Bullish Rectangle

was formed on 26.03 at 01:00:45 (UTC+0)

signal strength 2 of 5

According to the chart of M15, GBPCHF formed the Bullish Rectangle. This type of a pattern indicates a trend continuation. It consists of two levels: resistance 1.1425 and support 1.1415. In case the resistance level 1.1425 - 1.1425 is broken, the instrument is likely to follow the bullish trend.

The M5 and M15 time frames may have more false entry points.

- All

- All

- Bearish Rectangle

- Bearish Symmetrical Triangle

- Bearish Symmetrical Triangle

- Bullish Rectangle

- Double Top

- Double Top

- Triple Bottom

- Triple Bottom

- Triple Top

- Triple Top

- All

- All

- Buy

- Sale

- All

- 1

- 2

- 3

- 4

- 5

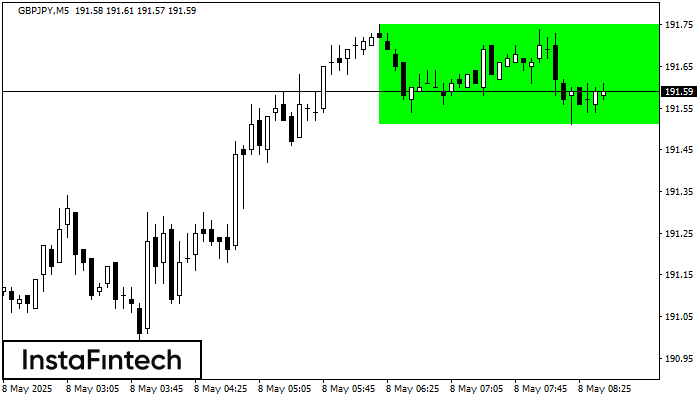

বুলিশ রেক্ট্যাঙ্গেল

was formed on 08.05 at 07:42:13 (UTC+0)

signal strength 1 of 5

M5 চার্ট অনুযায়ী, GBPJPY বুলিশ রেক্ট্যাঙ্গেল গঠন করেছে। এই প্যাটার্ন চলমান প্রবণতার ধারাবাহিকতা নির্দেশ করে। উপরের সীমানা হল 191.75, নীচের সীমানা হল 191.51৷ এই সংকেতের অর্থ হল বুলিশ রেক্ট্যাঙ্গেল -এর

M5 এবং M15 টাইম ফ্রেমে আরও ভুল এন্ট্রি পয়েন্ট থাকতে পারে।

Open chart in a new window

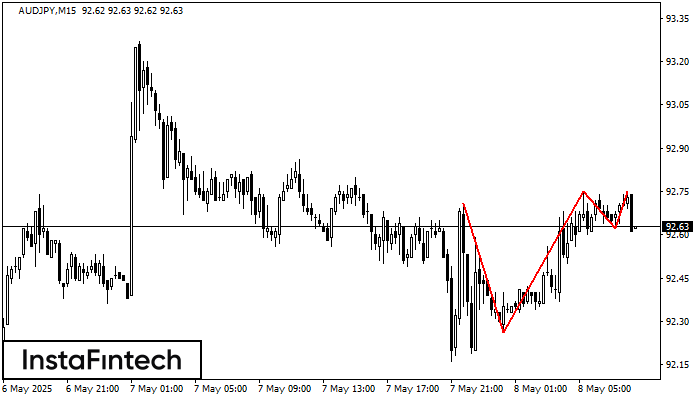

ট্রিপল টপ

was formed on 08.05 at 07:30:25 (UTC+0)

signal strength 2 of 5

M15 চার্টে, AUDJPY ট্রেডিং ইন্সট্রুমেন্টের ট্রিপল টপ প্যাটার্ন গঠিত হয়েছে। এটি একটি রিভার্সাল বা বিপরীতমুখী প্যাটার্ন যা নিম্নলিখিত বৈশিষ্ট্যগুলিকে সমন্বিত করে: রেজিস্ট্যান্স স্তর -4, সাপোর্ট স্তর -36 এবং প্যাটার্নের প্রস্থ

M5 এবং M15 টাইম ফ্রেমে আরও ভুল এন্ট্রি পয়েন্ট থাকতে পারে।

Open chart in a new window

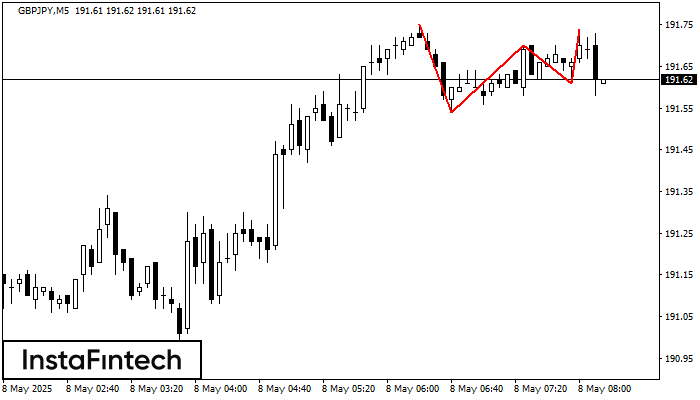

ট্রিপল টপ

was formed on 08.05 at 07:15:11 (UTC+0)

signal strength 1 of 5

M5 চার্টে, GBPJPY ট্রেডিং ইন্সট্রুমেন্টের ট্রিপল টপ প্যাটার্ন প্রবণতা পরিবর্তনের ইঙ্গিত দেয়। তৃতীয় পিকের গঠনের পরে, মূল্য 191.54-এর রেজিস্ট্যান্স স্তর ভেদ করার প্রচেষ্টা চালানোর সম্ভাবনা রয়েছে, এক্ষেত্রে আমরা সেল করার

M5 এবং M15 টাইম ফ্রেমে আরও ভুল এন্ট্রি পয়েন্ট থাকতে পারে।

Open chart in a new window