See also

20.09.2022 11:31 AM

20.09.2022 11:31 AMThe new trading week traditionally began with an empty macroeconomic calendar. Important statistics were not published in Europe and the United States. While, there was no trading in the UK due to the funeral of Queen Elizabeth II.

Investors and traders were guided by the information flow, identifying speeches / statements / comments regarding interest rates, inflation and everything related to monetary policy.

Information flow

ECB Governing Council member Pablo Hernandez de Cos said on Monday that interest rates should be raised until inflation is sure to return to its 2.0% target.

The main points of his speech:

- Weak economic growth is not enough to bring inflation back to target levels.

- There is a danger of inflation effects of the second wave.

- Recent reports point to a rapid slowdown in the EU economy.

- Rapid rate hikes to the neutral 2.0% level may be undesirable.

The EURUSD currency pair showed an upward interest, during which the quote jumped to the value of 1.0050. Despite the temporary shift of trading forces in favor of buyers, there is still a stagnation stage along the parity level for the currency pair.

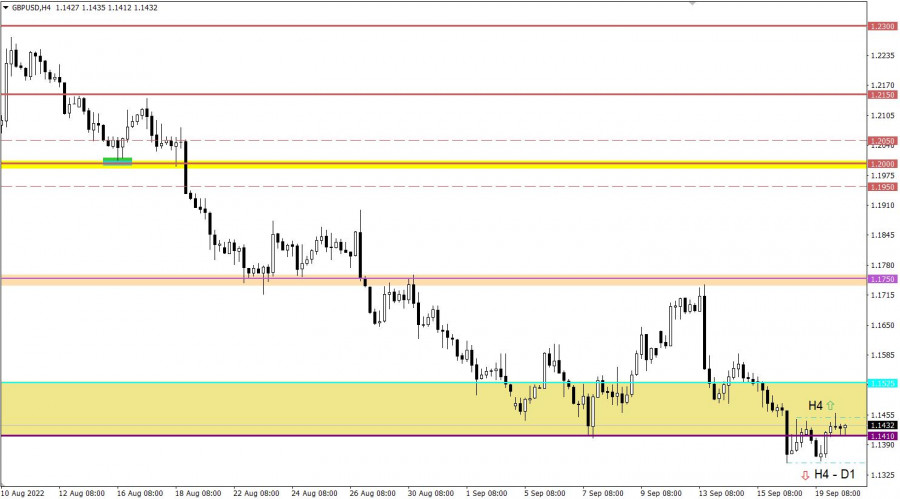

The GBPUSD currency pair did not manage to stay below the local low of the past week at 1.1350. As a result, there was a gradual increase in the volume of long positions in the pound sterling, which led to the formation of a pullback in the market.

Today, data on the construction sector of the United States will be published, which predicts a decline in all indicators. This is not the best economic signal, but it is likely that market participants will ignore them due to the release of the results of the two-day Fed meeting on Wednesday.

Thus, investors and traders will continue to monitor the incoming information flow, identifying possible speeches / statements / comments regarding interest rates, inflation and everything related to monetary policy.

Time targeting:

U.S. Building Permits Issued (Aug) – 12:30 UTC

U.S. Housing Starts (Aug) – 12:30 UTC

In this situation, the primary signal of rising interest among traders was received from the market. To confirm it, the quote needs to stay above the value of 1.0050. In this case, movement in the direction of 1.0150 is possible.

Otherwise, the quote will return to the previous cycle of fluctuations along the parity level.

The downside scenario is still relevant in the market, but in order for it to be confirmed, the quote needs to stay below 1.1350 for at least a four-hour period. Until then, traders will see a corrective move as a possible market opportunity. The subsequent increase in the volume of long positions on the pound is expected after holding the price above the value of 1.1450 in a four-hour period.

A candlestick chart view is graphical rectangles of white and black light, with sticks on top and bottom. When analyzing each candle in detail, you will see its characteristics of a relative period: the opening price, closing price, and maximum and minimum prices.

Horizontal levels are price coordinates, relative to which a stop or a price reversal may occur. These levels are called support and resistance in the market.

Circles and rectangles are highlighted examples where the price of the story unfolded. This color selection indicates horizontal lines that may put pressure on the quote in the future.

The up/down arrows are the reference points of the possible price direction in the future.

You have already liked this post today

*The market analysis posted here is meant to increase your awareness, but not to give instructions to make a trade.

In my morning forecast, I highlighted the 1.1337 level and planned to make market entry decisions based on it. Let's look at the 5-minute chart and analyze what happened there

Several entry points into the market were formed yesterday. Let's look at the 5-minute chart and break down what happened. I highlighted the 1.3282 level in my morning forecast

Yesterday, several entry points into the market were formed. Let's look at the 5-minute chart and analyze what happened. In my morning forecast, I highlighted the 1.1320 level

Analysis of Thursday's Trades 1H Chart of GBP/USD On Thursday, the GBP/USD pair continued its downward movement, although the overall picture still closely resembles a sideways range. The British pound

Analysis of Thursday's Trades 1H Chart of EUR/USD On Thursday, the EUR/USD currency pair continued its downward movement and reached the 1.1275 level by the end of the day, which

The GBP/USD currency pair continued to correct downward following Monday's rally and against the broader uptrend. There was no reason to expect the kind of price action that ultimately unfolded

The EUR/USD currency pair continued its mild upward movement on Thursday. The ongoing rise of the U.S. dollar looks strange, but strange price behavior has become the norm in recent

Graphical patterns

indicator.

Notices things

you never will!

Your IP address shows that you are currently located in the USA. If you are a resident of the United States, you are prohibited from using the services of InstaFintech Group including online trading, online transfers, deposit/withdrawal of funds, etc.

If you think you are seeing this message by mistake and your location is not the US, kindly proceed to the website. Otherwise, you must leave the website in order to comply with government restrictions.

Why does your IP address show your location as the USA?

Please confirm whether you are a US resident or not by clicking the relevant button below. If you choose the wrong option, being a US resident, you will not be able to open an account with InstaTrade anyway.

We are sorry for any inconvenience caused by this message.