23.12.2024 03:07 PM

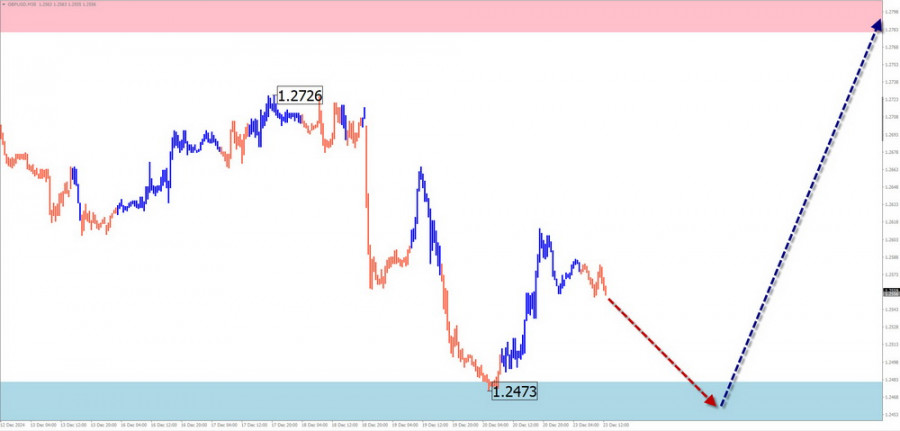

23.12.2024 03:07 PMSummary Analysis:The dominant wave for GBP/USD has been upward for the past few years, establishing a new short-term trend. Currently, the price is near the lower boundary of a strong resistance zone, forming a corrective wave (B) since late August. Although the wave structure appears complete, no clear reversal signals are evident on the chart.

Weekly Forecast:For most of the upcoming week, GBP/USD is expected to move within the range between nearby zones. After testing the support zone, a reversal and a change in direction are likely. A breakout above the resistance range within the weekly movement is unlikely.

Potential Reversal Zones:

Recommendations:

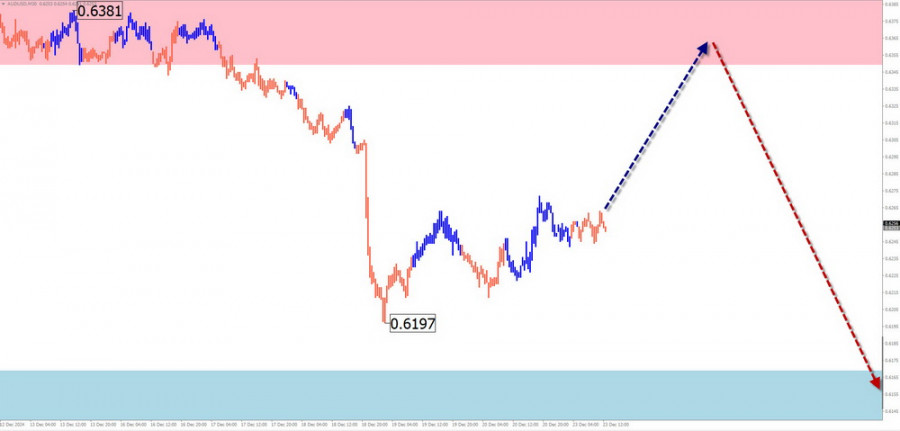

Summary Analysis:A downward wave has been forming for AUD/USD since late September. Last week, the pair developed a stretched corrective flat in a sideways range. The price broke below intermediate support, which has now become resistance. A consolidation above this level is needed before the decline resumes.

Weekly Forecast:At the start of the week, expect a short-term upward rebound, limited by the resistance zone. The bearish trend is likely to resume, pushing the price toward the support range.

Potential Reversal Zones:

Recommendations:

Summary Analysis:The short-term direction of USD/CHF has been upward since August 5. The wave structure appears complete, and the price has reached the preliminary target zone. However, there are no immediate reversal signals on the chart.

Weekly Forecast:Expect sideways movement near the calculated resistance zone early in the week. Toward the weekend, there is a higher probability of increased volatility and a potential price decline. Brief breaches of the resistance boundary cannot be ruled out.

