CHFMXN (Swiss Franc vs Mexican Peso). Exchange rate and online charts.

Currency converter

19 Jun 2025 08:20

(0.01%)

Closing price, the previous day.

Opening price.

The highest price over the last trading day.

The lowest price over the last trading day

Price range high in the last week

Price range low in the last week

CHF/MXP is the exchange rate of the Swiss franc against the Mexican peso and it is not popular among Forex traders. The US dollar significantly affects this currency pair even though it is not a part of it. It is easy to follow up: one only needs to merge USD/CHF and USD/MXN movements to get the chart for the CHF/MXN pair.

As the US dollar has a considerable influence on the Swiss franc and the Mexican peso, the main indiсes of the US economy should be taken into account when forecasting the most accurate prices of the currency trading instrument. These indexes include central bank interest rates, the GDP, unemployment rate, new jobs, etc. Remember that the represented currencies may react differently to changes in the US economy.

For several centuries, the Swiss economy has remained one of the highly developed economies in the world. That is why the Swiss franc is deemed the most stable currency as well as the safest one to keep funds. In times of economic crisis when capital flows to Switzerland зпт the franc advances sharply against other currencies. Take that aspect of the Swiss economy into account while trading the CHF/MXN pair.

Mexico has the highest per capita income in Latin America that lets it rank among the most developed countries in the region. The major part of state enterprises in Mexico were privatized in the 80 according to government measures against the economic crisis. Foreign companies take control of most organizations that used to be state-owned. Mexico trades with the US and Canada under the North American Free Trade Agreement. The profit from trading with these countries represents one of the government's main sources of revenue.

Besides, Mexico is the leading oil exporter in Latin America and money earned from selling oil makes an important contribution to the country’s budget. However, the key source of revenue comes from the services sector.

In spite of the large amount of oil and gas fields located on the territory of Mexico, natural hydrocarbon deposits are contracting gradually. To avoid new economic problems, the government has taken measures to decrease gas and oil production. Analysts believe that the ongoing restrictive policy is likely to make Mexico purchase raw materials to cope with its domestic demand. Besides movements in oil prices, the Mexican peso is influenced by different ratings from the most reliable international rating agencies, based on analysis of various factors.

CHF/MXN is less liquid compared to EUR/USD, USD/CHF, GBP/USD, and USD/JPY. You should consider the pairs that the Swiss franc and the Mexican peso form with the US dollar, preparing forecasts about the CHF/MXN pair.

Please do not forget that spreads for cross rate transactions are often wider than spreads for transaction which involve major currencies. That is why you need to examine your broker’s terms for cross currency pairs before you start trading this financial instrument.

See Also

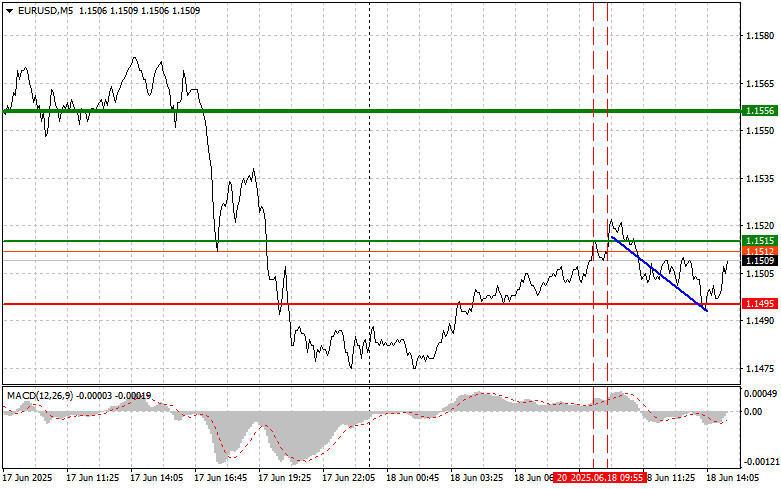

- EUR/USD: Simple Trading Tips for Beginner Traders – June 18th (U.S. Session)

