market clings to every piece of positive news and reacts accordingly

While the cryptocurrency market is experiencing a downturn, with only occasional small corrections, the Ethereum Foundation has introduced the concept of the Ethereum Interoperability Layer. The essence of this initiative

Our new app for your convenient and fast verification

Our new app for your convenient and fast verification

Your IP address shows that you are currently located in the USA. If you are a resident of the United States, you are prohibited from using the services of InstaFintech Group including online trading, online transfers, deposit/withdrawal of funds, etc.

If you think you are seeing this message by mistake and your location is not the US, kindly proceed to the website. Otherwise, you must leave the website in order to comply with government restrictions.

Why does your IP address show your location as the USA?

Please confirm whether you are a US resident or not by clicking the relevant button below. If you choose the wrong option, being a US resident, you will not be able to open an account with InstaTrade anyway.

We are sorry for any inconvenience caused by this message.