See also

12.02.2025 09:21 AM

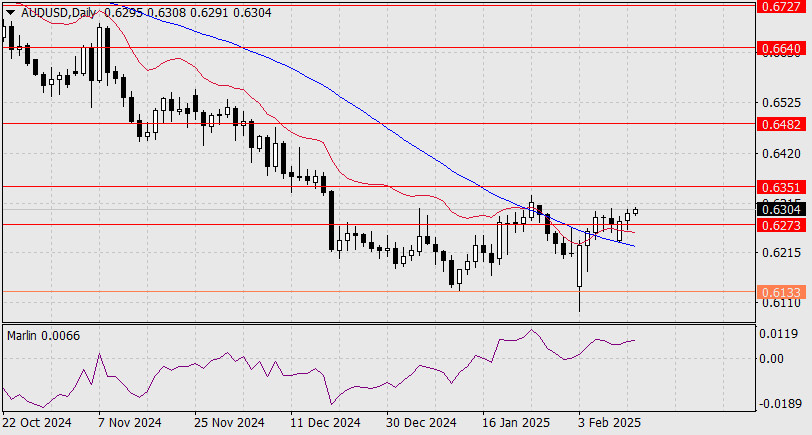

12.02.2025 09:21 AMOn Monday, the Australian dollar consolidated above the 0.6273 level, confirming bullish momentum. The next target is set at 0.6351, and a breakout above this level could pave the way toward 0.6482. The Marlin oscillator continues to rise, supporting further price appreciation.

Today, the U.S. inflation data for January is set to be released. The core Consumer Price Index (CPI) is expected to decline from 3.2% year-over-year (YoY) to 3.1% YoY, while the headline CPI is forecasted to remain steady at 2.9% YoY. These figures could provide short-term support for the Australian dollar. However, traders should also be attentive to the Reserve Bank of Australia's (RBA) monetary policy decision scheduled for February 18.

On the H4 chart, the price remains above all key support levels, reinforcing the uptrend. The Marlin oscillator has turned upward from the neutral zero line, confirming bullish momentum.

You have already liked this post today

*The market analysis posted here is meant to increase your awareness, but not to give instructions to make a trade.

Early in the American session, gold is trading around 3,381, retreating after reaching a high around 3,397. Gold as a safe-haven asset is nervous due to geopolitical tensions around

Useful links: My other articles are available in this section InstaForex course for beginners Popular Analytics Open trading account Important: The begginers in forex trading need to be very careful

On the 4-hour chart, the GBP/AUD cross currency pair appears to still be dominated by Sellers, which is confirmed by its price movement which is moving below the WMA (30

With the price movement forming Higher Low - Lower Low and supported by the decreasing slope of WMA (30 Shift 2) and the movement of Crude Oil prices moving below

Early in the American session, the EUR/USD pair is trading around 1.1345, reaching the top of the downtrend channel and showing signs of exhaustion. The euro could resume its bearish

Your IP address shows that you are currently located in the USA. If you are a resident of the United States, you are prohibited from using the services of InstaFintech Group including online trading, online transfers, deposit/withdrawal of funds, etc.

If you think you are seeing this message by mistake and your location is not the US, kindly proceed to the website. Otherwise, you must leave the website in order to comply with government restrictions.

Why does your IP address show your location as the USA?

Please confirm whether you are a US resident or not by clicking the relevant button below. If you choose the wrong option, being a US resident, you will not be able to open an account with InstaTrade anyway.

We are sorry for any inconvenience caused by this message.