Uniswap ( vs ). Exchange rate and online charts.

See Also

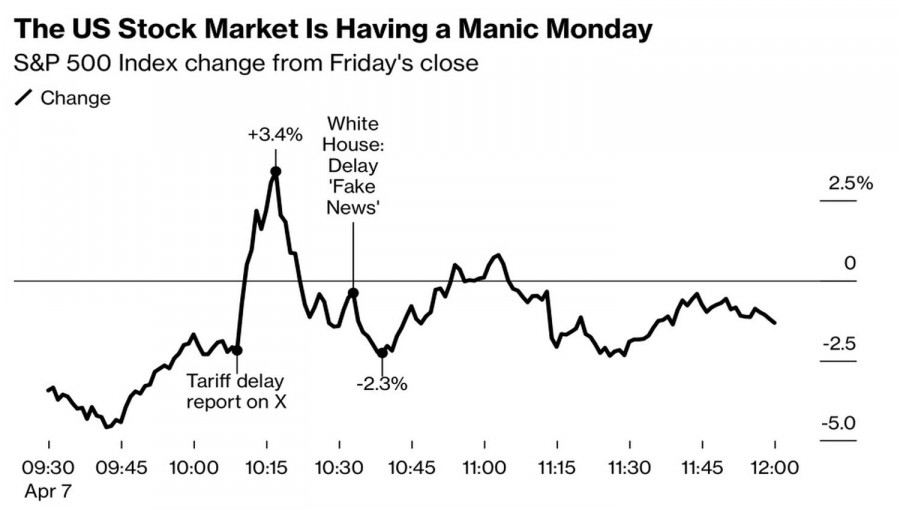

- What the S&P 500 signals after the rollercoaster ride due to the fake news about the White House's tariff pause

Author: Marek Petkovich

11:49 2025-04-08 UTC+2

1063

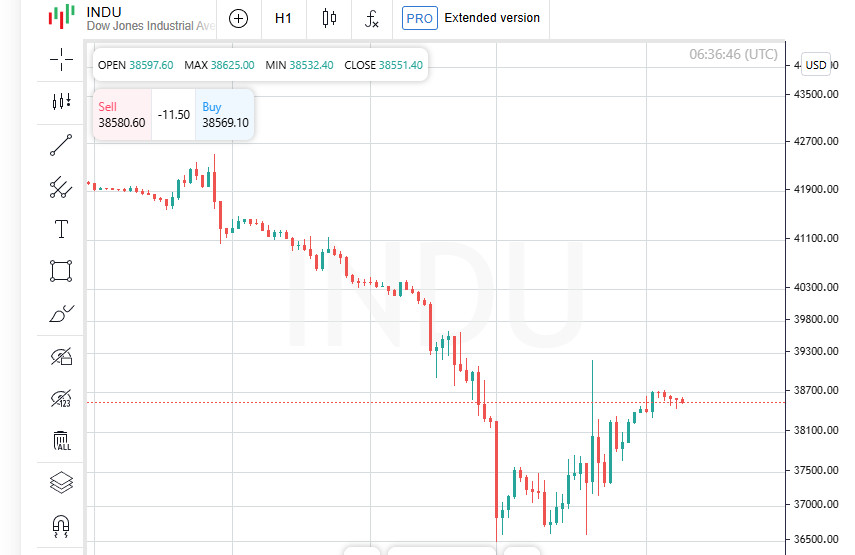

The changes in Wall Street indices for the last 24 hours: the S&P 500 fell by 0.23%, the Nasdaq rose by 0.10%, and the Dow dropped by 0.91%. The S&P 500 still balances on the edge of a bear market. Trump threatens extra tariffs for China.Author: Gleb Frank

12:25 2025-04-08 UTC+2

1018

- Technical analysis

Trading Signals for GOLD (XAU/USD) for April 8-10, 2025: buy above $2,993 (200 EMA - rebound)

Our trading plan for the coming hours is to sell gold below 3,020, as technically there is a bearish trend channel. If gold fails to break above this level, it will be seen as a signal to sell.Author: Dimitrios Zappas

14:56 2025-04-08 UTC+2

973

The Trump administration's latest wave of tariffs is reshaping economic expectations. Goldman Sachs is now forecasting a recession within the next 12 months, while JPMorgan analysts are pricing in a 0.3% cut to US GDP growthAuthor: Ekaterina Kiseleva

