NZDSGD (New Zealand Dollar vs Singapore Dollar). Exchange rate and online charts.

Currency converter

24 Mar 2025 10:08

(0.01%)

Closing price, the previous day.

Opening price.

The highest price over the last trading day.

The lowest price over the last trading day

Price range high in the last week

Price range low in the last week

NZD/SGD (New Zealand Dollar vs Singapore Dollar)

NZD/SGD is not actively traded on Forex. The pair represents a cross rate against the U.S. dollar which has a great influence on NZD/SGD. By combining the NZD/USD and USD/SGD price charts, it is possible to get an approximate NZD/SGD price chart.

As the U.S. dollar can affect the NZD/SGD rate, it is necessary to monitor major economic indices of the USA such as the discount rate, GDP growth, unemployment, new vacancies, and many others when analyzing the pair movements. Moreover, it should be noted that the currencies can respond with different speed to the changes in the U.S. economy.

Economic data from New Zealand on interest rate, GDP growth, economic activity, and the level of trade with other countries is also very important in trading NZD/SGD. Being one of the largest wool producers, New Zealand is famous for its wool industry which is one of the fundamental sectors of its economy. Besides, the country depends on its main trading partners: the USA, Australia, and the Asia-Pacific region. For this reason, it is necessary to consider the key indicators from those countries as well.

Singapore is a developed industrial country with high living standards. Advantageous location at the crossroads of major shipping routes enabled Singapore to reach such level of development and have an active trading with world main economies. To date, Singapore exports home electronics and information technology products, shipbuilding products and financial services. Thus, export strongly influences the economy of this country and its national currency.

Singapore is listed among the group of so-called "Asian tigers" thanks to the rapid development of its economy. In such a way, the country is approaching to major Western economies such as the USA, Germany, France, Great Britain, etc.

NZD/SGD has low liquidity as compared to EUR/USD, USD/CHF, GBP/USD, and USD/JPY. Therefore, when you try to project the pair's further movement, consider NZD/USD and USD/SGD currency pairs.

Usually, the brokers set a higher spread for cross rates rather than for major currency pairs. Thus, read carefully the terms and conditions offered by broker to trade crosses.

See Also

- The GBP/USD pair declined by 25 basis points on Friday heading into the U.S. session.

Author: Chin Zhao

19:42 2025-03-21 UTC+2

2743

Technical analysisTrading Signals for EUR/USD for March 21-24, 2025: buy above 1.0810 (+1/8Murray - rebound)

Our medium-term forecast remains bearish. So, any technical rebound will be seen as a signal to sell with a medium-term target at about 1.0361, the level where the instrument left a gap.Author: Dimitrios Zappas

14:22 2025-03-21 UTC+2

2563

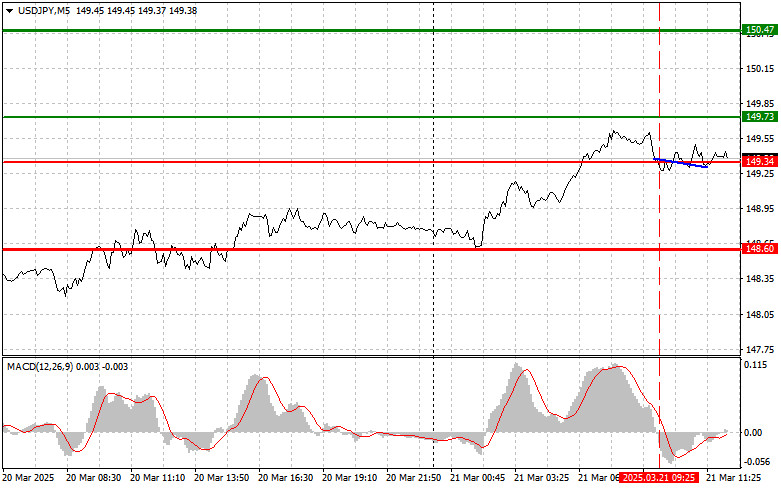

USDJPY: Simple Trading Tips for Beginner Traders on March 21st (U.S. Session)Author: Jakub Novak

19:30 2025-03-21 UTC+2

2443

- The EUR/USD pair saw no change on Friday. There was no news background in the direct sense of the word today, so the market had nothing to respond to, and trader activity remained minimal.

