See also

12.03.2025 12:45 PM

12.03.2025 12:45 PMDonald Trump doesn't see a recession, but that isn't helping the S&P 500. The broad stock index has reacted sharply to tensions between Ontario, Canada, which threatened to impose a 25% tariff on electricity exports to the U.S.—potentially leaving millions of Americans without power—and the White House. Trump responded by raising tariffs on imported steel and aluminum from 25% to 50%, followed by a subsequent reconciliation. However, the ordeal severely rattled nerves and further increased market volatility.

Markets rise on expectations, or rather, on speculation. The S&P 500 rally to February highs was driven by two theories: that Trump's tariff threats were merely a negotiating tactic and that the U.S. president would eventually throw the stock market a lifeline. Neither theory has materialized as spring unfolds.

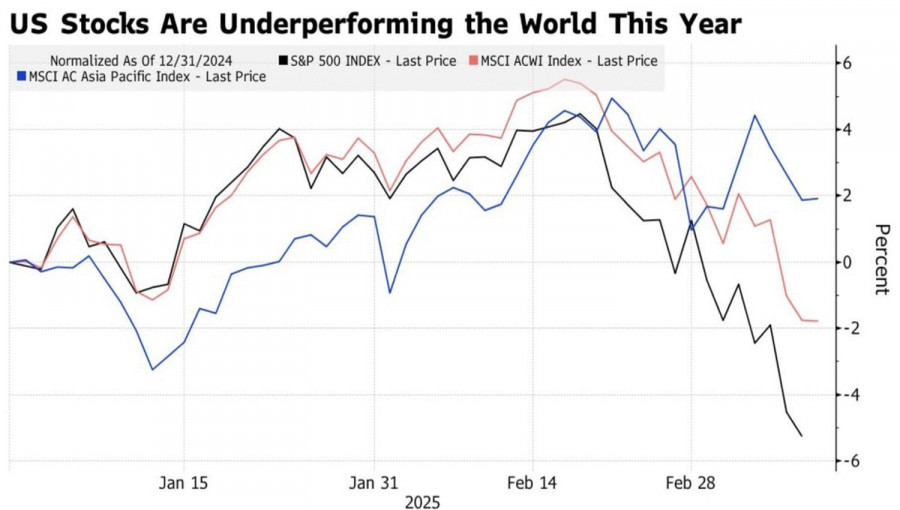

Tariffs are already high and could rise even further. Trump's speeches suggest he is willing to sacrifice the stock market to achieve his ultimate goal—making America great again. Fears that this strategy might fail are driving capital out of the U.S., leaving the S&P 500 lagging behind its major global competitors.

Stock Index Performance

According to Trump, markets will go up or down, but the priority is to restore the country by bringing factories and industries back to the U.S. Other countries have taken American businesses and jobs, and it's time to reclaim them. The president does not see a recession and expects an economic boom.

Markets aren't buying it. Goldman Sachs has lowered its year-end forecast for the S&P 500 from 6,500 to 6,200, citing a cooling U.S. economy, potentially higher tariff rates, and greater uncertainty. The latter typically leads to a higher risk premium on stocks.

If Trump doesn't support the S&P 500, could the Federal Reserve step in? Derivatives markets have increased their expectations for monetary easing by the end of the year, now pricing in a total rate cut of 80 basis points, up from 60 basis points just a week ago. However, BNP Paribas warns that investors may face disappointment here as well. The Fed, facing both an approaching recession and persistently high inflation, is likely to delay further rate cuts, preferring a wait-and-see approach.

The only silver lining is that historically, a 10% decline in the S&P 500 has only deepened into a 20% drop when one of three conditions was met: an economic downturn, an earnings recession, or aggressive Fed tightening. None of these factors are currently present, suggesting that the bottom for the U.S. stock market may be near.

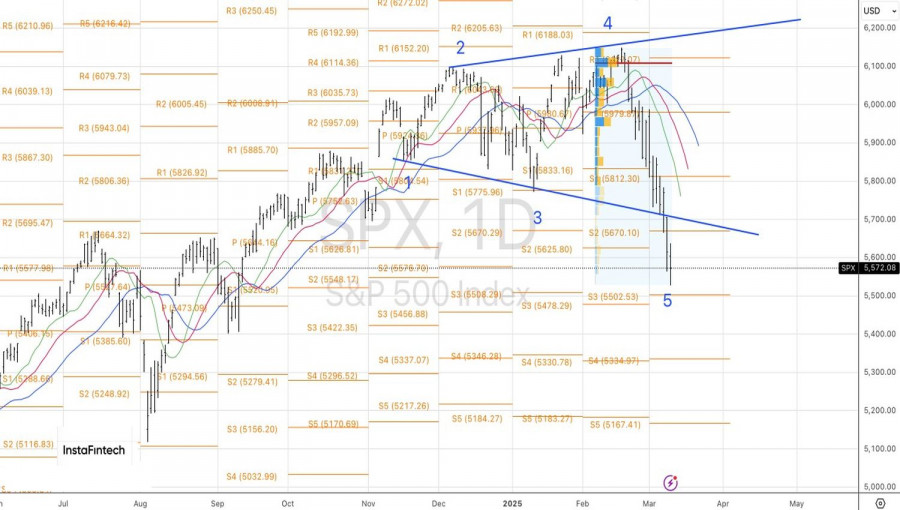

Technically, the S&P 500 continues to follow an Expanding Wedge pattern on the daily chart. The strategy remains the same—focus on selling opportunities and use rebounds from resistance at 5,670 and 5,750 to establish short positions on the broad equity index.

You have already liked this post today

*The market analysis posted here is meant to increase your awareness, but not to give instructions to make a trade.

A considerable number of macroeconomic reports are scheduled for Friday. In the European Union, Germany, the UK, and the US, indices of business activity in the services and manufacturing sectors

The GBP/USD currency pair traded more actively on Thursday following macroeconomic data from across the Atlantic. In our discussions about the Non-Farm Payrolls and unemployment reports, we emphasize that

The EUR/USD currency pair continued its movement on Thursday, following the trend started the day before. In the second half of the day, the U.S. dollar appreciated again. The word

Finally, after a two-and-a-half-month delay (initially scheduled for October 3), the U.S. Bureau of Labor Statistics released the official labor market data for September. Non-Farm Payrolls are significant in their

InstaTrade

video analytics

Your IP address shows that you are currently located in the USA. If you are a resident of the United States, you are prohibited from using the services of InstaFintech Group including online trading, online transfers, deposit/withdrawal of funds, etc.

If you think you are seeing this message by mistake and your location is not the US, kindly proceed to the website. Otherwise, you must leave the website in order to comply with government restrictions.

Why does your IP address show your location as the USA?

Please confirm whether you are a US resident or not by clicking the relevant button below. If you choose the wrong option, being a US resident, you will not be able to open an account with InstaTrade anyway.

We are sorry for any inconvenience caused by this message.