See also

03.02.2025 12:15 AM

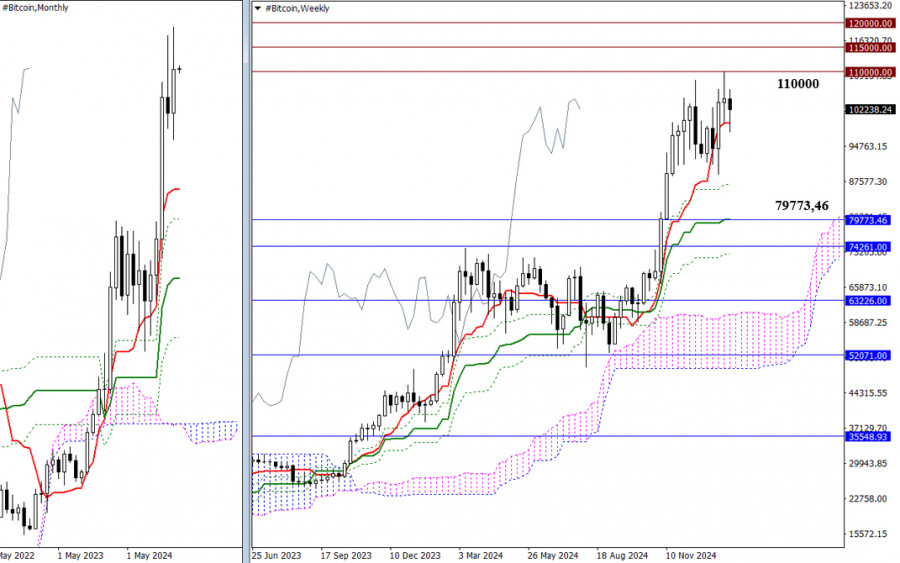

03.02.2025 12:15 AMIn January, Bitcoin reached a new all-time high, approaching the psychological level of $110,000. However, there was no significant upward momentum during the month. This stagnation, along with the detachment from the monthly short-term trend at $79,773.46, could lead to a downward correction. If bulls can maintain the upward movement, new historical highs may be possible, with psychological targets at $115,000 and $120,000.

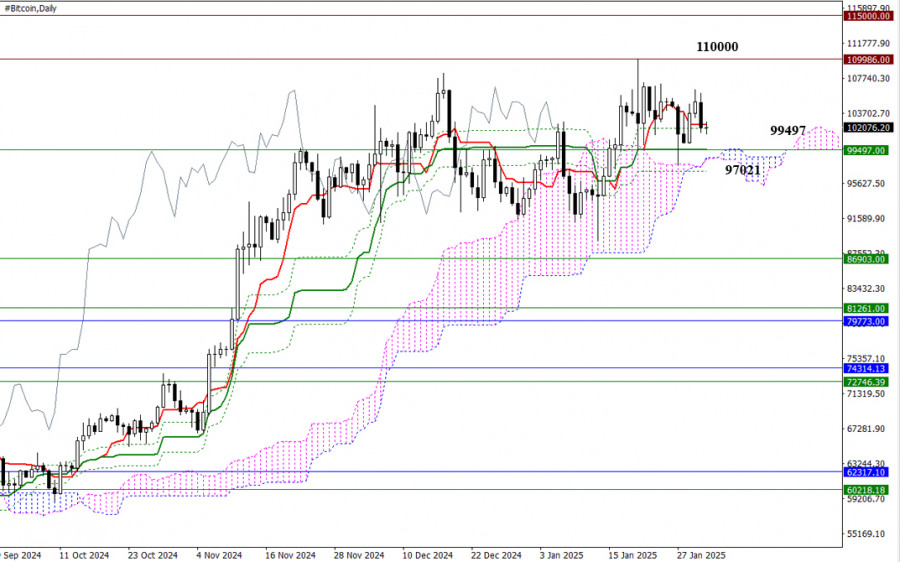

On the daily timeframe, the market is currently exhibiting sideways movement and uncertainty around the daily short-term trend at 102,383. For the bulls to gain momentum and break free from this uncertainty, they need to overcome the tested resistance at 110,000 and aim for new highs. On the other hand, if the bears take control, they must target the weekly short-term trend at 99,497, break through the daily range between 99,497 and 97,021, and establish a position in the bearish zone relative to the daily Ichimoku cloud at 98,457. Successfully achieving these milestones will open up new bearish opportunities.

