06.02.2023 11:25 AM

06.02.2023 11:25 AMFriday's main event was the United States Department of Labor report, which caused a strong reaction in the financial markets.

Report details:

- Unemployment fell to 3.4% from 3.5%, with a forecast increase to 3.6%.

- Change in the number of people employed in the non-agricultural sector (January) +550,000, with a forecast of +185,000. We have indicators above December.

- Average hourly wages fell to 4.4% YoY from December's 4.9%.

The statistics turned out to be better than all forecasts. A strong January jobs report indicates that the U.S. economy can handle further interest rate hikes. As a result, the U.S. dollar strengthened in the financial markets.

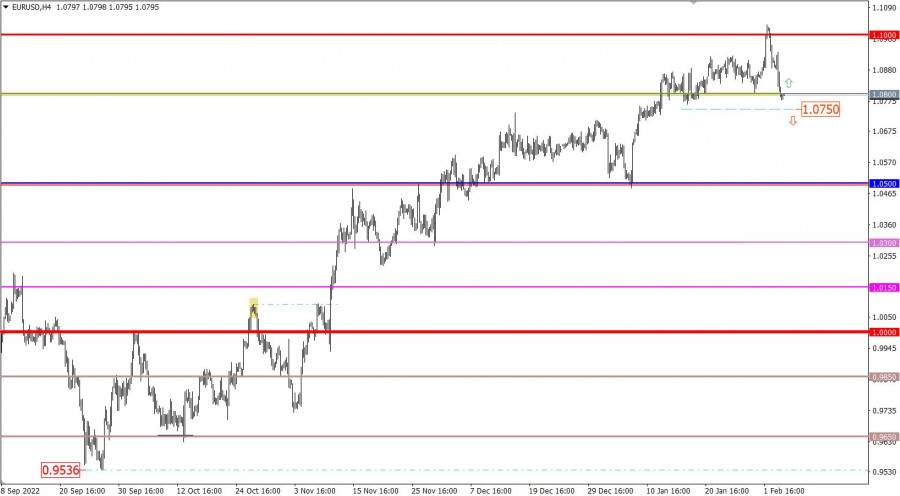

The EURUSD currency pair accelerated its decline due to the strong information and news background. As a result, the quote not only reached the level of 1.0800, it managed to stay below it in a four-hour period. This price move at least indicates a slowdown in the upward trend.

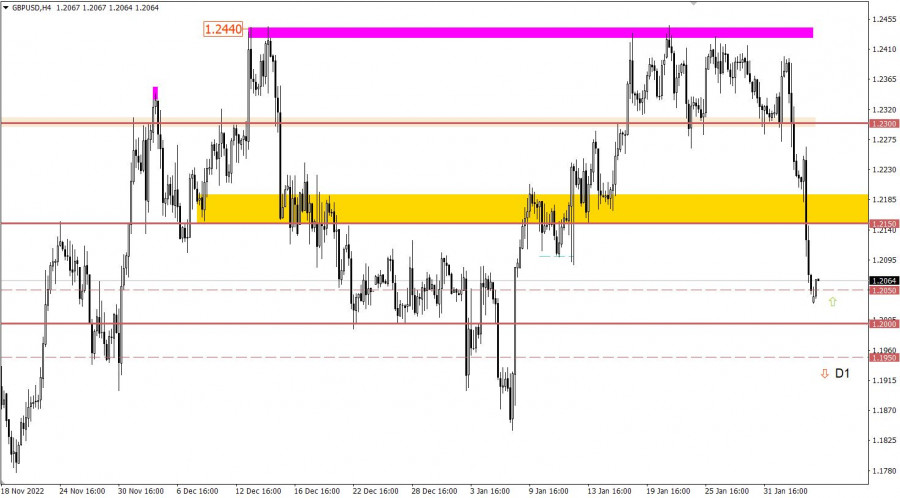

The GBPUSD currency pair, during the inertial downward movement, came close to the 1.2000 psychological level. In view of the fact that the market has a status of oversold pound sterling, as well as the convergence of the price with the control level, there was a reduction in the volume of short positions. This slowed down the inertial movement.

Statistics from the U.K. and the European Union are expected.

UK construction PMI for January is estimated to rise from 48.8 to 49.6. The construction sector is an important part of the British economy.

EU retail sales may slowdown its decline from -2.8% to -2.6% in annual terms.

Time targeting:

United States Department of Labor Report – 13:30 UTC

In order to consolidate the sellers' positions on the euro, the quote needs to hold below the value of 1.0750. In this case a subsequent decline in the euro rate in the direction of 1.0650–1.0500 is possible.

As for the reversal, it is also considered by the traders in the scenario of the price rebound from the level of 1.0800. In this case the technical signal of an oversold euro, caused by the inertial move, is taken into account.

The absence of a breakdown of the psychological level will lead at least to stagnation. Ideally, the 1.2000 level will play the role of support, in this case, a pullback in the direction of 1.2150 is possible.

As for the prolongation of the downside scenario, it will be considered by traders if the price remains below 1.1950, preferably in the daily period.

The candlestick chart type is white and black graphic rectangles with lines above and below. With a detailed analysis of each individual candle, you can see its characteristics relative to a particular time frame: opening price, closing price, intraday high and low.

Horizontal levels are price coordinates, relative to which a price may stop or reverse its trajectory. In the market, these levels are called support and resistance.

Circles and rectangles are highlighted examples where the price reversed in history. This color highlighting indicates horizontal lines that may put pressure on the asset's price in the future.

The up/down arrows are landmarks of the possible price direction in the future.

在我今天早上的預測中,我專注於1.3310的水平並計劃從這裡做出交易決策。讓我們看看5分鐘的圖表,看看發生了什麼。

在我的早間預測中,我專注於1.1391水平並計劃在該點位附近做出入市決策。我們來看看5分鐘圖表,評估發生了什麼情況。

在星期四,英鎊/美元貨幣對繼續以「歐元模式」交易。日內波動相對較弱,技術分析顯示趨勢可能會向下轉變。

在今天早上的預測中,我突出強調了1.3293水準,並計畫以此作為進入市場的參考點。我們來看看5分鐘的圖表並分析發生了什麼。

在我早上的預報中,我主要關注了1.1358這個水平,並根據它來做出交易決策。讓我們看一下5分鐘的圖表,來了解發生了什麼事。

週三,英鎊/美元的匯率走勢緊隨歐元/美元匯率的變動,進一步證實了當前局勢取決於美元。而美元的命運完全取決於唐納德·特朗普的意願。

週三,歐元/美元貨幣對的交易表現波動。全天內,價格多次改變方向,這些逆轉並非由宏觀經濟數據引發。

培训视频

Your IP address shows that you are currently located in the USA. If you are a resident of the United States, you are prohibited from using the services of InstaFintech Group including online trading, online transfers, deposit/withdrawal of funds, etc.

If you think you are seeing this message by mistake and your location is not the US, kindly proceed to the website. Otherwise, you must leave the website in order to comply with government restrictions.

Why does your IP address show your location as the USA?

Please confirm whether you are a US resident or not by clicking the relevant button below. If you choose the wrong option, being a US resident, you will not be able to open an account with InstaTrade anyway.

We are sorry for any inconvenience caused by this message.