See also

23.04.2025 02:31 PM

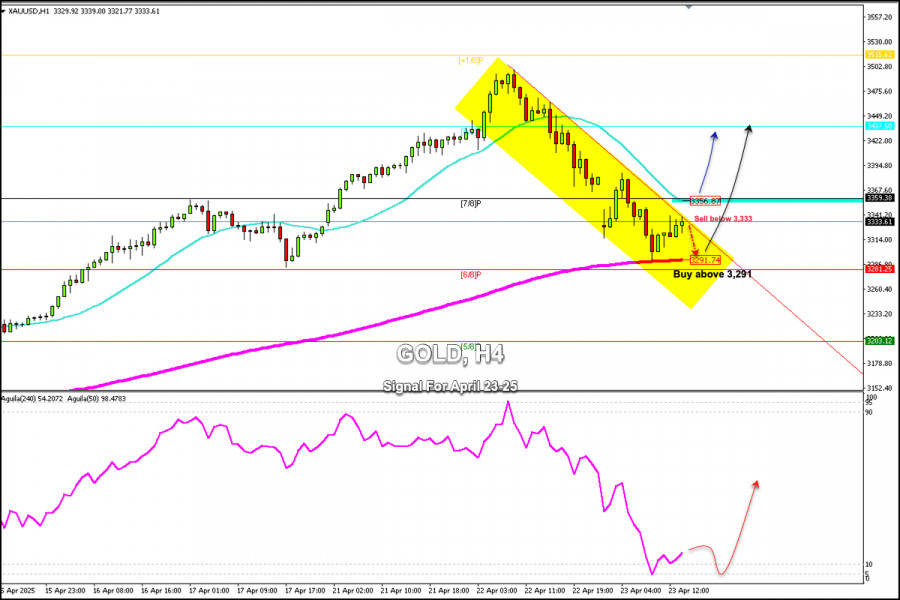

23.04.2025 02:31 PMEarly in the American session, gold was trading at around 3,333 within the downtrend channel formed on April 22. XAU/USD is showing signs of oversold and is bouncing after reaching the 6/8 Murray level and the 200 EMA area.

Gold could continue its bearish cycle if it falls below 3,333 (the top of the bearish channel) and could likely reach 3,291, even reaching the Murray 6/8 at 3,281.

Conversely, if it finds strong support around the 200 EMA, it could rebound again, as it technically shows signs of being oversold, and a recovery is expected to occur in the coming days.

On the other hand, if gold breaks and consolidates above $3,341, it could be positive, and we could look for buying opportunities with targets at $3,389 and eventually at about $3,437.

Having reached a high of $3,497, gold made a technical correction of more than $200, which means we could expect a correction in line with the Fibonacci indicator around $3,400 in the coming days. The key is to watch for the gold price to consolidate above $3,280.

Our trading plan for the next few hours is to sell gold below $3,333, with targets at $3,313 and $3,291. We can buy above $3,280 with short-term targets at $3,437.

You have already liked this post today

*The market analysis posted here is meant to increase your awareness, but not to give instructions to make a trade.

On the 4-hour chart, the Natural Gas commodity instrument appears to have a bearish 123 pattern followed by a bearish Ross Hook (RH) plus confirmation that the price movement

If we look at the 4-hour chart of the AUD/JPY cross currency pair, we will see a Descending Broadening Wedge pattern where this pattern gives an indication that

Early in the American session, gold is trading around 3,381, retreating after reaching a high around 3,397. Gold as a safe-haven asset is nervous due to geopolitical tensions around

Useful links: My other articles are available in this section InstaForex course for beginners Popular Analytics Open trading account Important: The begginers in forex trading need to be very careful

On the 4-hour chart, the GBP/AUD cross currency pair appears to still be dominated by Sellers, which is confirmed by its price movement which is moving below the WMA (30

With the price movement forming Higher Low - Lower Low and supported by the decreasing slope of WMA (30 Shift 2) and the movement of Crude Oil prices moving below

Early in the American session, the EUR/USD pair is trading around 1.1345, reaching the top of the downtrend channel and showing signs of exhaustion. The euro could resume its bearish

Graphical patterns

indicator.

Notices things

you never will!

Your IP address shows that you are currently located in the USA. If you are a resident of the United States, you are prohibited from using the services of InstaFintech Group including online trading, online transfers, deposit/withdrawal of funds, etc.

If you think you are seeing this message by mistake and your location is not the US, kindly proceed to the website. Otherwise, you must leave the website in order to comply with government restrictions.

Why does your IP address show your location as the USA?

Please confirm whether you are a US resident or not by clicking the relevant button below. If you choose the wrong option, being a US resident, you will not be able to open an account with InstaTrade anyway.

We are sorry for any inconvenience caused by this message.