See also

13.02.2025 01:37 PM

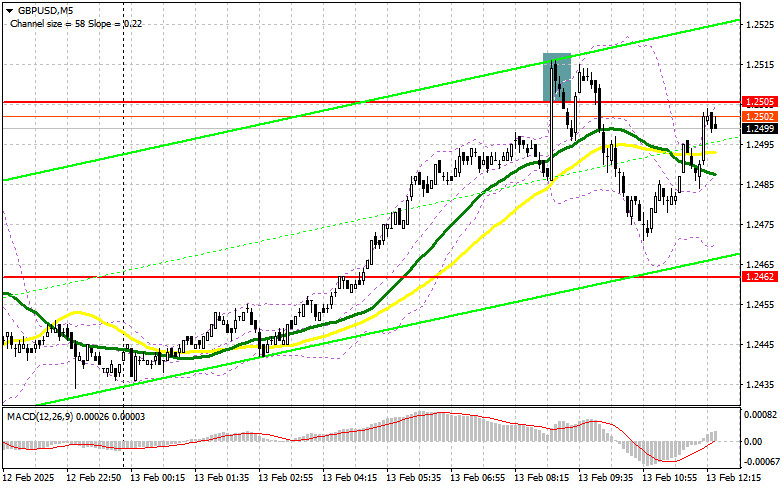

13.02.2025 01:37 PMIn my morning forecast, I focused on the 1.2505 level and planned to make trading decisions based on it. Let's examine the 5-minute chart to see what happened. A rise and false breakout at 1.2505 provided a strong short entry point, resulting in a 30+ point decline. The technical outlook has been revised for the second half of the session.

News that UK GDP exceeded economists' forecasts triggered pound purchases, pushing GBP/USD to a new daily high. However, the rally quickly faded, as stronger economic growth may prompt further rate cuts by the Bank of England, which could negatively impact the pair's bullish prospects.

In the second half of the session, U.S. inflation data will be released, including the Producer Price Index (PPI) and core PPI. If these indicators rise, mirroring yesterday's trend, pressure on the pound will return, forcing buyers to defend the 1.2473 support level.

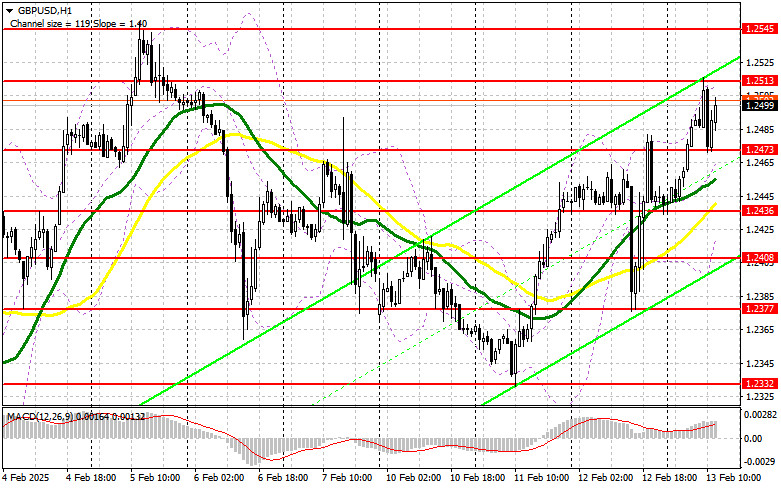

I will open long positions only after a false breakout at 1.2473, targeting 1.2513, a resistance level formed earlier in the day. A break and retest of this range will confirm a new buying opportunity, potentially pushing GBP/USD to 1.2545, reinforcing bullish prospects. The final target will be 1.2592, where I will lock in profits.

If GBP/USD falls and there is no buyer activity at 1.2473, the pressure on the pound will increase, though this will not yet be a major issue for buyers. In this case, a false breakout at 1.2436 will serve as a suitable entry for long positions. I also plan to buy immediately on a rebound from 1.2408, targeting a 30-35 point intraday correction.

Short Position Strategy for GBP/USD:

Sellers made their presence felt, signaling that they are not willing to give full control to the bulls. If GBP/USD attempts another rise, I will watch the 1.2513 resistance level for a false breakout, confirming a short position, aiming for 1.2473. Just below this level, the 30- and 50-period moving averages support the bulls.

A break and retest of 1.2473 from below will trigger stop-loss orders, opening the way to 1.2436. The final downward target will be 1.2408, where I will take profits.