Potential Reversal Zones:

Recommendations:

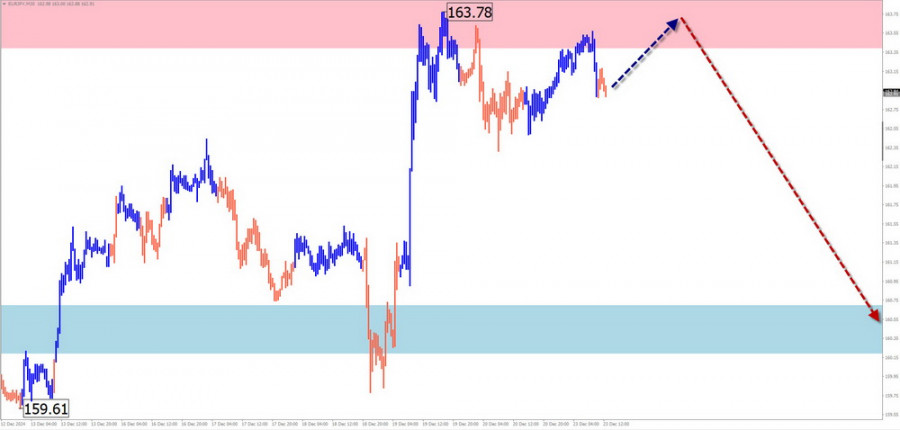

Summary Analysis:The upward wave for EUR/JPY, which began on December 3, remains unfinished. Late last week, the price reached the lower boundary of a strong potential reversal zone on a higher timeframe. Since December 19, a counter-directional wave with reversal potential has started forming.

Weekly Forecast:The price is expected to move from the resistance zone toward the calculated support zone during the week. A breakout beyond these zones is unlikely within the weekly timeframe.

Potential Reversal Zones:

Recommendations:

EUR/GBP

Summary Analysis:The short-term movements of EUR/GBP have been driven by a downward wave since March 19. The final segment (C) is forming a horizontal correction that remains incomplete.

Weekly Forecast:Sideways movement is likely at the beginning of the week, with a potential upward bias. A reversal and renewed downward movement are expected near the resistance zone. The weekly decline will likely be limited by the calculated support zone.

Potential Reversal Zones:

Recommendations:

Summary Analysis:The upward wave for the US Dollar Index, which began in late September, is ongoing. After breaking through strong resistance in mid-December, the price established a base for further growth, though it needs consolidation at current levels.

Weekly Forecast:Expect the index to complete its downward retracement within the first few days of the week. A reversal and resumption of the upward movement are likely in the second half, with gains extending toward the resistance zone.

Potential Reversal Zones:

Recommendations:

在歐元/美元的4小時圖表上,波浪形態已經轉變為上升結構,並且持續如此。很明顯,這種轉變完全是由於美國新貿易政策的影響。

英鎊/美元貨幣對的波浪結構繼續表明多頭衝動波浪形態的形成。這一波浪配置與歐元/美元的波浪形態非常相似。

在四小時的歐元/美元走勢圖中,波浪結構已轉變為看漲型態,並持續沿著這個軌跡發展。毫無疑問,這一轉變完全是由新的美國貿易政策所驅動。

在4小時圖上,歐元/美元的波浪形態已經轉變為看漲結構並保持這種形式。我相信這一變化明顯是由於美國新貿易政策的影響。

GBP/USD的波浪結構繼續指示著一個看漲的衝動波浪型態的形成。這一波浪設置幾乎與EUR/USD相同。

英鎊/美元的波浪結構持續顯示出多頭衝動波浪模式的發展。此波浪形態與歐元/美元的波浪結構非常相似。

GBP/USD 分析:自1月以來,英鎊呈上升趨勢。當前未完成的階段自4月8日開始。

對於英鎊/美元(GBP/USD)這對貨幣,浪型結構繼續顯示出看漲的衝動型趨勢。此浪型圖案幾乎與歐元/美元(EUR/USD)相同。

在4小時圖中,EUR/USD的波浪形態已經轉變為多頭結構,並且這種態勢持續不變。我相信沒有人懷疑這種轉變是全因美國新貿易政策而引起的。

Your IP address shows that you are currently located in the USA. If you are a resident of the United States, you are prohibited from using the services of InstaFintech Group including online trading, online transfers, deposit/withdrawal of funds, etc.

If you think you are seeing this message by mistake and your location is not the US, kindly proceed to the website. Otherwise, you must leave the website in order to comply with government restrictions.

Why does your IP address show your location as the USA?

Please confirm whether you are a US resident or not by clicking the relevant button below. If you choose the wrong option, being a US resident, you will not be able to open an account with InstaTrade anyway.

We are sorry for any inconvenience caused by this message.