CHFHUF (Swiss Franc vs Hungarian Forint). Exchange rate and online charts.

Currency converter

21 Mar 2025 21:36

(-0%)

Closing price, the previous day.

Opening price.

The highest price over the last trading day.

The lowest price over the last trading day

Price range high in the last week

Price range low in the last week

The CHF/HUF currency pair, which is the cross rate against the U.S. dollar, is not very popular on Forex market. Although there is no U.S. dollar in this currency pair, it falls under the greenback’s powerful influence. To make it clear, just combine the USD/CHF and USD/HUF charts in the same price chart, and you will get the approximate CHF/HUF chart.

The U.S. dollar extends the strong influence over the Swiss franc and the Hungarian forint. So for a better prognosis for the future rate movement of this financial instrument you should take into account the main economic indicators of the United States. There are such indicators as the interest rate, GDP, unemployment, new workplaces indicator and many others. Please remember that these currencies can react differently to the changes in the economic situation of the U.S.A.

The Swiss economy has been highly developed for several centuries. Thus, the Swiss franc is known as the most reliable and stable currency in the world and as the safest currency for the capital investment. At the time of crisis, when the world capital is urgently goes to Switzerland, the Swiss franc rate rises sharply against other currencies. This peculiarity of the Swiss economy should be considered while trading currency pair.

The rate of this financial instrument was tied to euro since it had been introduced as the currency of the most European Union’s countries. However, in 2008 the further attachment of its national currency to the euro became unprofitable to this country and Hungary denied it.

The great amount of the foreign companies and organizations do their businesses in Hungary. Therefore, the Hungarian economy is entirely dependent on their commercial activity.

This country of the Central Europe has both developed industry and agricultural sectors. The main industrial sectors of Hungary are engineering, metallurgy and chemical industry. As for agriculture, gardening and wine-making industries that mostly goes on export, they occupy the significant part of this sector. The beautiful Hungarian nature, its ancient culture and architecture attract millions of tourists every year, so this country has also developed tourism. The major trading partners of Hungary are EU countries and Russia. Therefore, keep in mind the economic indicators of these regions while forecasting the future rate of the Hungarian forint.

Comparing to the major currency pairs such as EUR/USD, USD/CHF, GBP/USD and USD/JPY this one is relatively illiquid. So when you make a forecast of the future movement of this currency pair, you should pay special attention to the currency pairs that consist of the Swiss franc and the Hungarian Forint in tandem with the U.S. dollar.

Please remember that the spread for the cross currency pairs is usually higher than for the more popular ones. Therefore, before trading the cross rate pairs learn properly the broker’s conditions for this specified financial instrument.

See Also

- Today, following the release of data showing a February slowdown in the national Consumer Price Index (CPI), the Japanese yen continues to trade with a negative tone, creating uncertainty in the market.

Author: Irina Yanina

12:07 2025-03-21 UTC+2

1393

Bulls had the upper hand for two weeks, but it's time for a pauseAuthor: Samir Klishi

12:02 2025-03-21 UTC+2

1348

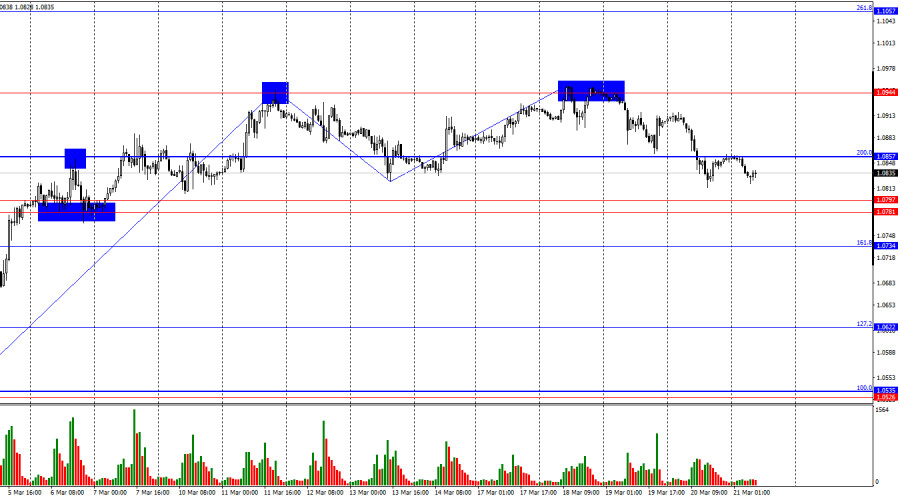

Technical analysisTrading Signals for EUR/USD for March 21-24, 2025: buy above 1.0810 (+1/8Murray - rebound)