If demand for the pound remains strong after U.S. inflation data, and sellers fail to act at 1.2513, GBP/USD will likely extend its rally. In that case, I will wait for a test of 1.2545 before entering short positions on a false breakout. If no bearish reaction occurs there, I will look for short entries around 1.2592, but only for a 30-35 point intraday correction.

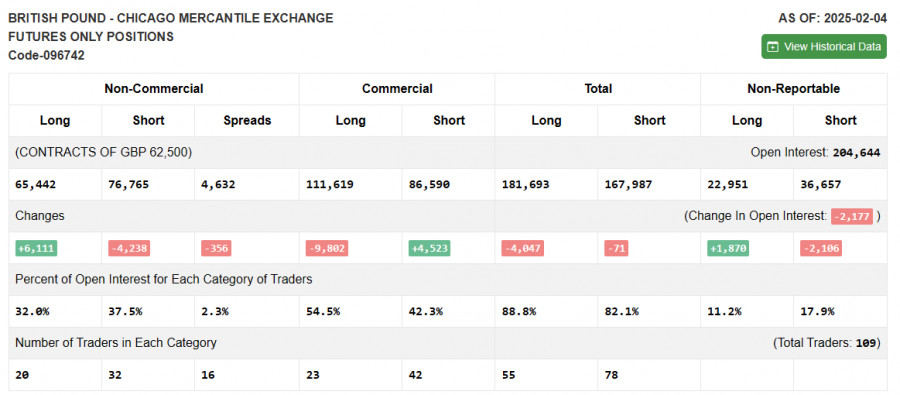

Commitment of Traders (COT) Report Analysis:

The February 4 COT report showed a decline in short positions and an increase in long positions. However, this should not be taken as a clear signal for pound appreciation.

This report does not yet reflect the Bank of England's rate cut decision and its increasingly dovish stance. The recent GBP rally was merely a correction, while the fundamental pressure on the pair remains. Additionally, new U.S. trade measures will continue to pressure risk assets, maintaining demand for the U.S. dollar. Long non-commercial positions increased by 6,111 to 65,442 Short non-commercial positions decreased by 4,238 to 76,765 The gap between long and short positions narrowed by 356.

Indicator Signals

GBP/USD is trading above the 30- and 50-day moving averages, signaling potential further upside.

Note: The author uses H1 chart moving averages, which may differ from traditional daily moving averages on the D1 chart.

If GBP/USD declines, the lower Bollinger Band near 1.2436 will serve as support.

Technical Indicator Descriptions:

You have already liked this post today

*The market analysis posted here is meant to increase your awareness, but not to give instructions to make a trade.

Analysis of Wednesday's Trades 1H Chart of GBP/USD The GBP/USD pair showed no notable movements on Wednesday. After Jerome Powell stated the need for more time to assess the full

Analysis of Wednesday's Trades 1H Chart of EUR/USD The EUR/USD currency pair continued to trade within the sideways channel on Wednesday, which is visible on the hourly timeframe

On Wednesday, the GBP/USD currency pair continued trading within a sideways channel, clearly visible on the hourly timeframe. There was virtually no movement throughout the day, and no fundamental

On Wednesday, the EUR/USD currency pair continued to trade in the same flat range. The 1.1274 and 1.1426 levels bound the broader sideways channel, while the narrower channel ranges between

In my morning forecast, I highlighted the 1.1379 level and planned to base market entry decisions around it. Let's look at the 5-minute chart to understand what happened. A rise

Analysis of Tuesday's Trades 1H Chart of GBP/USD The GBP/USD pair exhibited a notable upward movement on Tuesday, although it remains within a sideways channel that may not be immediately

Analysis of Tuesday's Trades 1H Chart of EUR/USD On Tuesday, the EUR/USD currency pair traded completely flat. Throughout the day, there were no significant reports or events either

InstaTrade in figures

Your IP address shows that you are currently located in the USA. If you are a resident of the United States, you are prohibited from using the services of InstaFintech Group including online trading, online transfers, deposit/withdrawal of funds, etc.

If you think you are seeing this message by mistake and your location is not the US, kindly proceed to the website. Otherwise, you must leave the website in order to comply with government restrictions.

Why does your IP address show your location as the USA?

Please confirm whether you are a US resident or not by clicking the relevant button below. If you choose the wrong option, being a US resident, you will not be able to open an account with InstaTrade anyway.

We are sorry for any inconvenience caused by this message.