Author: Jakub Novak

19:01 2025-06-18 UTC+2

1273

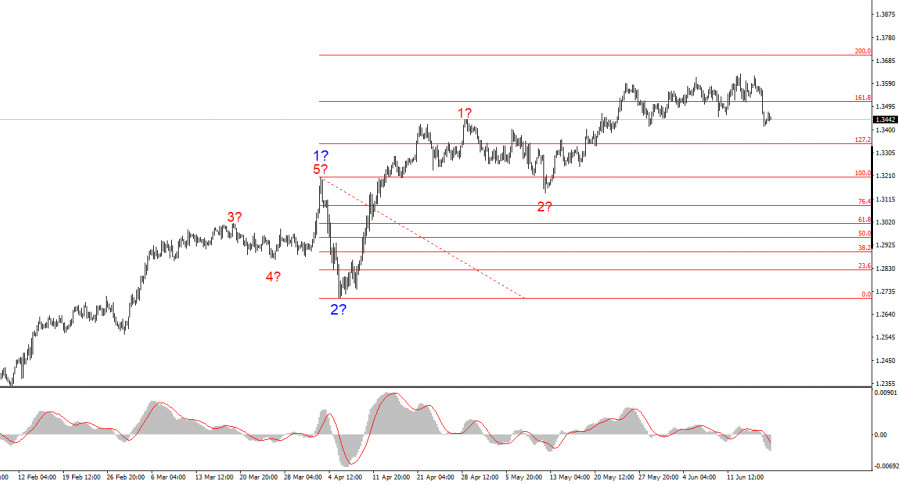

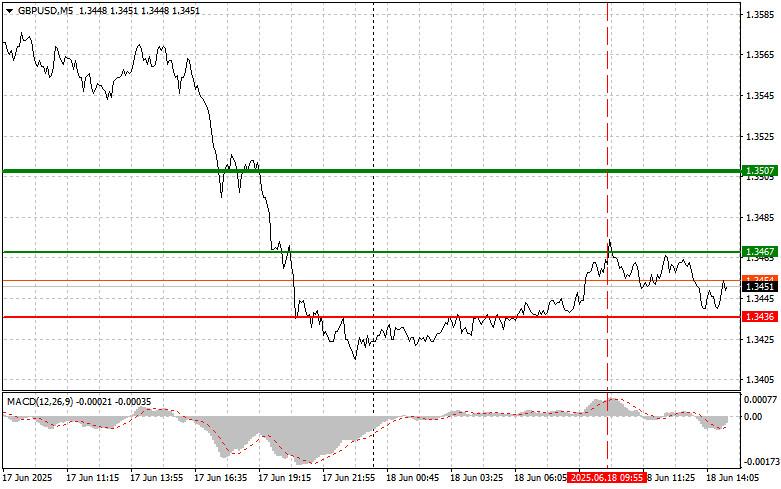

The GBP/USD exchange rate remained nearly unchanged throughout Wednesday, following a 100-basis-point drop the previous day.Author: Chin Zhao

20:01 2025-06-18 UTC+2

1183

The NZD/USD pair is regaining positive momentum on Wednesday amid moderate U.S. dollar weakness.Author: Irina Yanina

19:16 2025-06-18 UTC+2

1153

- The Bank of Japan has signaled a more cautious approach to unwinding its decade-long monetary stimulus program, citing uncertainty in the country's economic growth.

Author: Irina Yanina

19:43 2025-06-18 UTC+2

1138

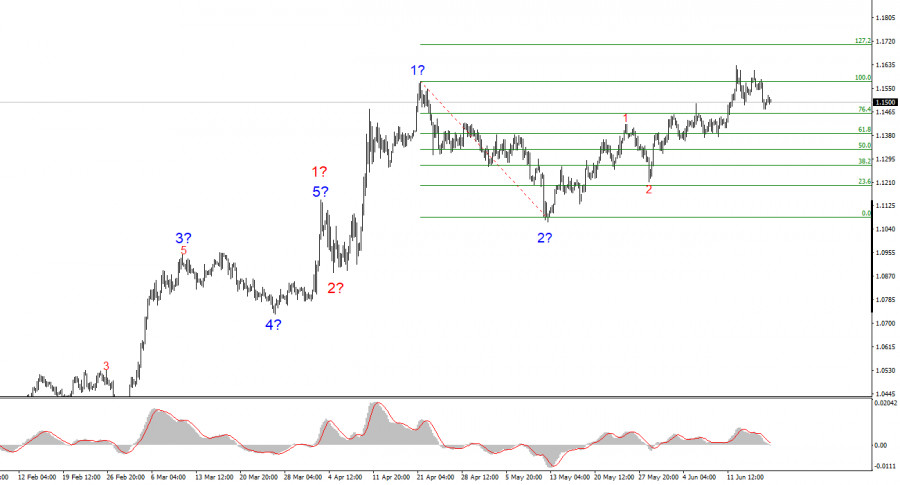

The EUR/USD pair rose by 20 basis points on Wednesday, but the most significant market action is both behind and ahead.Author: Chin Zhao

19:56 2025-06-18 UTC+2

1123

Silver enters a bullish consolidation phaseAuthor: Irina Yanina

19:13 2025-06-18 UTC+2

1108

- GBP/USD: Simple Trading Tips for Beginner Traders – June 18th (U.S. Session)

Author: Jakub Novak

19:03 2025-06-18 UTC+2

718

EUR/USD: Trading Plan for the U.S. Session on June 18th (Review of Morning Trades)Author: Miroslaw Bawulski

18:34 2025-06-18 UTC+2

703

GBP/USD traders did not react to the UK inflation growth report that was published on Wednesday, just before the June Bank of England meeting. The focus of the market remains on the Middle East.Author: Irina Manzenko

00:42 2025-06-19 UTC+2

688

- EUR/USD: Simple Trading Tips for Beginner Traders – June 18th (U.S. Session)

Author: Jakub Novak

19:01 2025-06-18 UTC+2

1273

- The GBP/USD exchange rate remained nearly unchanged throughout Wednesday, following a 100-basis-point drop the previous day.

Author: Chin Zhao

20:01 2025-06-18 UTC+2

1183

- The NZD/USD pair is regaining positive momentum on Wednesday amid moderate U.S. dollar weakness.

Author: Irina Yanina

19:16 2025-06-18 UTC+2

1153

- The Bank of Japan has signaled a more cautious approach to unwinding its decade-long monetary stimulus program, citing uncertainty in the country's economic growth.

Author: Irina Yanina

19:43 2025-06-18 UTC+2

1138

- The EUR/USD pair rose by 20 basis points on Wednesday, but the most significant market action is both behind and ahead.

Author: Chin Zhao

19:56 2025-06-18 UTC+2

1123

- Silver enters a bullish consolidation phase

Author: Irina Yanina

19:13 2025-06-18 UTC+2

1108

- GBP/USD: Simple Trading Tips for Beginner Traders – June 18th (U.S. Session)

Author: Jakub Novak

19:03 2025-06-18 UTC+2

718

- EUR/USD: Trading Plan for the U.S. Session on June 18th (Review of Morning Trades)

Author: Miroslaw Bawulski

18:34 2025-06-18 UTC+2

703

- GBP/USD traders did not react to the UK inflation growth report that was published on Wednesday, just before the June Bank of England meeting. The focus of the market remains on the Middle East.

Author: Irina Manzenko

00:42 2025-06-19 UTC+2

688