AUDZAR (Australian Dollar vs South African Rand). Exchange rate and online charts.

Currency converter

17 Jun 2025 23:45

(0.02%)

Closing price, the previous day.

Opening price.

The highest price over the last trading day.

The lowest price over the last trading day

Price range high in the last week

Price range low in the last week

AUD/ZAR is a common currency pair on Forex. It can serve as the cross rate against the U.S. dollar. Although the U.S. dollar is not obviously present in this currency pair, it has a pronounced impact on it. Thus, by combining the AUD/USD and the USD/ZAR price charts, it is possible get an approximate AUD/ZAR chart.

In order to make the correct analysis of the future price trend, pay the utmost attention to the changes in the U.S. dollar rate as it has a significant influence on both AUD and ZAR. It should be noted that the mentioned above currencies can respond differently towards the changes in the U.S. dollar rate. Thus, the AUD/ZAR currency pair can serve as a peculiar indicator of the currencies changes.

South African rand is widely-spread currency which can be found in great majority of trading operations. South Africa is the richest country in Africa due to great amount of the mineral deposits. South Africa has also the largest stock exchange which can be compared to the world largest stock exchanges. The country’s economy is based on the minerals export and extraction.

South Africa is a large producer of precious stones and metals, including gold and diamonds. In addition, the country is the major car manufacturer in Africa, contributing most to the region’s exports. South Africa is almost self-sufficient in providing all the necessary raw materials. The country’s exchange rate can be greatly affected by prices for precious stones and metals and machinery construction industry.

When trading cross-rate, remember that brokers usually set a higher spread for such currencies pairs compared to others. For this reason, read and understand the terms of trade suggested by the broker to trade this instrument.

See Also

- Technical analysis / Video analytics

Forex forecast 17/06/2025: EUR/USD, USD/JPY, NZD/USD, SP500 and Bitcoin

Technical analysis of EUR/USD, USD/JPY, NZD/USD, SP500 and BitcoinAuthor: Sebastian Seliga

10:46 2025-06-17 UTC+2

4558

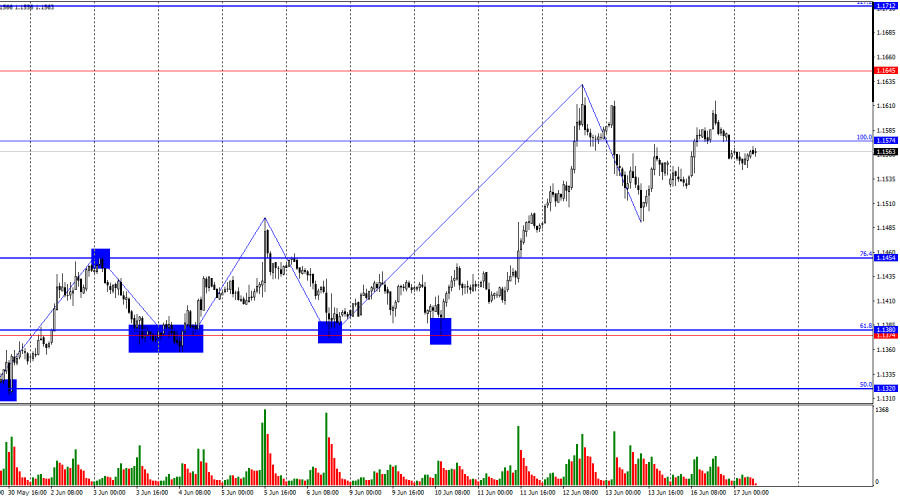

Bears still can't find supportAuthor: Samir Klishi

12:00 2025-06-17 UTC+2

1498

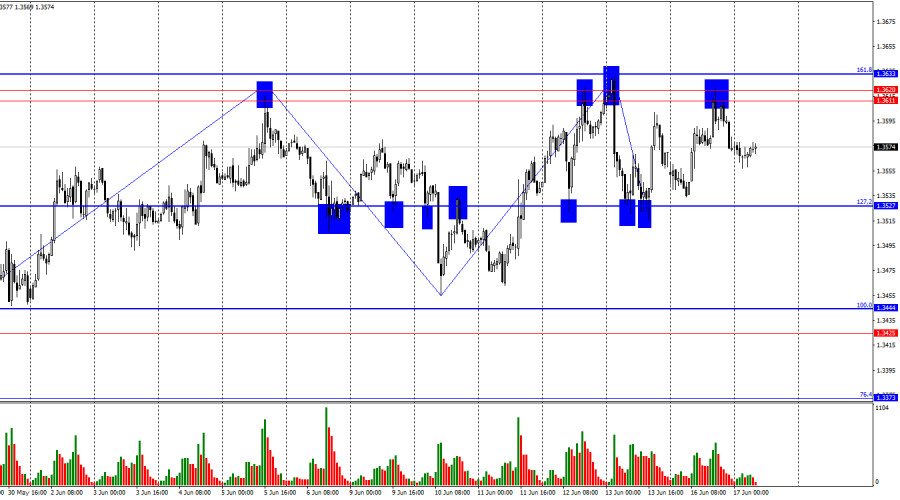

Bulls struggle to break through the 1.3611–1.3633 resistance zoneAuthor: Samir Klishi

