12.02.2025 09:21 AM

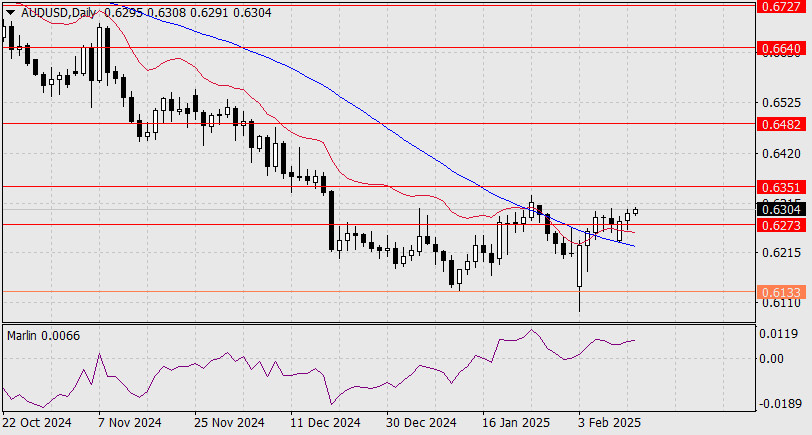

12.02.2025 09:21 AM週一,澳元在0.6273的水平上方鞏固,確認了上升動能。下一個目標設定在0.6351,若突破該水平,可能會開啟通往0.6482的道路。Marlin 振盪指標持續上升,支撐價格進一步上行。

今日,美國將發佈1月份的通脹數據。預計核心消費者物價指數(CPI)將從同比3.2%下降至3.1%,而整體CPI則預計將穩定在同比2.9%。這些數據可能為澳元提供短期支撐。然而,交易者也應關注澳洲儲備銀行(RBA)定於2月18日的貨幣政策決定。

在H4圖表上,價格仍高於所有關鍵支撐水平,加強了上升趨勢。Marlin振盪指標從中性零線向上轉折,確認了看漲動能。

週三,歐元/美元組合繼續上漲,並穩固在1.1320的50.0%斐波那契回檔位之上。因此,歐元可能繼續升值,走向下一個阻力區1.1374–1.1380。

在小時圖上,週三英鎊/美元對繼續上漲,該日收盤於接近1.3425水平。就在幾週前,還沒有跡象顯示美元會再次被拋售,但交易者對美中協議的樂觀情緒很快消退。

從美元/瑞士法郎(USD/CHF)主要貨幣對的4小時圖表中,我們可以看到一些有趣的信息,首先是USD/CHF的價格走勢與隨機指標(Stochastic Oscillator)之間出現了背離,其次出現了看跌123形態,隨後伴隨著幾個看跌的羅斯鉤。基於這些數據,我們可以看出USD/CHF目前仍受到賣方的壓力,即便有加強修正的潛力,但只要未突破並收於0.8365關口之上,USD/CHF將繼續走弱至0.8185作為其主要目標,及0.8085作為下一目標。

周三,歐元成功穩定於1.1266水平和均衡指標線之上。下一個目標水平是1.1420和1.1535。

Our new app for your convenient and fast verification

Our new app for your convenient and fast verification

InstaForex在图中

Your IP address shows that you are currently located in the USA. If you are a resident of the United States, you are prohibited from using the services of InstaFintech Group including online trading, online transfers, deposit/withdrawal of funds, etc.

If you think you are seeing this message by mistake and your location is not the US, kindly proceed to the website. Otherwise, you must leave the website in order to comply with government restrictions.

Why does your IP address show your location as the USA?

Please confirm whether you are a US resident or not by clicking the relevant button below. If you choose the wrong option, being a US resident, you will not be able to open an account with InstaTrade anyway.

We are sorry for any inconvenience caused by this message.