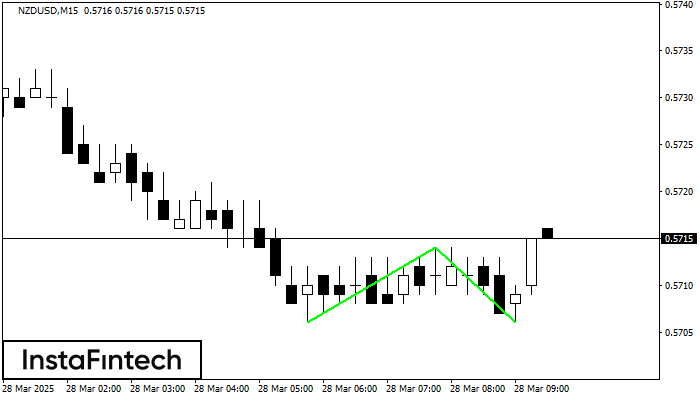

Double Bottom

was formed on 28.03 at 09:30:15 (UTC+0)

signal strength 2 of 5

The Double Bottom pattern has been formed on NZDUSD M15. This formation signals a reversal of the trend from downwards to upwards. The signal is that a buy trade should be opened after the upper boundary of the pattern 0.5714 is broken. The further movements will rely on the width of the current pattern 8 points.

The M5 and M15 time frames may have more false entry points.

See Also

- All

- All

- Bearish Rectangle

- Bearish Symmetrical Triangle

- Bearish Symmetrical Triangle

- Bullish Rectangle

- Double Top

- Double Top

- Triple Bottom

- Triple Bottom

- Triple Top

- Triple Top

- All

- All

- Buy

- Sale

- All

- 1

- 2

- 3

- 4

- 5

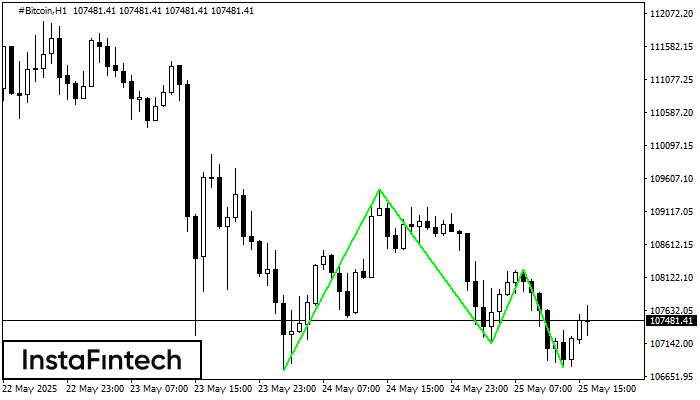

Triple Bottom

was formed on 25.05 at 15:59:45 (UTC+0)

signal strength 4 of 5

The Triple Bottom pattern has formed on the chart of the #Bitcoin H1 trading instrument. The pattern signals a change in the trend from downwards to upwards in the case

Open chart in a new window

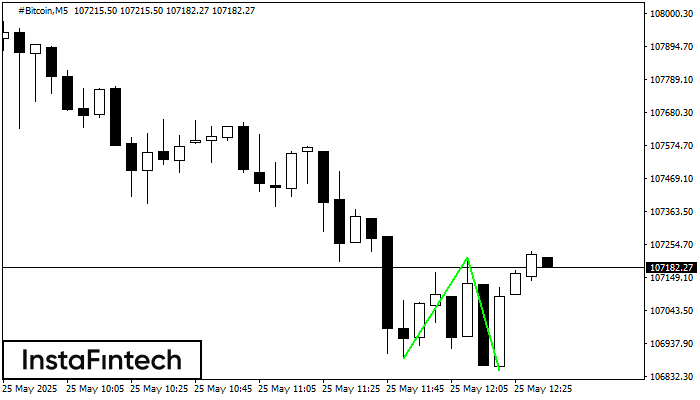

Double Bottom

was formed on 25.05 at 12:20:13 (UTC+0)

signal strength 1 of 5

The Double Bottom pattern has been formed on #Bitcoin M5. Characteristics: the support level 106888.42; the resistance level 107214.56; the width of the pattern 32614 points. If the resistance level

The M5 and M15 time frames may have more false entry points.

Open chart in a new window

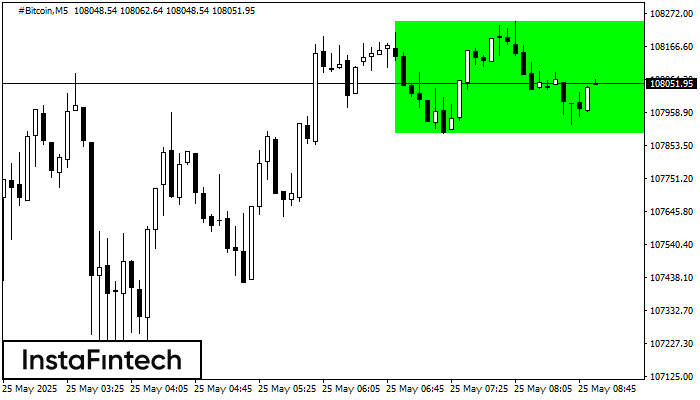

Bullish Rectangle

was formed on 25.05 at 07:55:30 (UTC+0)

signal strength 1 of 5

According to the chart of M5, #Bitcoin formed the Bullish Rectangle which is a pattern of a trend continuation. The pattern is contained within the following borders: the lower border

The M5 and M15 time frames may have more false entry points.

Open chart in a new window