10:18 2025-06-17 UTC+2

1408

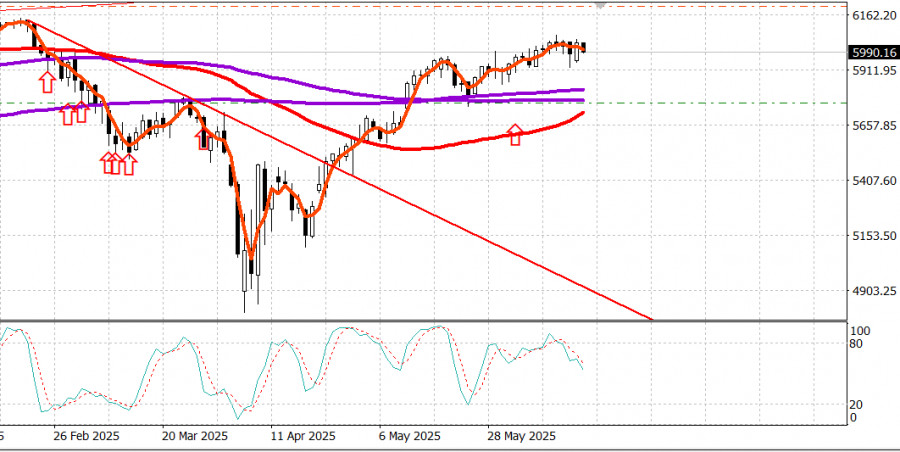

- How the US stock market is trading ahead of the Federal Reserve's policy meeting

Author: Jozef Kovach

10:45 2025-06-17 UTC+2

1393

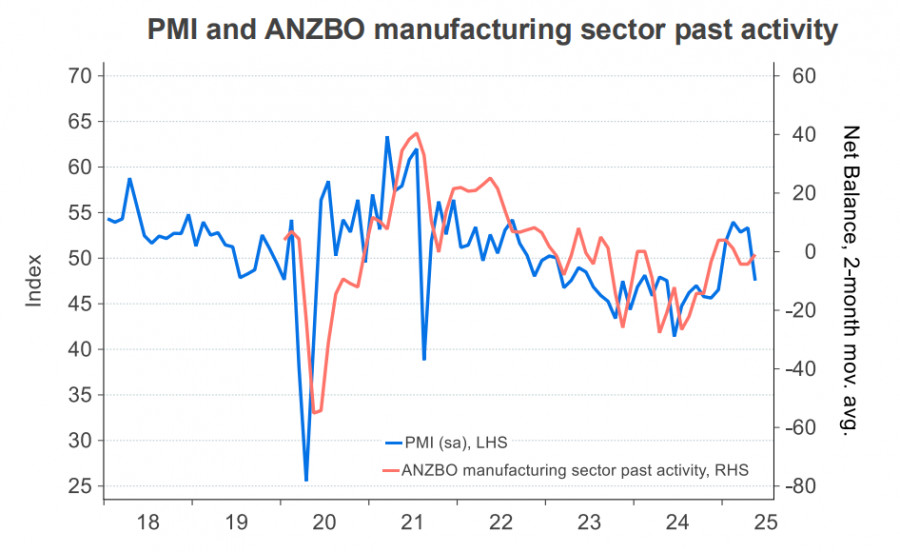

The Kiwi Doesn't Give Up Despite New Zealand's Weak EconomyAuthor: Kuvat Raharjo

12:10 2025-06-17 UTC+2

1288

The overconfidence of dip buyers poses serious risks for S&P 500 bullsAuthor: Marek Petkovich

11:07 2025-06-17 UTC+2

1123

- The US stock market continues to disregard geopolitical realities. Indices have approached key levels and are ready for a breakout. The only question is, in which direction? If upcoming events (PPI, Fed, retail sales) do not disappoint

Author: Natalya Andreeva

13:27 2025-06-17 UTC+2

1093

Tensions in the US stock market are rising as the conflict between Israel and Iran intensifies. Analysts warn that a potential full-scale war could trigger a 20% drop in the S&P 500Author: Ekaterina Kiseleva

13:25 2025-06-17 UTC+2

1033

Stock Market on May 17th: S&P 500 and NASDAQAuthor: Jakub Novak

11:56 2025-06-17 UTC+2

1018

- Technical analysis / Video analytics

Forex forecast 17/06/2025: EUR/USD, USD/JPY, NZD/USD, SP500 and Bitcoin

Technical analysis of EUR/USD, USD/JPY, NZD/USD, SP500 and BitcoinAuthor: Sebastian Seliga

10:46 2025-06-17 UTC+2

4558

- Bears still can't find support

Author: Samir Klishi

12:00 2025-06-17 UTC+2

1498

- Bulls struggle to break through the 1.3611–1.3633 resistance zone

Author: Samir Klishi

10:18 2025-06-17 UTC+2

1408

- How the US stock market is trading ahead of the Federal Reserve's policy meeting

Author: Jozef Kovach

10:45 2025-06-17 UTC+2

1393

- The Kiwi Doesn't Give Up Despite New Zealand's Weak Economy

Author: Kuvat Raharjo

12:10 2025-06-17 UTC+2

1288

- The overconfidence of dip buyers poses serious risks for S&P 500 bulls

Author: Marek Petkovich

11:07 2025-06-17 UTC+2

1123

- The US stock market continues to disregard geopolitical realities. Indices have approached key levels and are ready for a breakout. The only question is, in which direction? If upcoming events (PPI, Fed, retail sales) do not disappoint

Author: Natalya Andreeva

13:27 2025-06-17 UTC+2

1093

- Tensions in the US stock market are rising as the conflict between Israel and Iran intensifies. Analysts warn that a potential full-scale war could trigger a 20% drop in the S&P 500

Author: Ekaterina Kiseleva

13:25 2025-06-17 UTC+2

1033

- Stock Market on May 17th: S&P 500 and NASDAQ

Author: Jakub Novak

11:56 2025-06-17 UTC+2

1018