02.01.2024 01:02 PM

02.01.2024 01:02 PMGlobal markets open today, albeit not completely. Exchanges in Europe and the US have resumed operations, while the holidays continue in other regions.

Looking at the overall dynamics, investors may continue the bullish momentum noted at the end of last year. The main driver of this will be the expected easing of interest rates by the Fed and other global central banks.

Upcoming economic data, especially those related to the US labor market, will also affect the market's direction. ADP's report on the number of new jobs, which forecasts say will increase to 113,000 in December compared to 103,000 in November, could lead to a decline in dollar because the figure remains very low and the labor market needs a stable number above 200,000. Similarly, although a slight decrease in the number of jobless claims, from 218,000 to 215,000, may be seen, the total number remains above 200,000.

Official data from the US Department of Labor will also attract attention as it will show changes in employment in December, the number of new jobs, the average length of the workweek, and the average hourly earnings. For the number of new jobs, a decrease in growth from 199,000 to 163,000 may occur. The unemployment rate may slightly rise from 3.7% to 3.8%, while the average length of the workweek may remain at 34.4 hours. Hourly earnings may decrease from 0.4% to 0.3%.

A worsening situation in the labor market will be a strong signal for the purchase of risk assets and the weakening of dollar. Such a piece of news can be interpreted by the Fed as an important reason to start lowering interest rates in the first quarter of 2024.

Forecasts for today:

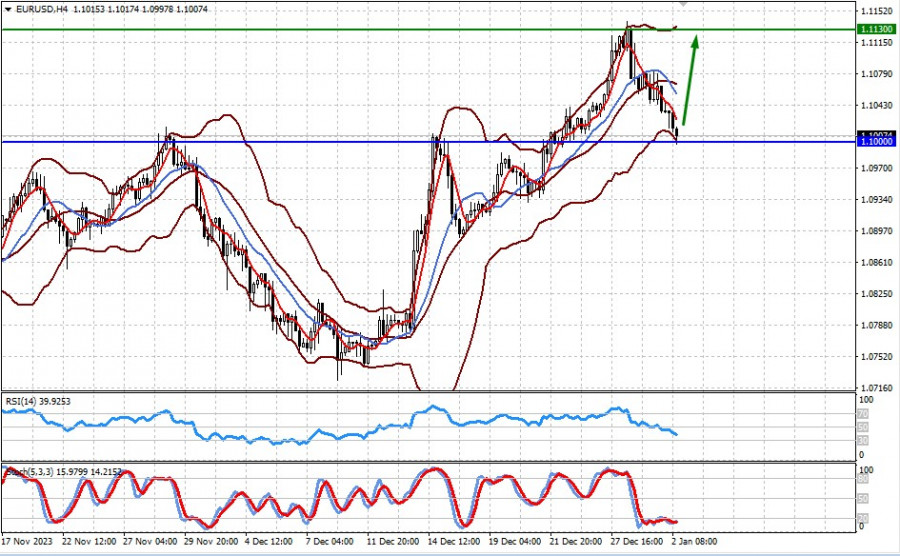

EUR/USD:

The pair found support at the level of 1.1000. The worsening situation in the US labor market, as well as the likely resumption of inflation growth in the Eurozone, could be the basis for growth to 1.1130.

GBP/USD

The pair traded at 1.2700. Weakening dollar due to a bleak picture in the US labor market may lead to an increase to 1.2825.

星期一,我感覺到歐洲似乎很少有人知道馮德萊恩即將做出的讓步。美方的談判可能不僅僅是對歐盟委員會主席提出要求,馮德萊恩也並非獨自審閱這些要求。

在8月1日——談判最後期限——的四天前,歐盟和美國宣布簽署了一項貿易協定。這項協定在歐洲受到了大量批評,我能理解為什麼。

「含淚的慶祝」——這或許是形容歐洲對美歐貿易協定簽署反應的最準確方式。歐盟委員會主席烏蘇拉·馮·德萊恩受到了強烈批評——幾乎沒有人對該協議給予好評。

所有的新事物都是遺忘的舊事物。到2024年底,對於歐元/美元的看跌預測變得普遍。

趨勢讓位於整合,整合為新趨勢鋪平道路。這是市場的本質,而比特幣也不例外。

在亞洲交易時段的早盤反彈之後,歐元迅速恢復了下跌趨勢。顯然,投資者已經意識到歐盟和美國之間的貿易協議並不是一場勝利,而是一場失敗。

日圓繼續在走強的美元面前失去地位。 週日,美國與歐盟達成貿易協議的消息,以及美國和中國官員即將舉行的延長貿易休戰會晤,正在為市場帶來樂觀情緒。

東京的年通脹率從6月的3.1%下降至7月的2.9%。不包括食品和能源價格的核心指數也同樣從3.1%放緩至2.9%。

Our new app for your convenient and fast verification

Our new app for your convenient and fast verification

培训视频

Your IP address shows that you are currently located in the USA. If you are a resident of the United States, you are prohibited from using the services of InstaFintech Group including online trading, online transfers, deposit/withdrawal of funds, etc.

If you think you are seeing this message by mistake and your location is not the US, kindly proceed to the website. Otherwise, you must leave the website in order to comply with government restrictions.

Why does your IP address show your location as the USA?

Please confirm whether you are a US resident or not by clicking the relevant button below. If you choose the wrong option, being a US resident, you will not be able to open an account with InstaTrade anyway.

We are sorry for any inconvenience caused by this message.