See also

20.12.2024 07:59 AM

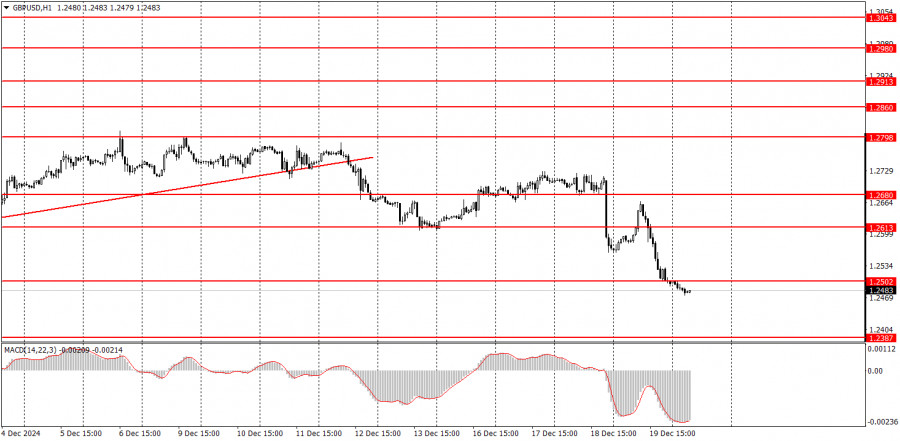

20.12.2024 07:59 AMThe GBP/USD pair continued its near-collapse on Friday. Recall that the Federal Reserve meeting results were announced on Wednesday evening, followed by the Bank of England meeting results on Thursday afternoon. In both cases, the outcomes were unequivocally unfavorable for the British currency. It can be said that the pound was rather fortunate, as it managed to show some growth in the first half of the day, which was not based on any apparent justification. However, as we have repeatedly mentioned before, while the pound sterling continues to demonstrate remarkable resilience, it cannot indefinitely withstand an overwhelmingly negative fundamental backdrop. The pound remains overbought and unjustifiably expensive. Over the past two years, the market has focused solely on the factor of the Fed's monetary easing. Although the BoE is in no rush to lower rates, which somewhat supports the British currency, we believe that the decline will continue under virtually any circumstances. It is important not to assume that a downward trend means daily declines in the pound.

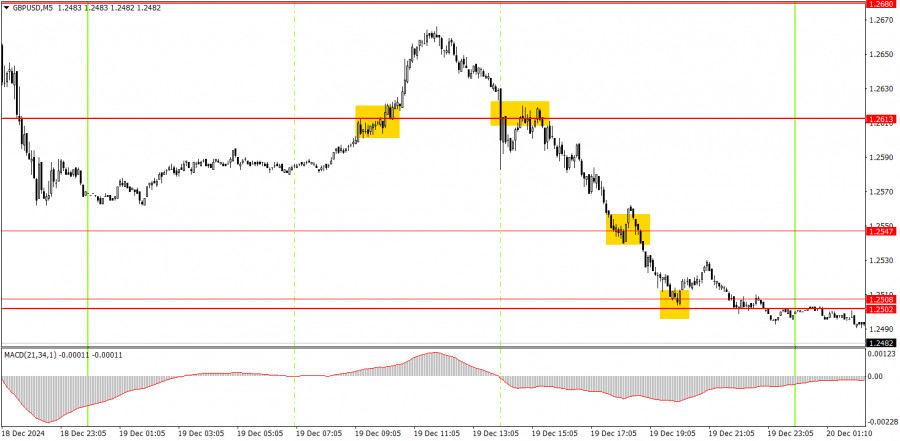

In the 5-minute timeframe on Thursday, numerous trading signals were generated. The upward movement during the European trading session was particularly confusing and inexplicable. However, the only buy signal near the 1.2613 level could not have resulted in a loss by definition. Afterward, only sell signals were formed, which were also profitable. As a result, the day concluded with a substantial profit.

The GBP/USD pair has completed its upward correction on the hourly timeframe. We fully support the pound's decline in the medium term, as we believe this is the only logical scenario. However, it should be remembered that the pound sterling demonstrates high resilience against the US dollar. Thus, while further declines are expected, traders should rely on technical signals. The outcomes of the BoE and Fed meetings strongly support continued downward movement.

On Friday, the GBP/USD pair may continue its decline. While a new corrective wave is possible, a drop toward the 1.2387 target appears much more likely.

On the 5-minute timeframe, trading can be based on the following levels: 1.2387, 1.2445, 1.2502-1.2508, 1.2547, 1.2633, 1.2680-1.2685, 1.2723, 1.2791-1.2798, 1.2848-1.2860, 1.2913, 1.2980-1.2993. A retail sales report in the UK will be published on Friday, which is unlikely to cause more than a mild market reaction. In the US, four secondary reports are scheduled, with the PCE Index and Consumer Sentiment Index being the most notable.

Support and Resistance Levels: These are target levels for opening or closing positions and can also serve as points for placing Take Profit orders.

Red Lines: Channels or trendlines indicating the current trend and the preferred direction for trading.

MACD Indicator (14,22,3): A histogram and signal line used as a supplementary source of trading signals.

Important Events and Reports: Found in the economic calendar, these can heavily influence price movements. Exercise caution or exit the market during their release to avoid sharp reversals.

Forex trading beginners should remember that not every trade will be profitable. Developing a clear strategy and practicing proper money management are essential for long-term trading success.

You have already liked this post today

*The market analysis posted here is meant to increase your awareness, but not to give instructions to make a trade.

Analysis of Friday's Trades 1H Chart of EUR/USD On Friday, the EUR/USD currency pair generally continued upward movement. And why would it stop? The trade war between the U.S

The GBP/USD currency pair continued trading higher on Friday, although the dollar avoided substantial losses this time. Even though one day without a complete dollar collapse may seem significant

On Friday, the EUR/USD currency pair continued its ultra-strong rally—something no one was surprised by anymore. U.S. and China reciprocal tariffs continue to rise, while all other news remains irrelevant

In my morning forecast, I highlighted the level of 1.2986 and planned to make market entry decisions from that point. Let's take a look at the 5-minute chart and break

Analysis of Thursday's Trades 1H Chart of EUR/USD On Thursday, the EUR/USD currency pair resumed its upward movement and posted a gain of more than 300 pips. As Friday began

The EUR/USD currency pair showed ultra-strong growth on Thursday—a move that, by now, probably surprised no one. Just as we reported that tariffs on China had been raised to 125%

InstaFutures

Make money with a new promising instrument!

InstaFutures

Make money with a new promising instrument!

Your IP address shows that you are currently located in the USA. If you are a resident of the United States, you are prohibited from using the services of InstaFintech Group including online trading, online transfers, deposit/withdrawal of funds, etc.

If you think you are seeing this message by mistake and your location is not the US, kindly proceed to the website. Otherwise, you must leave the website in order to comply with government restrictions.

Why does your IP address show your location as the USA?

Please confirm whether you are a US resident or not by clicking the relevant button below. If you choose the wrong option, being a US resident, you will not be able to open an account with InstaTrade anyway.

We are sorry for any inconvenience caused by this message.