Our medium-term forecast remains bearish. So, any technical rebound will be seen as a signal to sell with a medium-term target at about 1.0361, the level where the instrument left a gap.Author: Dimitrios Zappas

14:22 2025-03-21 UTC+2

1318

- The outcomes of the Bank of England and FOMC meetings contradicted each other

Author: Samir Klishi

11:52 2025-03-21 UTC+2

1303

US stock market in limbo despite positive economic dataAuthor: Andreeva Natalya

15:48 2025-03-21 UTC+2

1258

- Technical analysis

Trading Signals for GOLD (XAU/USD) for March 21-24, 2025: buy above $3,026 (7/8 Murray - 61.8%)

The Eagle indicator is reaching oversold levels. So, we believe that gold could resume its bullish cycle in the coming days. For this, we should expect consolidation above the psychological level of $3,000.Author: Dimitrios Zappas

14:04 2025-03-21 UTC+2

1168

At the close of yesterday's regular trading session, U.S. stock indices ended in the red. The S&P 500 fell by 0.22%, while the Nasdaq 100 lost 0.33%.Author: Jakub Novak

11:46 2025-03-21 UTC+2

1138

Technical analysis of EUR/USD, USD/JPY, Gold and Bitcoin.Author: Sebastian Seliga

13:14 2025-03-21 UTC+2

958

- Today, following the release of data showing a February slowdown in the national Consumer Price Index (CPI), the Japanese yen continues to trade with a negative tone, creating uncertainty in the market.

Author: Irina Yanina

12:07 2025-03-21 UTC+2

1393

- Bulls had the upper hand for two weeks, but it's time for a pause

Author: Samir Klishi

12:02 2025-03-21 UTC+2

1348

- Technical analysis

Trading Signals for EUR/USD for March 21-24, 2025: buy above 1.0810 (+1/8Murray - rebound)

Our medium-term forecast remains bearish. So, any technical rebound will be seen as a signal to sell with a medium-term target at about 1.0361, the level where the instrument left a gap.Author: Dimitrios Zappas

14:22 2025-03-21 UTC+2

1318

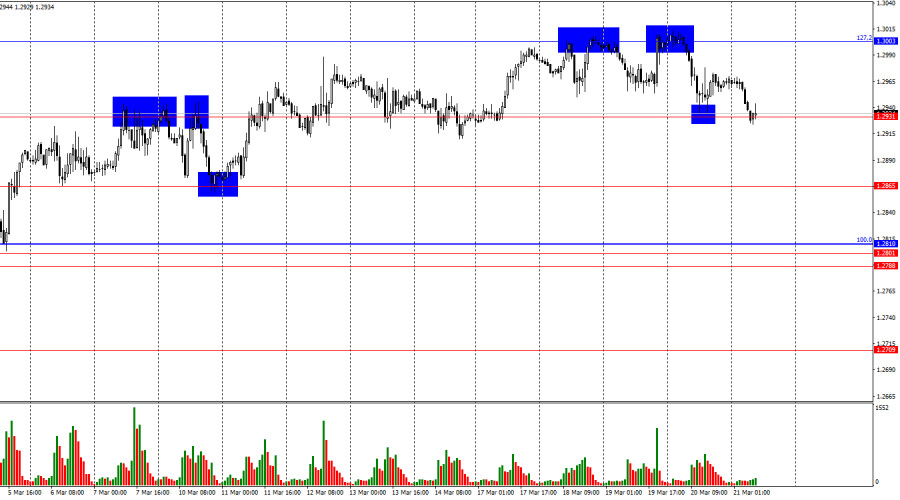

- The outcomes of the Bank of England and FOMC meetings contradicted each other

Author: Samir Klishi

11:52 2025-03-21 UTC+2

1303

- US stock market in limbo despite positive economic data

Author: Andreeva Natalya

15:48 2025-03-21 UTC+2

1258

- Technical analysis

Trading Signals for GOLD (XAU/USD) for March 21-24, 2025: buy above $3,026 (7/8 Murray - 61.8%)

The Eagle indicator is reaching oversold levels. So, we believe that gold could resume its bullish cycle in the coming days. For this, we should expect consolidation above the psychological level of $3,000.Author: Dimitrios Zappas

14:04 2025-03-21 UTC+2

1168

- At the close of yesterday's regular trading session, U.S. stock indices ended in the red. The S&P 500 fell by 0.22%, while the Nasdaq 100 lost 0.33%.

Author: Jakub Novak

11:46 2025-03-21 UTC+2

1138

- Technical analysis of EUR/USD, USD/JPY, Gold and Bitcoin.

Author: Sebastian Seliga

13:14 2025-03-21 UTC+2

958