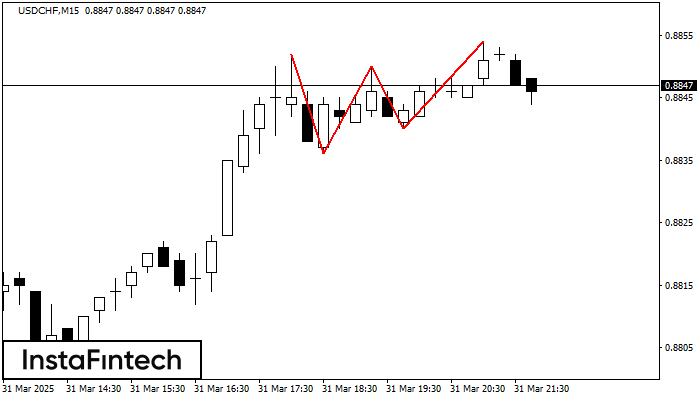

Triple Top

was formed on 31.03 at 21:00:23 (UTC+0)

signal strength 2 of 5

The Triple Top pattern has formed on the chart of the USDCHF M15 trading instrument. It is a reversal pattern featuring the following characteristics: resistance level -2, support level -4, and pattern’s width 16. Forecast If the price breaks through the support level 0.8836, it is likely to move further down to 0.8827.

The M5 and M15 time frames may have more false entry points.

See Also

- All

- All

- Bearish Rectangle

- Bearish Symmetrical Triangle

- Bearish Symmetrical Triangle

- Bullish Rectangle

- Double Top

- Double Top

- Triple Bottom

- Triple Bottom

- Triple Top

- Triple Top

- All

- All

- Buy

- Sale

- All

- 1

- 2

- 3

- 4

- 5

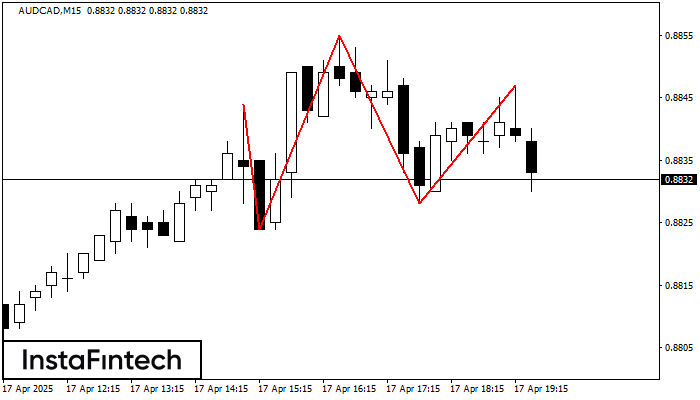

Head and Shoulders

was formed on 17.04 at 18:45:16 (UTC+0)

signal strength 2 of 5

The AUDCAD M15 formed the Head and Shoulders pattern with the following features: The Head’s top is at 0.8855, the Neckline and the upward angle are at 0.8824/0.8828. The formation

The M5 and M15 time frames may have more false entry points.

Open chart in a new window

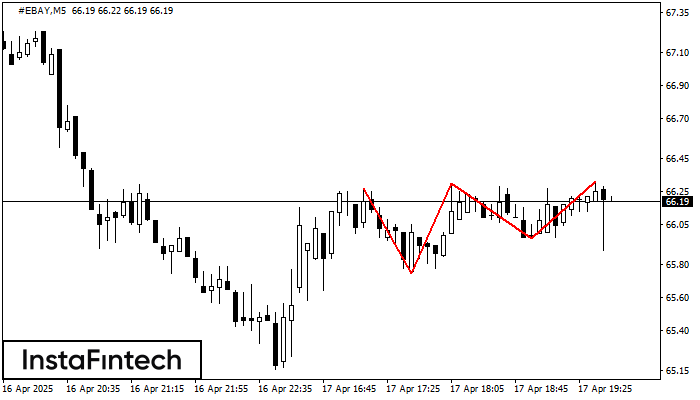

Triple Top

was formed on 17.04 at 18:45:16 (UTC+0)

signal strength 1 of 5

The Triple Top pattern has formed on the chart of the #EBAY M5. Features of the pattern: borders have an ascending angle; the lower line of the pattern

The M5 and M15 time frames may have more false entry points.

Open chart in a new window

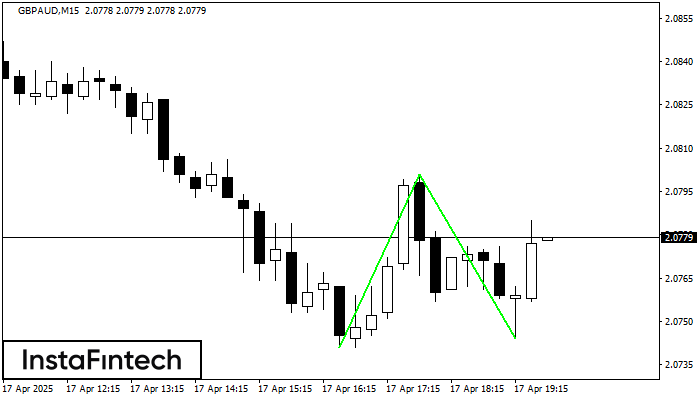

Double Bottom

was formed on 17.04 at 18:45:14 (UTC+0)

signal strength 2 of 5

The Double Bottom pattern has been formed on GBPAUD M15; the upper boundary is 2.0801; the lower boundary is 2.0744. The width of the pattern is 60 points. In case

The M5 and M15 time frames may have more false entry points.

Open chart in a new window