21.12.2023 01:20 PM

21.12.2023 01:20 PMOn Wednesday, inflation data for the United Kingdom was published, dropping to the September 2021 low. The Consumer Price Index fell from 4.6% to 3.9%, versus the expected 4.3%. Thus, the Bank of England is likely no longer able to avoid the question of reducing the interest rate. The reaction of the pound sterling was corresponding, which swiftly began to decline in value.

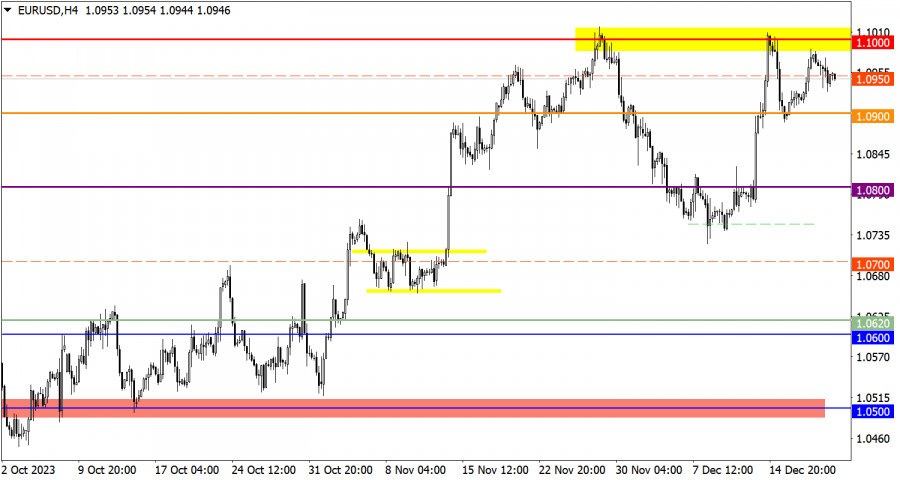

The EUR/USD currency pair reduced the volume of long positions near the 1.1000 mark. This move led to another rebound in price from the resistance level.

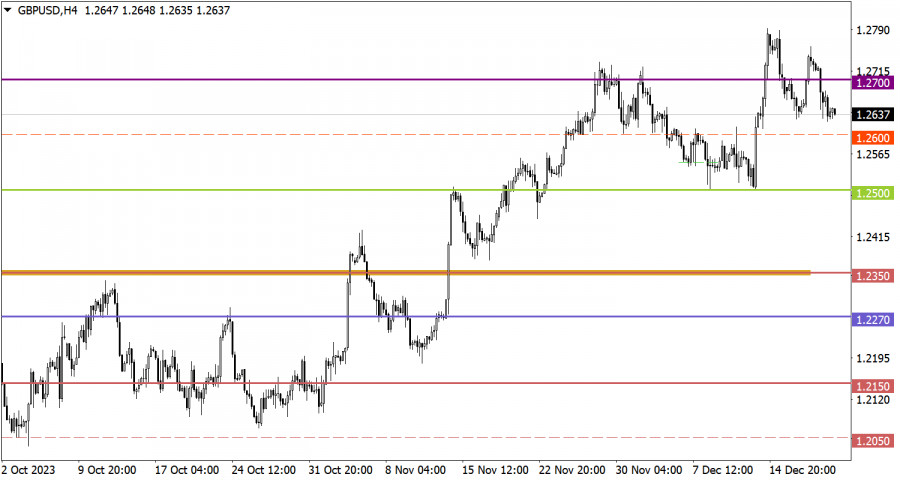

The GBP/USD pair traded in a downward trend, during which the quote managed to update the local low of the correction cycle.

Today, the publication of data on jobless claims in the United States is expected, where an overall increase in this indicator is predicted. Statistical data details indicate that the volume of continuing claims for benefits may rise from 1.876 million to 1.888 million, and the volume of initial claims may rise from 202,000 to 215,000.

Time Targeting:

U.S. jobless claims – 13:30 UTC

With further decline, the quote may reach the level of 1.0900. To continue the upward trend, price stabilization above the level of 1.1000 is necessary.

If the price stabilizes below 1.2600, this may lead to further depreciation of the pound sterling to the level of 1.2500.

As for the upward scenario, for its consideration, the quote needs to first rise above the level of 1.2700 with confirmation on the daily period.

The candlestick chart type is white and black graphic rectangles with lines above and below. With a detailed analysis of each individual candle, you can see its characteristics relative to a particular time frame: opening price, closing price, intraday high and low.

Horizontal levels are price coordinates, relative to which a price may stop or reverse its trajectory. In the market, these levels are called support and resistance.

Circles and rectangles are highlighted examples where the price reversed in history. This color highlighting indicates horizontal lines that may put pressure on the asset's price in the future.

The up/down arrows are landmarks of the possible price direction in the future.

在週四的一整天裡,歐元/美元貨幣對進行了雙向交易。宏觀經濟背景豐富,但正如我們所預期的,它沒有產生決定性的影響。

星期四,英鎊/美元貨幣對的交易呈現低波動的橫向走勢。儘管有著繁忙的宏觀經濟日曆,市場如預期一樣忽視了大多數數據。

週四,EUR/USD 貨幣對只顯示了一種情況——完全不願意移動。儘管宏觀經濟日曆十分緊湊,但我們整天觀察到橫盤整理。

歐元/美元貨幣對在周三的一半時間內出現了上升趨勢。雖然這次歐元的最新「激增」尤其「令人印象深刻」,但很可能只是美元的又一次下跌。

EUR/USD 貨幣對在週三繼續上行,但僅是短暫的。在下午時段,歐元開始下跌,儘管缺乏支持此類變動的宏觀經濟因素。

週二,英鎊/美元貨幣對經歷了顯著增長,儘管背後並無明確的推動因素。週一,美元因為特定原因走強,但週二卻毫無原因地下跌,只因為這就是美元。

InstaForex

PAMM账户

Your IP address shows that you are currently located in the USA. If you are a resident of the United States, you are prohibited from using the services of InstaFintech Group including online trading, online transfers, deposit/withdrawal of funds, etc.

If you think you are seeing this message by mistake and your location is not the US, kindly proceed to the website. Otherwise, you must leave the website in order to comply with government restrictions.

Why does your IP address show your location as the USA?

Please confirm whether you are a US resident or not by clicking the relevant button below. If you choose the wrong option, being a US resident, you will not be able to open an account with InstaTrade anyway.

We are sorry for any inconvenience caused by this message.