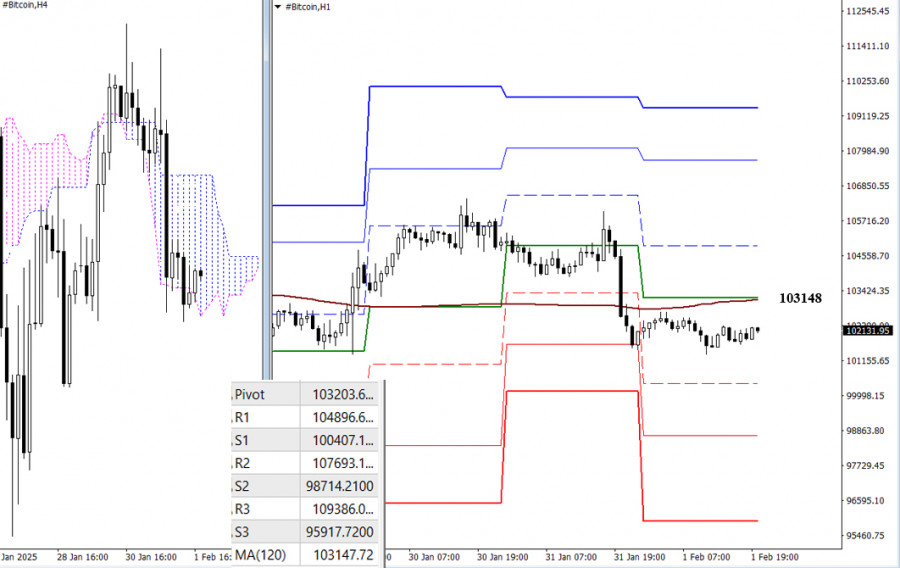

Currently, on the lower timeframes, Bitcoin is fluctuating around the weekly long-term trend level of 103,148. This movement is happening without significant changes in the angle of the trend, indicating a state of uncertainty in the market. Any development of a clear directional movement will alter the current balance of power and affect the slope of the trend. For intraday bullish traders, the classic Pivot resistance levels will be important reference points, while bearish traders will look to the classic Pivot support levels for guidance. Please note that Pivot levels are updated daily.

***

You have already liked this post today

*The market analysis posted here is meant to increase your awareness, but not to give instructions to make a trade.

Early in the American session, gold is trading around 3,382, rebounding after reaching a low of 3,359 during the opening session. A strong technical rebound suggests a rally

Useful links: My other articles are available in this section InstaForex course for beginners Popular Analytics Open trading account Important: The begginers in forex trading need to be very careful

On the 4-hour chart, the Natural Gas commodity instrument appears to have a bearish 123 pattern followed by a bearish Ross Hook (RH) plus confirmation that the price movement

If we look at the 4-hour chart of the AUD/JPY cross currency pair, we will see a Descending Broadening Wedge pattern where this pattern gives an indication that

Early in the American session, gold is trading around 3,381, retreating after reaching a high around 3,397. Gold as a safe-haven asset is nervous due to geopolitical tensions around

Useful links: My other articles are available in this section InstaForex course for beginners Popular Analytics Open trading account Important: The begginers in forex trading need to be very careful

E-mail/SMS

notifications

Your IP address shows that you are currently located in the USA. If you are a resident of the United States, you are prohibited from using the services of InstaFintech Group including online trading, online transfers, deposit/withdrawal of funds, etc.

If you think you are seeing this message by mistake and your location is not the US, kindly proceed to the website. Otherwise, you must leave the website in order to comply with government restrictions.

Why does your IP address show your location as the USA?

Please confirm whether you are a US resident or not by clicking the relevant button below. If you choose the wrong option, being a US resident, you will not be able to open an account with InstaTrade anyway.

We are sorry for any inconvenience caused by this message.