See also

10.02.2025 08:40 AM

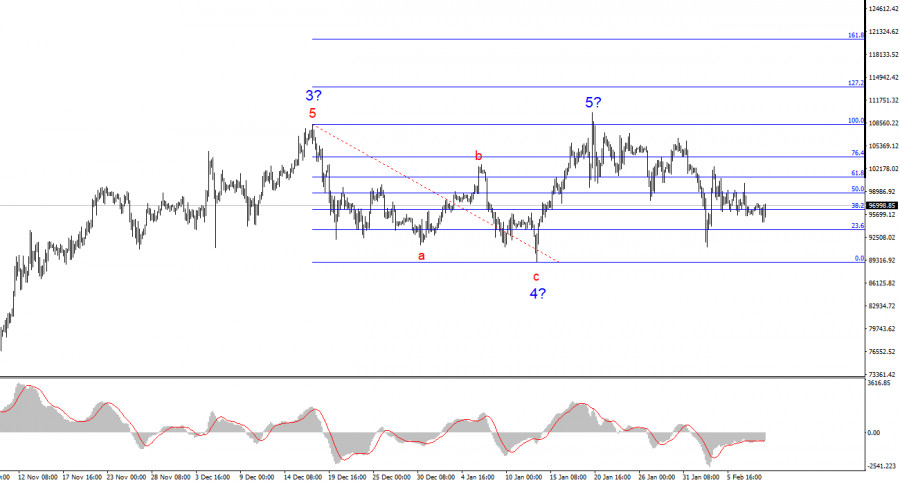

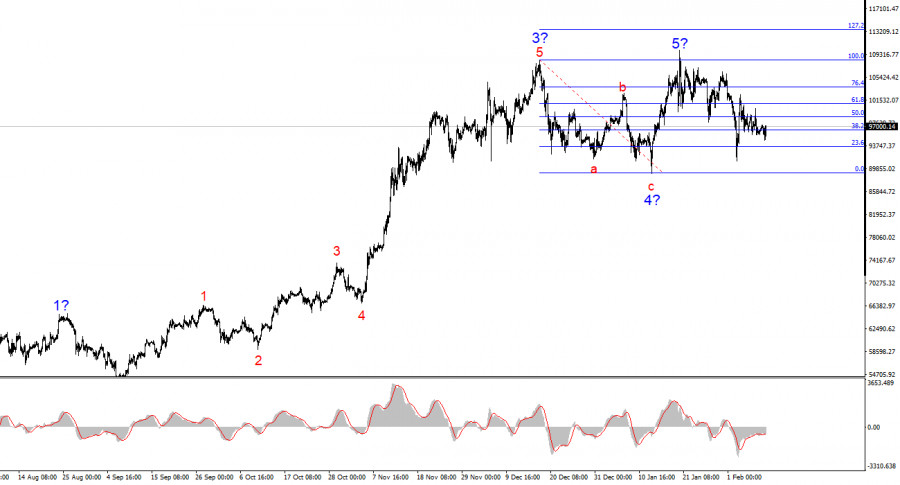

10.02.2025 08:40 AMThe wave structure on the 4-hour chart appears clear. Following a prolonged and complex corrective structure (a-b-c-d-e) that lasted from March 14 to August 5, a new impulse wave began forming. This impulse wave has already developed into a five-wave pattern. Based on the size of the first wave, the fifth wave may end up being shortened. Thus, I do not expect Bitcoin to rise above $110,000–$115,000 in the coming months.

Additionally, wave 4 has taken a three-wave form, which supports the accuracy of the current wave count. The news cycle has been supporting Bitcoin's growth due to continued institutional investments, interest from governments, and pension funds. However, Donald Trump's policies could push investors out of the market, and no trend lasts indefinitely. The current structure of wave 2 in wave 5 raises doubts about whether it is truly wave 2 in 5. I am inclined to believe that the bullish trend is nearing completion.

Bitcoin Stuck in a Limited Range

Over the weekend, BTC/USD remained stagnant. This time, Donald Trump was inactive, taking a break from policy decisions, so Monday did not start with another market shock. Price movement amplitude in recent days has been low, which many traders may find frustrating. I see no strong catalyst for renewed Bitcoin demand. The trend that started on January 20 appears corrective, which also rules out the likelihood of a sharp decline. After a six-month bullish rally, the market might be taking a break for a few months.

On Friday, key U.S. labor market and unemployment data were released, but their impact on Bitcoin market sentiment was minimal.

The crypto community continues to receive various news updates, but most of these are speculative opinions rather than solid fundamentals. Some analysts predict that Bitcoin could become a political tool under Donald Trump and expect it to drop to $70,000. Others believe Bitcoin will rise indefinitely, with a short-term target of $250,000.

Since December 17, Bitcoin has been moving sideways. In the near future, prices may decline to $90,000, forming a five-wave corrective structure (a-b-c-d-e). Only a successful breakout below $89,000 would signal that the market is ready to establish a new bearish trend.

BTC/USD uptrend is nearing completion. This may not be a popular opinion, but wave 5 could be shortened. If this assumption is correct, we could see a sharp drop or a complex correction. I do not recommend buying Bitcoin at this stage. In the near future, Bitcoin could fall below wave 4's low, confirming the transition to a bearish trend.

On a higher wave scale, Bitcoin has formed a five-wave bullish structure. A corrective bearish wave or a new bearish trend could begin soon.

Key Principles of My Analysis:

You have already liked this post today

*The market analysis posted here is meant to increase your awareness, but not to give instructions to make a trade.

Bitcoin and Ethereum spent the day in a sideways channel, although signs of active selling during yesterday's American session raise certain questions about the trading instruments' further short-term upward prospects

Bitcoin is under pressure once again. On Monday, the price of the world's largest cryptocurrency dropped below $95,000, and this is more than just another correction. It's a symptom

Bitcoin and Ethereum buyers have achieved new key resistance levels, indicating strong demand. Bitcoin has reached the $97,400 level, while Ethereum has approached the $1,870 mark. Meanwhile, the buzz around

With the appearance of the Bullish 123 pattern followed by the appearance of the Bullish Ross Hook which managed to break the previous downtrend line and the Stochastic Oscillator indicator

Amid a steady outflow of coins from exchanges, renewed futures market activity, and a rise in short-term holders, the world's largest cryptocurrency lays the groundwork for a potential move that

While financial mainstream market participants are mulling over recession risks and interest rates, Bitcoin is steadily gaining ground. April has turned out to be the strongest month for the leading

E-mail/SMS

notifications

Your IP address shows that you are currently located in the USA. If you are a resident of the United States, you are prohibited from using the services of InstaFintech Group including online trading, online transfers, deposit/withdrawal of funds, etc.

If you think you are seeing this message by mistake and your location is not the US, kindly proceed to the website. Otherwise, you must leave the website in order to comply with government restrictions.

Why does your IP address show your location as the USA?

Please confirm whether you are a US resident or not by clicking the relevant button below. If you choose the wrong option, being a US resident, you will not be able to open an account with InstaTrade anyway.

We are sorry for any inconvenience caused by this message.