See also

13.03.2025 10:25 AM

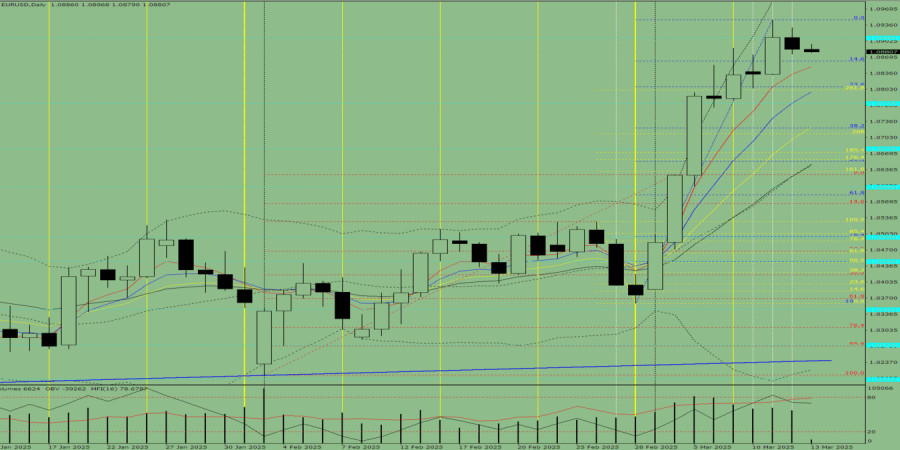

13.03.2025 10:25 AMOn Thursday, the market may continue moving downward from 1.0886 (yesterday's daily close) toward 1.0861 – the 14.6% Fibonacci retracement level (blue dashed line). From this level, a rebound upward toward 1.0897 – the upper fractal (blue dashed line) – is possible.

On Thursday, the market may continue declining from 1.0886 (yesterday's daily close) toward 1.0808 – the 23.6% Fibonacci retracement level (blue dashed line). From this level, the price may rebound upward toward 1.0861 – the 14.6% Fibonacci retracement level (blue dashed line).

You have already liked this post today

*The market analysis posted here is meant to increase your awareness, but not to give instructions to make a trade.

If gold consolidates above the 21 SMA and 6/8 Murray in the coming hours, we could open long positions, with short-term targets around $4,218. The instrument could even reach $4,311

Bitcoin reached a low around the psychological level of $80,000. From this level, we observed a technical rebound, so it is likely that BTC will continue to rise

Useful links: My other articles are available in this section InstaForex course for beginners Popular Analytics Open trading account Important: The begginers in forex trading need to be very careful

InstaTrade

video analytics

Your IP address shows that you are currently located in the USA. If you are a resident of the United States, you are prohibited from using the services of InstaFintech Group including online trading, online transfers, deposit/withdrawal of funds, etc.

If you think you are seeing this message by mistake and your location is not the US, kindly proceed to the website. Otherwise, you must leave the website in order to comply with government restrictions.

Why does your IP address show your location as the USA?

Please confirm whether you are a US resident or not by clicking the relevant button below. If you choose the wrong option, being a US resident, you will not be able to open an account with InstaTrade anyway.

We are sorry for any inconvenience caused by this message.