12:14 2025-04-08 UTC+2

973

The CEO of BlackRock believes the market sell-off may still have further to go.Author: Jakub Novak

12:27 2025-04-08 UTC+2

928

- Markets remain in shock over Trump

Author: Samir Klishi

10:57 2025-04-08 UTC+2

868

Bears abruptly returned, only to retreat againAuthor: Samir Klishi

10:53 2025-04-08 UTC+2

823

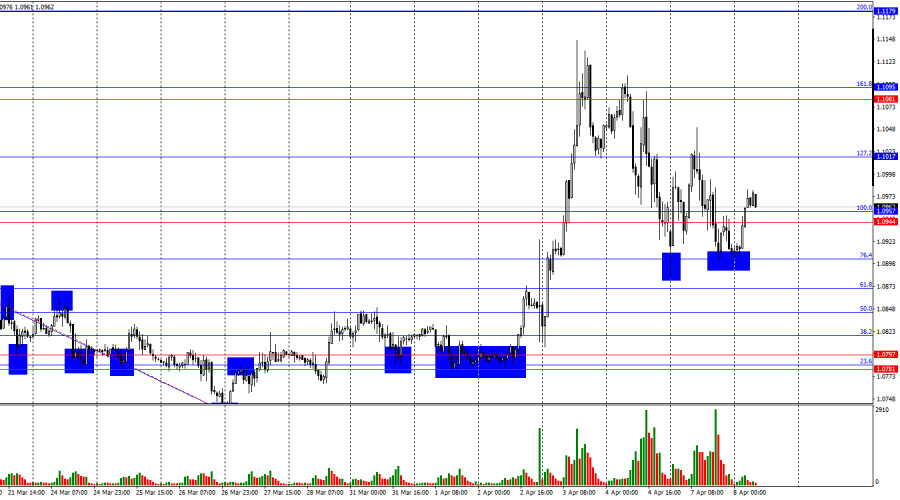

Technical analysisTrading Signals for EUR/USD for April 8-10, 2025: sell below 1.0986 (200 EMA - 6/8 Murray)

If the euro breaks the downtrend channel, we could expect a new upward movement that could push EUR/USD up to 1.1051, last week's high, the 7/8 Murray at 1.1115, and even surpass its highest level since early April.Author: Dimitrios Zappas

14:54 2025-04-08 UTC+2

718

- What the S&P 500 signals after the rollercoaster ride due to the fake news about the White House's tariff pause

Author: Marek Petkovich

11:49 2025-04-08 UTC+2

1063

- The changes in Wall Street indices for the last 24 hours: the S&P 500 fell by 0.23%, the Nasdaq rose by 0.10%, and the Dow dropped by 0.91%. The S&P 500 still balances on the edge of a bear market. Trump threatens extra tariffs for China.

Author: Gleb Frank

12:25 2025-04-08 UTC+2

1018

- Technical analysis

Trading Signals for GOLD (XAU/USD) for April 8-10, 2025: buy above $2,993 (200 EMA - rebound)

Our trading plan for the coming hours is to sell gold below 3,020, as technically there is a bearish trend channel. If gold fails to break above this level, it will be seen as a signal to sell.Author: Dimitrios Zappas

14:56 2025-04-08 UTC+2

973

- The Trump administration's latest wave of tariffs is reshaping economic expectations. Goldman Sachs is now forecasting a recession within the next 12 months, while JPMorgan analysts are pricing in a 0.3% cut to US GDP growth

Author: Ekaterina Kiseleva

12:14 2025-04-08 UTC+2

973

- The CEO of BlackRock believes the market sell-off may still have further to go.

Author: Jakub Novak

12:27 2025-04-08 UTC+2

928

- Markets remain in shock over Trump

Author: Samir Klishi

10:57 2025-04-08 UTC+2

868

- Bears abruptly returned, only to retreat again

Author: Samir Klishi

10:53 2025-04-08 UTC+2

823

- Technical analysis

Trading Signals for EUR/USD for April 8-10, 2025: sell below 1.0986 (200 EMA - 6/8 Murray)

If the euro breaks the downtrend channel, we could expect a new upward movement that could push EUR/USD up to 1.1051, last week's high, the 7/8 Murray at 1.1115, and even surpass its highest level since early April.Author: Dimitrios Zappas

14:54 2025-04-08 UTC+2

718