See also

12.03.2025 09:01 AM

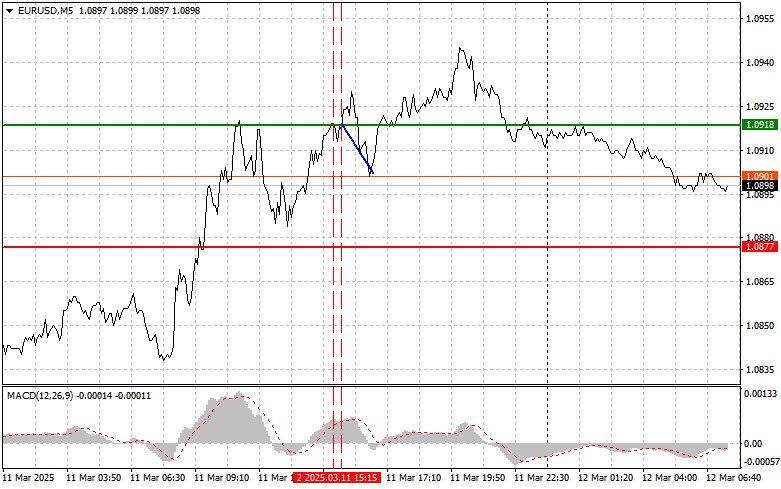

12.03.2025 09:01 AMThe test of the 1.0918 price level occurred when the MACD indicator had already moved significantly above the zero mark, which, in my opinion, limited the pair's upward potential. For this reason, I did not buy the euro. Shortly after, there was another test of 1.0918 while the MACD was in the overbought zone, which allowed for Scenario #2 to sell to materialize. However, after a 20-pip correction, demand for the euro returned.

Reports regarding U.S.-Ukraine negotiations and the possibility of a temporary ceasefire have supported interest in riskier assets. Market participants reacted positively to the prospect of easing tensions, leading to a rise in prices and a weakening of the U.S. dollar. However, this optimism may be short-lived. Key factors will include the outcomes of further discussions and Russia's concrete actions toward resolving the conflict. If negotiations fail, risk-related assets could face a wave of sell-offs.

Today, apart from European Central Bank President Christine Lagarde's speech, there are no significant economic releases. Given Lagarde's substantial influence on the market, her statements could be crucial in determining the direction. Considering the current economic situation in the Eurozone, any mention of maintaining a tight monetary policy could serve as a catalyst for strengthening the euro.

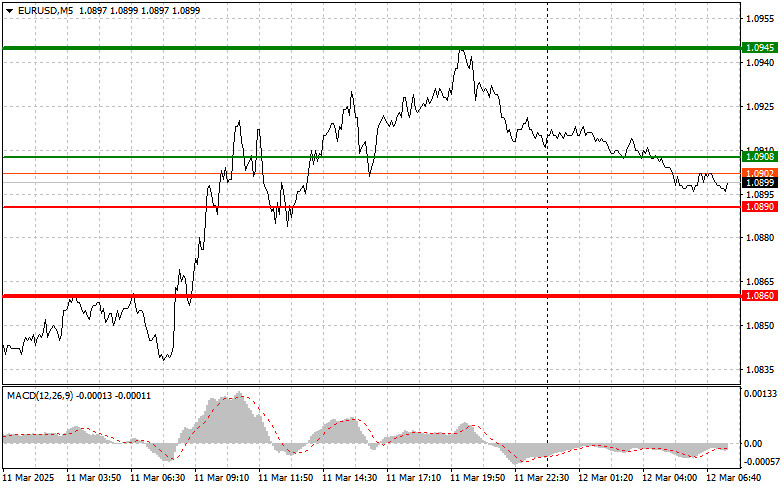

For intraday strategy, I will primarily rely on Scenarios #1 and #2.

Scenario #1: I plan to buy the euro today if the price reaches 1.0908 (green line on the chart), targeting a rise to 1.0945. At 1.0945, I intend to exit the market and sell the euro in the opposite direction, aiming for a 30-35 pip movement from the entry point. The euro is expected to continue its upward trend in the first half of the day. Important: Before buying, ensure that the MACD indicator is above the zero mark and starting to rise.

Scenario #2: I will also consider buying the euro today if there are two consecutive tests of the 1.0890 price level while the MACD indicator is in the oversold zone. This will limit the pair's downside potential and lead to a market reversal to the upside, with expected growth toward the opposite levels of 1.0908 and 1.0945.

Scenario #1: I plan to sell the euro after it reaches 1.0890 (red line on the chart), targeting 1.0860, where I intend to exit the market and immediately buy in the opposite direction, aiming for a 20-25 pip movement in the reverse direction. Selling pressure on the pair could return today if Lagarde adopts a dovish tone. Important: Before selling, ensure that the MACD indicator is below the zero mark and starting to decline.

Scenario #2: I will also consider selling the euro today if there are two consecutive tests of the 1.0908 price level while the MACD indicator is in the overbought zone. This will limit the pair's upside potential and lead to a downward market reversal, with an expected decline toward the opposite levels of 1.0890 and 1.0860.

You have already liked this post today

*The market analysis posted here is meant to increase your awareness, but not to give instructions to make a trade.

The price test at 157.45 coincided with the MACD indicator already moving significantly above the zero mark, which limited the pair's upward potential. For this reason

The price test at 1.3089 coincided with the MACD indicator just beginning to move up from the zero mark, confirming the correct entry point for buying the pound and leading

The price test at 1.1521 coincided with the MACD indicator just beginning to move down from the zero mark, confirming the correct entry point for selling the euro

InstaTrade

video analytics

Your IP address shows that you are currently located in the USA. If you are a resident of the United States, you are prohibited from using the services of InstaFintech Group including online trading, online transfers, deposit/withdrawal of funds, etc.

If you think you are seeing this message by mistake and your location is not the US, kindly proceed to the website. Otherwise, you must leave the website in order to comply with government restrictions.

Why does your IP address show your location as the USA?

Please confirm whether you are a US resident or not by clicking the relevant button below. If you choose the wrong option, being a US resident, you will not be able to open an account with InstaTrade anyway.

We are sorry for any inconvenience caused by this message.