See also

26.05.2023 10:49 AM

26.05.2023 10:49 AMThe topic of negotiations regarding the US debt ceiling continues to dominate market attention, with implications expected both in negative and positive terms. However, today, investors' focus will shift towards the release of crucial inflation indicators.

Markets will be closely monitoring the release of the core Personal Consumption Expenditures (PCE) price index data and the figures on US incomes and expenditures.

According to the consensus forecast, the core PCE price index is expected to maintain its growth rate on a monthly and yearly basis at 0.3% and 4.6% respectively. Meanwhile, the broader measure of the PCE price index is anticipated to decline year-on-year to 3.9% from 4.2%. However, on a monthly basis, it is projected to show a noticeable increase of 0.4% in April compared to a 0.1% rise in March. Personal incomes are expected to have risen by 0.4% in April, following a 0.3% increase in March, while expenditures are projected to grow by 0.4%, following no change in March.

How will markets react to this data?

While investors continue to bear in mind the high likelihood of a government debt default on June 1, they also acknowledge that life goes on even after such an extreme event, should it occur. Consequently, once this issue is resolved, attention will shift to the Federal Reserve's decision on monetary policy, which will be announced at the meeting on June 14.

It is worth noting that the Federal Reserve has closely monitored the dynamics of the core PCE price index, considering it the most accurate reflection of real consumer inflation. Therefore, against the backdrop of the data release and taking into account the overall economic situation, the central bank faces a challenging task. It will need to respond to inflation acceleration by increasing the key interest rate by 0.25% to 5.50%. However, given the slowdown in economic growth, turbulence in the banking sector, and several other issues, such a move may not be advisable. This lack of consensus among the voting members of the Federal Reserve adds to the complexity of the situation.

Investors are likely to exhibit a cautious response to the upcoming data release. If the figures align with or slightly fall below expectations, it may inspire limited stock purchases and dollar sales among investors who hope that interest rates will not be raised on June 14 and that Congress will finally reach an agreement on the debt ceiling. However, if the numbers indicate higher inflation in relation to incomes and expenditures, one can expect a continuation of declining demand for stocks, commodity assets, and a strengthening US dollar. This would result not only from concerns about the debt default but also from increased expectations of interest rate hikes.

Overall, observing the recent developments in the debt ceiling negotiations, it is believed that an agreement may be reached by the beginning of the following week. This could serve as a catalyst for a local market rally, accompanied by a weakening US dollar.

EUR/USD

The currency pair has found support just above the 1.0700 level. The market rumors about an imminent debt ceiling agreement in the US are providing support for the pair. A rise above 1.0760 may lead the pair higher to 1.0830.

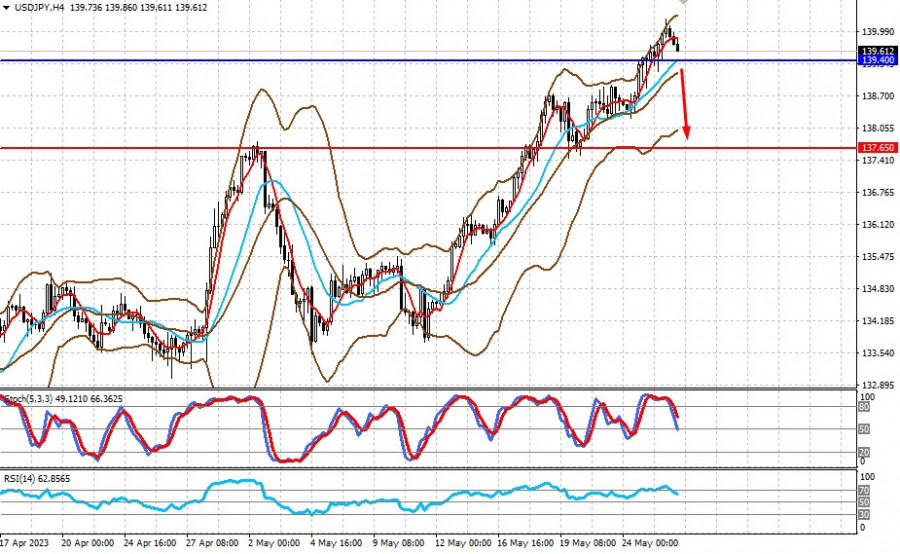

USD/JPY

The pair shows a reversal amid speculation that the agreement on the US debt ceiling will be reached soon. Against this backdrop, the pair may drop below 139.40 and slide even lower to 137.65.

You have already liked this post today

*The market analysis posted here is meant to increase your awareness, but not to give instructions to make a trade.

Markets have fully priced in the outcome of the U.S.–China talks, which resulted in a 90-day trade truce. Weaker-than-expected U.S. economic data offset the early-week optimism. The recent rally lost

Few macroeconomic events are scheduled for Friday, and they are not more significant than the reports released on Thursday, which did not provoke any market reaction. In essence, the only

The EUR/USD currency pair moved in both directions on Thursday but ultimately remained below the moving average line. Its position beneath the moving average allows us to expect further strengthening

InstaTrade

PAMM accounts

Your IP address shows that you are currently located in the USA. If you are a resident of the United States, you are prohibited from using the services of InstaFintech Group including online trading, online transfers, deposit/withdrawal of funds, etc.

If you think you are seeing this message by mistake and your location is not the US, kindly proceed to the website. Otherwise, you must leave the website in order to comply with government restrictions.

Why does your IP address show your location as the USA?

Please confirm whether you are a US resident or not by clicking the relevant button below. If you choose the wrong option, being a US resident, you will not be able to open an account with InstaTrade anyway.

We are sorry for any inconvenience caused by this message.