See also

23.01.2025 09:21 AM

23.01.2025 09:21 AMThe inaugural week for Donald Trump has been marked by celebrations, but it has seen relatively few significant economic data releases. Consequently, market participants are focusing their attention on the president's actions and statements.

Trump's decision to impose steep tariffs on Canada and Mexico, along with substantial but somewhat less aggressive tariffs on China, has already created tensions in Europe. Disgruntled European globalist elites are preparing to push back against his actions, expressing their intent to respond to his tariff measures and the suspension of external funding for 90 days.

The U.S. stock market has reacted positively to Trump's policies, experiencing strong growth for the second consecutive day. Investors believe—correctly—that his geopolitical and economic strategies will enhance demand for corporate stocks. However, the U.S. dollar is not enjoying the same support, showing a downward trend.

The dollar faced pressure earlier this week as investors sought clarity on Trump's economic plans. The ICE Dollar Index fell by approximately 1% since the beginning of the week, primarily due to Trump's decision not to impose tariffs that could have heightened fears of rising inflation. Previously, concerns over inflation were significant in driving the U.S. dollar higher, alongside increasing Treasury yields.

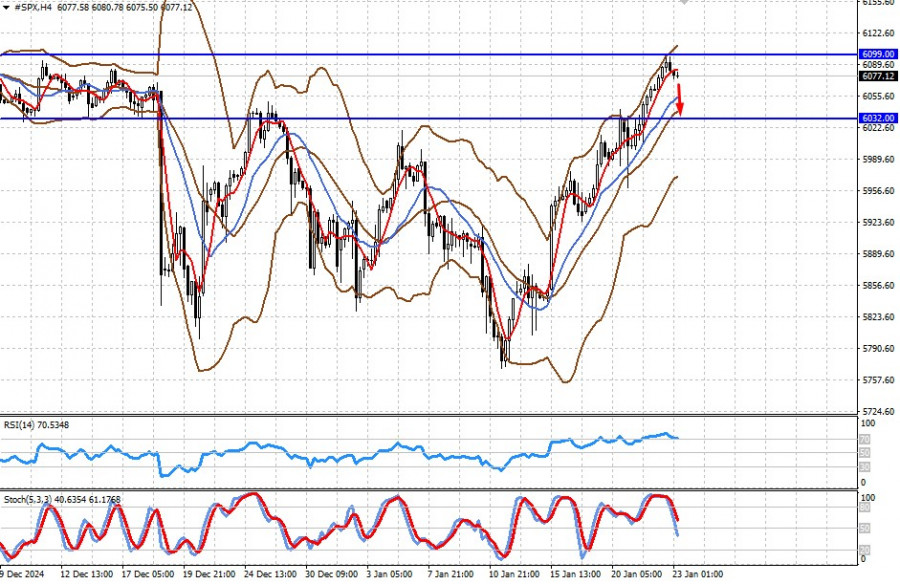

However, after Trump announced tariff hikes on imports from China, Mexico, Canada, and the EU, markets reacted sharply, leading to a slight stabilization of the dollar and curbing the rally in stock indices. Today, we are observing a downward correction in futures for the three major stock indices: the Dow Jones 30, S&P 500, and Nasdaq 100. Another factor limiting demand for stocks is the anticipation of next week's Federal Reserve monetary policy meeting. Market participants are eager to understand whether the Fed will continue the rate-cutting cycle initiated last year, especially in the context of Trump's presidency.

The Fed is expected to keep interest rates unchanged at its January meeting. According to federal funds futures, markets anticipate a rate cut in July, with the possibility of another cut later in the year. Meanwhile, the Bank of Japan is forecasted to raise rates this Friday, and the European Central Bank may cut rates again at its meeting next week. These changes could strengthen the yen against major currencies in the Forex market while putting pressure on the euro.

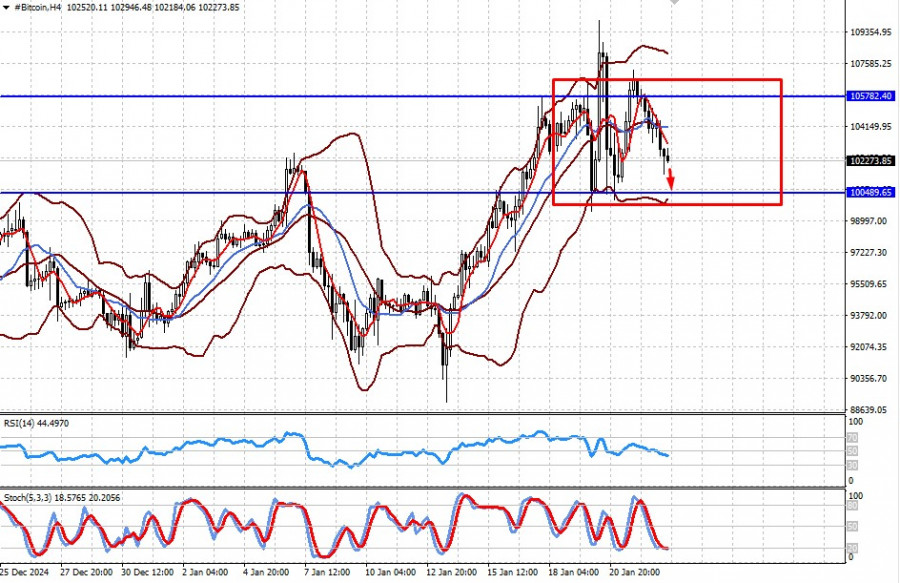

I believe the cryptocurrency market will consolidate within a sideways range for the rest of the week. Crypto traders are waiting for a clear signal regarding Trump's stance on cryptocurrencies. So far, the only relevant information they have is his statement from last year supporting the development of the crypto industry, which has already been fully priced in by the market.

Regarding U.S. stock market dynamics, there is every reason to expect a minor downward correction ahead of next week's Fed meeting on monetary policy.

The dollar is also likely to consolidate in the Forex market. Meanwhile, gold prices show potential to climb back to their recent historical high, driven by heightened geopolitical tensions—a scenario that Trump has successfully maintained.

Bitcoin is consolidating within a wide range of 100,489.65–105,782.40, awaiting news from Trump regarding the cryptocurrency market's future. The cryptocurrency will likely correct toward the lower boundary of this range.

The CFD contract on S&P 500 futures is also correcting downward following a strong rally after the new president's inauguration. Before resuming its upward movement, it is likely to drop to the 6032.00 level.

You have already liked this post today

*The market analysis posted here is meant to increase your awareness, but not to give instructions to make a trade.

Markets remain tense. The U.S. Dollar Index and the cryptocurrency market are stagnating, caught between opposing forces. Investors are tensely awaiting the outcome of the Federal Reserve's monetary policy meeting

There are very few macroeconomic events scheduled for Tuesday. In the Eurozone and Germany, the second estimate of April's services PMI will be published, but these are unlikely to attract

Your IP address shows that you are currently located in the USA. If you are a resident of the United States, you are prohibited from using the services of InstaFintech Group including online trading, online transfers, deposit/withdrawal of funds, etc.

If you think you are seeing this message by mistake and your location is not the US, kindly proceed to the website. Otherwise, you must leave the website in order to comply with government restrictions.

Why does your IP address show your location as the USA?

Please confirm whether you are a US resident or not by clicking the relevant button below. If you choose the wrong option, being a US resident, you will not be able to open an account with InstaTrade anyway.

We are sorry for any inconvenience caused by this message.