Author: Chin Zhao

19:39 2025-03-21 UTC+2

2353

US stock market in limbo despite positive economic dataAuthor: Andreeva Natalya

15:48 2025-03-21 UTC+2

2263

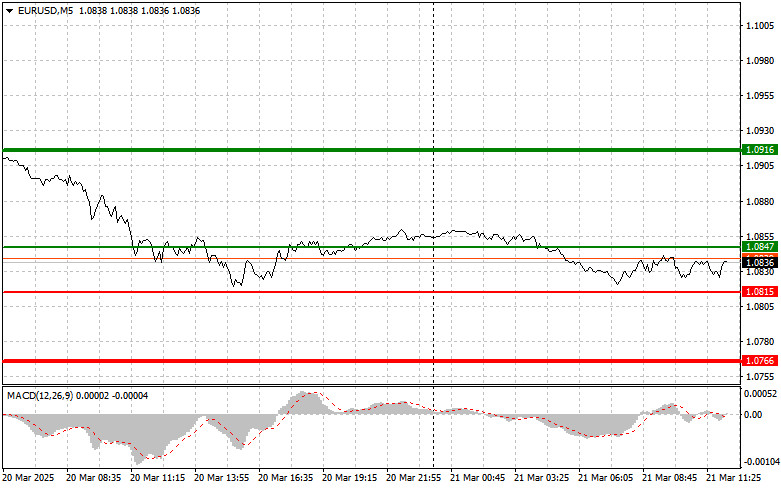

EURUSD: Simple Trading Tips for Beginner Traders on March 21st (U.S. Session)Author: Jakub Novak

19:09 2025-03-21 UTC+2

2188

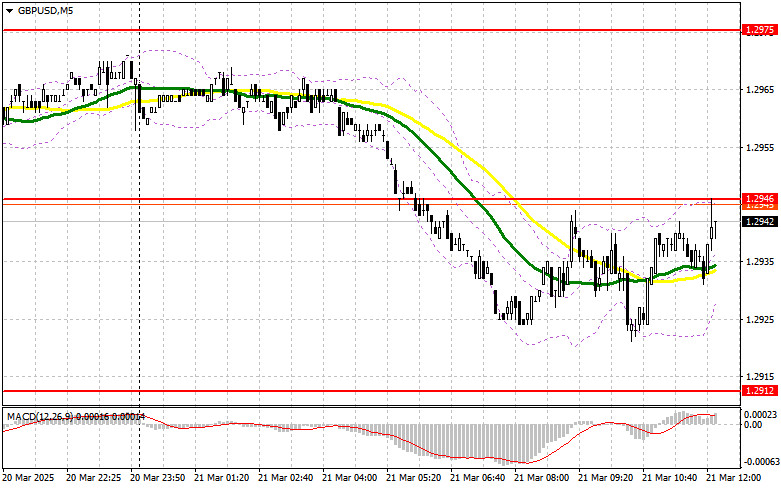

- GBPUSD: Simple Trading Tips for Beginner Traders on March 21st (U.S. Session)

