20.03.2024 01:05 PM

20.03.2024 01:05 PM隨著交易商和投資者等待聯邦儲備局對降息前景的澄清,市場動盪不安。如聯邦儲備局主席鮑威爾發表含糊不清的聲明,可能對其產生負面影響,支撐美元匯率,也可能成為金價持續修正的依據。

此前,全球地緣政治緊張局勢和降息預期推動價格創下新高。然而,後者的延遲將引發金價繼續修正,體現出技術上的超買情況。只有如果鮑威爾最終向市場妥協並宣布今年降息計劃,另一種情況才會發生。

技術圖表與交易理念:

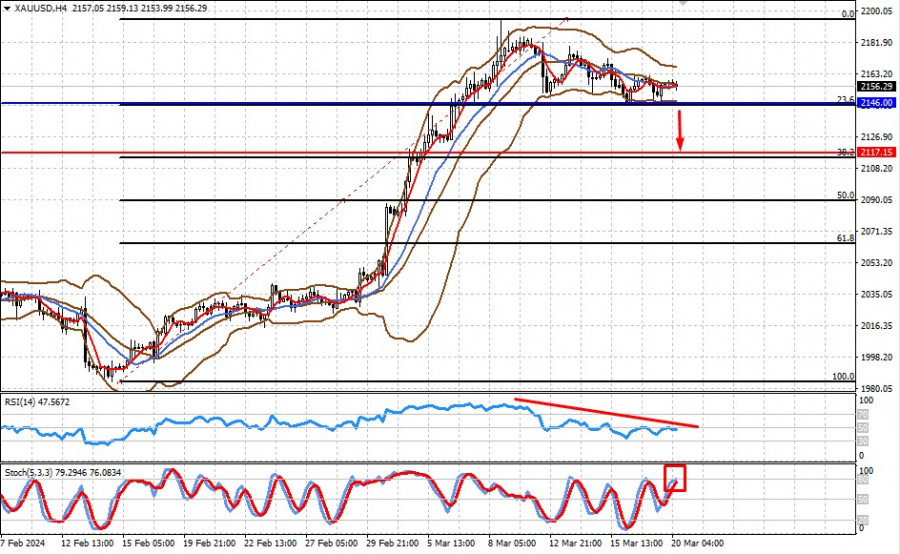

目前價格位於布林帶的中間線之上,高於SMA 5和SMA 14。RSI跌破50%水平,而隨機指標再次轉跌。

若突破2146.00支撐位將加強下行趨勢,導致下跌至2117.15,該點對應38%的斐波納契修正位。

上週,多頭刷新了歷史高點,並在3499.58形成了新的最高極點。隨後,黃金進入了一波向下修正,朝著日線短期趨勢的支撐位3346.45進行調整。

上周,市場創下新低,但賣方未能完全繼續向下運動。這可能是因為前一週的低點(141.63)被月度支撐位(141.96)所鞏固。

Your IP address shows that you are currently located in the USA. If you are a resident of the United States, you are prohibited from using the services of InstaFintech Group including online trading, online transfers, deposit/withdrawal of funds, etc.

If you think you are seeing this message by mistake and your location is not the US, kindly proceed to the website. Otherwise, you must leave the website in order to comply with government restrictions.

Why does your IP address show your location as the USA?

Please confirm whether you are a US resident or not by clicking the relevant button below. If you choose the wrong option, being a US resident, you will not be able to open an account with InstaTrade anyway.

We are sorry for any inconvenience caused by this message.