See also

13.03.2025 12:59 AM

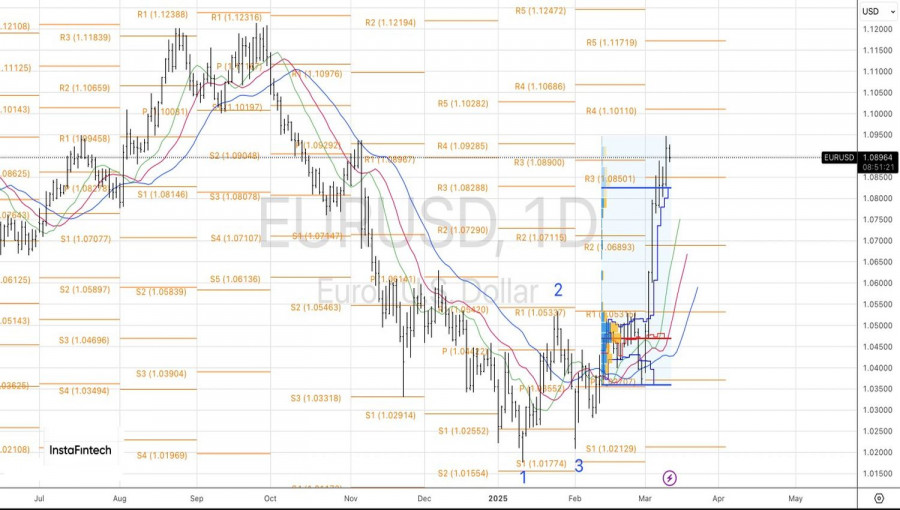

13.03.2025 12:59 AMThe euro represents the currency of optimists, and as spring begins, optimism in the financial markets is at an all-time high. Europe is standing firm against Russia without support from the US and is not intimidated by a trade war with the US. This lack of fear has allowed the EUR/USD to maintain a position around the 1.09 level, pushing the major currency pair toward the upper end of the 1.02-1.12 trading range that it has occupied for the past two years.

In 2023-2024, the US economy outperformed those of other countries, which led to the dominance of the US dollar in the Forex market. The US dollar index peaked during Donald Trump's inauguration, driven by expectations that differences in GDP growth would only widen. The anticipated fiscal stimulus was expected to accelerate growth in the US while slowing it down in Europe, China, and other regions. However, the reality turned out to be quite the opposite.

Trump's administration began not with tax cuts but with tariffs and reductions in government spending. These actions have slowed, rather than stimulated, the economy. Fears of an impending recession in the US have prompted investors to flee the US stock and bond markets, contributing to the rise of the EUR/USD. Investors are increasingly optimistic that the Federal Reserve will step in to support the financial markets, which is leading to expectations of a significant increase in monetary expansion.

The White House implemented tariffs on steel and aluminum, effective March 12, which prompted a response from the European Union in the form of duties on imports of U.S. goods totaling €26 billion. Additionally, Brussels began discussing a list of U.S. agricultural products and industrial goods on which it plans to impose 25% tariffs starting in mid-April. It's important to note that from April 1, the EU intends to lift the freeze on retaliatory levies on metals, which had been put in place during Donald Trump's first presidential term.

This situation marks the beginning of a trade war. Initially viewed as a clear negative for the export-oriented eurozone economy and the euro at the end of 2024, the reluctance of EUR/USD to decline suggests a different narrative. Are investors genuinely optimistic that the White House will reach an agreement, preventing further escalation beyond mere threats?

Meanwhile, markets remain optimistic about fiscal stimulus in Germany, especially as Friedrich Merz is nearing an agreement with the Green Party. Germany's increased spending could significantly shift the balance of power in the Forex market. The United States may lose its exclusivity, while other parts of the world begin to catch up, leading to a decline in the dollar's favorability.

On the daily chart of EUR/USD, there is a high probability of forming a new inner bar, indicating market uncertainty. If the price breaks above the upper boundary near 1.0930, it will provide an opportunity to increase existing long positions. Conversely, if the currency pair falls below 1.0875, this could signal a potential reversal, leading to selling the euro against the U.S. dollar.

You have already liked this post today

*The market analysis posted here is meant to increase your awareness, but not to give instructions to make a trade.

Equity markets have improved, demand for cryptocurrencies has risen, yet gold prices dropped sharply after a local rally. Meanwhile, the U.S. dollar has remained almost unchanged against major currencies

InstaTrade video

analytics

Daily analytical reviews

InstaTrade

PAMM accounts

Your IP address shows that you are currently located in the USA. If you are a resident of the United States, you are prohibited from using the services of InstaFintech Group including online trading, online transfers, deposit/withdrawal of funds, etc.

If you think you are seeing this message by mistake and your location is not the US, kindly proceed to the website. Otherwise, you must leave the website in order to comply with government restrictions.

Why does your IP address show your location as the USA?

Please confirm whether you are a US resident or not by clicking the relevant button below. If you choose the wrong option, being a US resident, you will not be able to open an account with InstaTrade anyway.

We are sorry for any inconvenience caused by this message.