See also

28.02.2023 03:30 PM

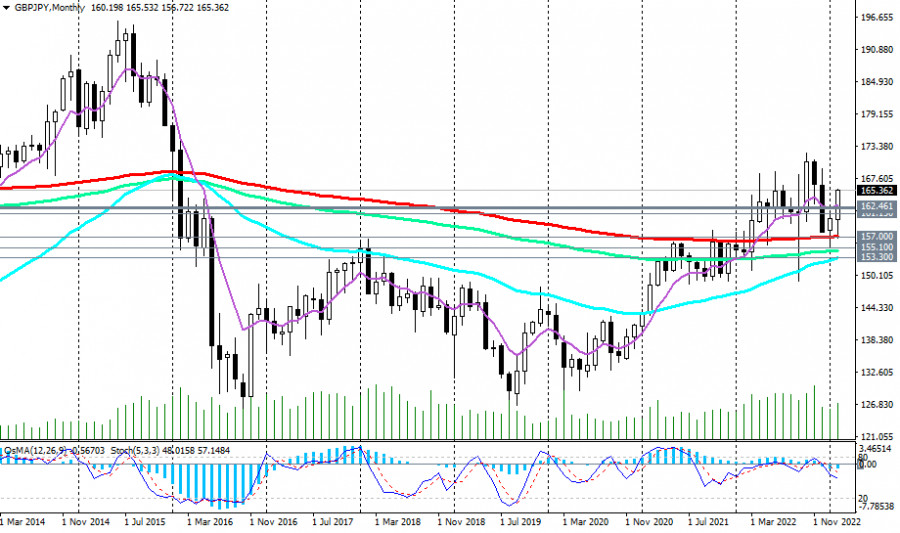

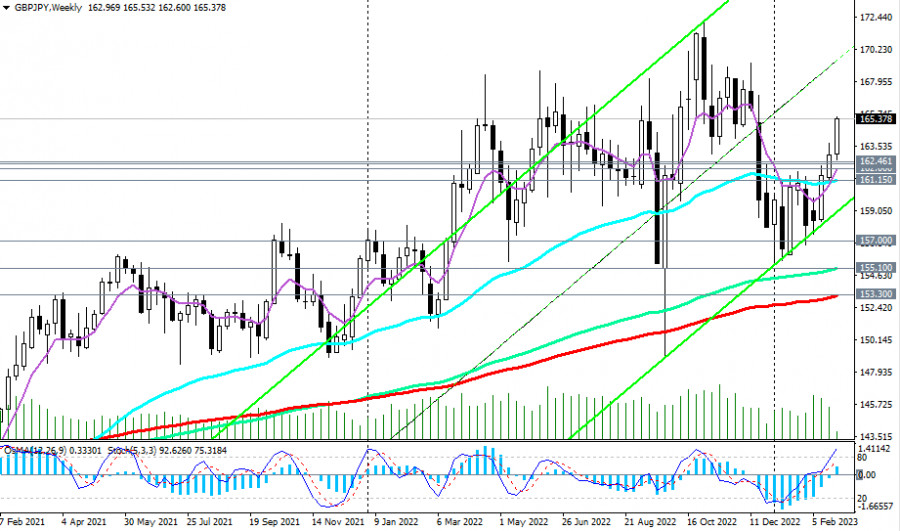

28.02.2023 03:30 PMThe yen is weakening amid comments of incoming Bank of Japan Governor Kazuo Ueda, while the pound is strengthening in the major cross pairs. That is accordingly true for the GBP/JPY, which as of writing, was trading above 165.30, having strengthened by 1.5% just in the last two incomplete trading days and has been in the bull market zone for two years since the breakdown of 142.00.

Today, GBP/JPY continued to rise, trading above the key support levels 162.00 (200 EMA on the daily chart), 157.00 (200 EMA on the monthly chart), 153.30 (200 EMA on the weekly chart).

Technical indicators OsMA and Stochastic on the daily and weekly charts are also on the buyers' side, while a strong bullish momentum pushes the pair towards last year's highs above 172.00.

In an alternative scenario, the first signal to sell may be a breakdown of the local low 165.05, and today's local low at 164.08. In the meantime, long positions remain preferable, short positions are considered only as a short-term alternative.

Support levels: 164.00, 163.00, 162.46, 162.30, 162.00, 161.15, 157.00

Resistance levels: 166.00, 167.00, 168.00, 169.00, 170.00, 171.00

Trading scenarios

Sell Stop 164.90. Stop-Loss 165.60. Take-Profit 164.00, 163.00, 162.46, 162.30, 162.00, 161.15, 157.00

Buy on the market, Buy Stop 165.60. Stop-Loss 164.90. Take-Profit166.00, 167.00, 168.00, 169.00, 170.00, 171.00

You have already liked this post today

*The market analysis posted here is meant to increase your awareness, but not to give instructions to make a trade.

Analysis of Friday's Trades 1H Chart of GBP/USD On Friday, the GBP/USD pair showed extremely low volatility, yet the British pound steadily crept upward even with such market conditions

Analysis of Friday's Trades 1H Chart of EUR/USD The EUR/USD currency pair showed no movement on Friday. It was Good Friday, and Easter Sunday followed. As a result, many countries

The GBP/USD currency pair traded higher again on Friday, albeit with minimal volatility. Despite the lack of important events in the U.S. or the U.K. that day (unlike earlier

Analysis of Thursday's Trades 1H Chart of GBP/USD The GBP/USD pair continued to trade higher throughout Thursday. Even at its peak levels, the British pound shows no intention of correcting

Analysis of Thursday's Trades 1H Chart of EUR/USD The EUR/USD currency pair continued trading within a sideways channel on Thursday, as shown on the hourly timeframe chart above. The current

The GBP/USD currency pair continued its upward movement on Thursday, trading near multi-year highs. Despite the lack of significant events in the U.S. or the U.K. (unlike Wednesday), the market

The EUR/USD currency pair continued to trade sideways on Thursday. While previously it had been moving within a range between 1.1274 and 1.1391, on Thursday, it was stuck

Your IP address shows that you are currently located in the USA. If you are a resident of the United States, you are prohibited from using the services of InstaFintech Group including online trading, online transfers, deposit/withdrawal of funds, etc.

If you think you are seeing this message by mistake and your location is not the US, kindly proceed to the website. Otherwise, you must leave the website in order to comply with government restrictions.

Why does your IP address show your location as the USA?

Please confirm whether you are a US resident or not by clicking the relevant button below. If you choose the wrong option, being a US resident, you will not be able to open an account with InstaTrade anyway.

We are sorry for any inconvenience caused by this message.