Author: Jakub Novak

19:17 2025-03-21 UTC+2

2188

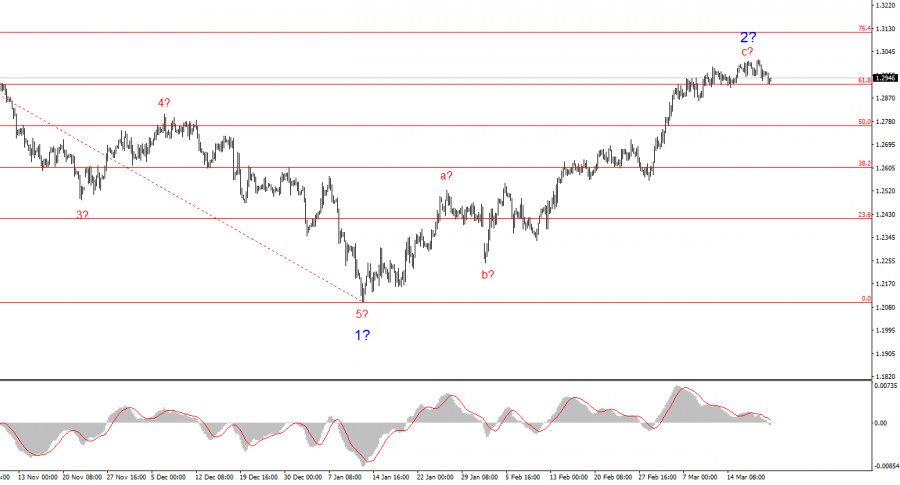

In my morning forecast, I focused on the 1.2946 level and planned to make trading decisions from that pointAuthor: Miroslaw Bawulski

19:04 2025-03-21 UTC+2

2053

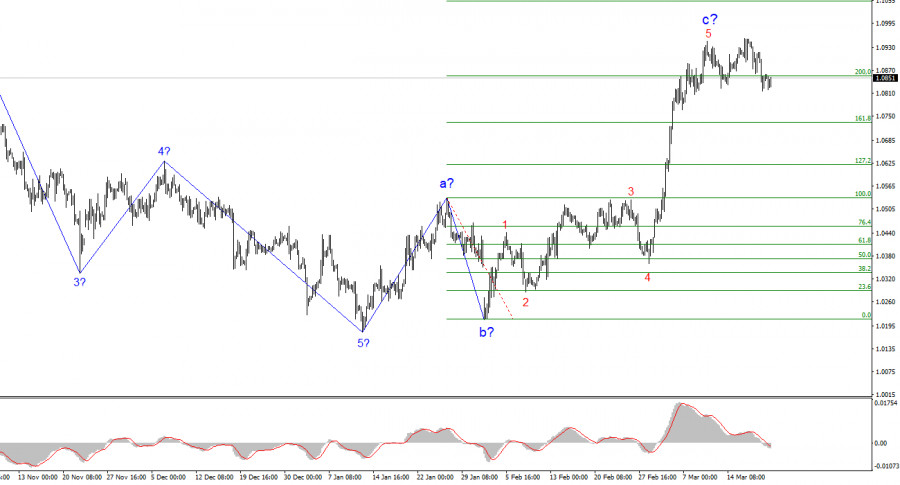

In my morning forecast, I highlighted the 1.0856 level and planned to make trading decisions around it.Author: Miroslaw Bawulski

18:59 2025-03-21 UTC+2

2023

- The GBP/USD pair declined by 25 basis points on Friday heading into the U.S. session.

Author: Chin Zhao

19:42 2025-03-21 UTC+2

2743

- Technical analysis

Trading Signals for EUR/USD for March 21-24, 2025: buy above 1.0810 (+1/8Murray - rebound)

Our medium-term forecast remains bearish. So, any technical rebound will be seen as a signal to sell with a medium-term target at about 1.0361, the level where the instrument left a gap.Author: Dimitrios Zappas

14:22 2025-03-21 UTC+2

2563

- USDJPY: Simple Trading Tips for Beginner Traders on March 21st (U.S. Session)

Author: Jakub Novak

19:30 2025-03-21 UTC+2

2443

- The EUR/USD pair saw no change on Friday. There was no news background in the direct sense of the word today, so the market had nothing to respond to, and trader activity remained minimal.

Author: Chin Zhao

19:39 2025-03-21 UTC+2

2353

- US stock market in limbo despite positive economic data

Author: Andreeva Natalya

15:48 2025-03-21 UTC+2

2263

- EURUSD: Simple Trading Tips for Beginner Traders on March 21st (U.S. Session)

Author: Jakub Novak

19:09 2025-03-21 UTC+2

2188

- GBPUSD: Simple Trading Tips for Beginner Traders on March 21st (U.S. Session)

Author: Jakub Novak

19:17 2025-03-21 UTC+2

2188

- In my morning forecast, I focused on the 1.2946 level and planned to make trading decisions from that point

Author: Miroslaw Bawulski

19:04 2025-03-21 UTC+2

2053

- In my morning forecast, I highlighted the 1.0856 level and planned to make trading decisions around it.

Author: Miroslaw Bawulski

18:59 2025-03-21 UTC+2

2023