24.10.2022 12:00 PM

24.10.2022 12:00 PMUK retail sales data showed an acceleration in the pace of decline from -5.4% to -6.9%, with expectations at -4.8%.

The reaction of the pound sterling to the negative statistics was appropriate; it continued to decline.

What are they talking about in the media?

The Wall Street Journal published an article at the close of the European session, which said that during the November meeting of the Fed, there may well be hints about a future pause in raising interest rates.

On this, the market played a sell-off of dollar positions.

Friday's key event was another currency intervention in USDJPY, which provoked a collapse of the dollar index by 1.5%. This step supported risky assets, at the same time stimulated dollar sellers.

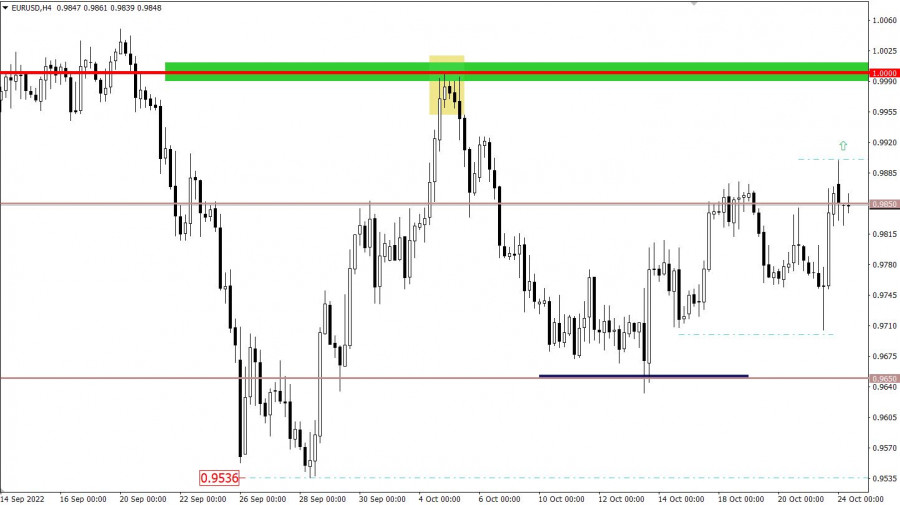

The EURUSD currency pair returned to the intermediate level of 0.9850 during the impulse price jump, locally overcoming it.

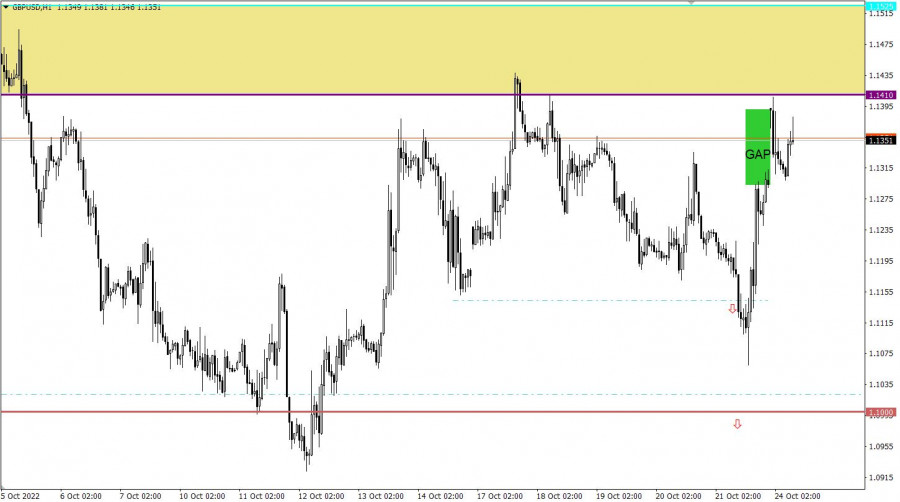

The GBPUSD currency pair showed strong activity at the end of last week. As a result, the pound sterling first collapsed by more than 150 points, approaching the psychological level of 1.1000, and then strengthened by 250 points. This kind of V-shaped amplitude indicates a multidirectional trading interest among market participants.

Preliminary data on business activity indices in Europe and the United Kingdom have already been published today, where the indicators came out worse than expected.

Details:

The Eurozone manufacturing PMI for October fell from 48.4 to 46.6 points, with a forecast of 47.8 points. Services PMI fell from 48.8 to 48.2 points, while composite PMI fell from 48.1 to 47.1 points.

The euro reacts to the statistics with a decline.

The UK manufacturing PMI for October fell from 48.4 to 45.8 points, with a forecast of 48.0 points. Services PMI fell from 50.0 to 47.5 points, with a forecast of 47.5 points, while composite PMI fell from 50.0 to 47.5 points.

The pound reacts to the statistics with a decrease.

During the American trading session, the US manufacturing PMI is also expected, which is predicted to decrease from 51.1 to 52.0 points.

Time targeting:

US Manufacturing PMI – 13:45 UTC

In terms of information flow, traders should pay special attention to the political race for the seat of the British Prime Minister. This news may provoke new speculative price hikes.

In this situation, the level of 0.9850 once again led to a reduction in the volume of long positions in the euro. This step, in turn, led to a slowdown in the upward cycle, as a result of the price pullback. It can be assumed that the strongest technical signal to buy the euro may occur only after the quote holds above 0.9900 in a four-hour period. Otherwise, the pullback/stagnation scenario will be relevant in the market.

The new trading week was opened with an upward price gap of about 100 points, which led to touching the lower border of the 1.1410/1.1525 resistance area. On the basis of such a sharp strengthening of the pound, there was a technical signal of overbought in short-term time periods. This has already led to a pullback, but the strengthening of short positions on the pound may occur after holding the price below the gap - 1.1290.

As for the upward scenario, the quote needs to return to the resistance area. As to how speculators will behave within the values of 1.1410/ 1.1525, the subsequent course of the price will be clear.

A candlestick chart view is graphical rectangles of white and black light, with sticks on top and bottom. When analyzing each candle in detail, you will see its characteristics of a relative period: the opening price, closing price, and maximum and minimum prices.

Horizontal levels are price coordinates, relative to which a stop or a price reversal may occur. These levels are called support and resistance in the market.

Circles and rectangles are highlighted examples where the price of the story unfolded. This color selection indicates horizontal lines that may put pressure on the quote in the future.

The up/down arrows are the reference points of the possible price direction in the future.

英鎊/美元貨幣對在週四甚至未嘗試進行修正。儘管歐元因歐元區和德國的商業活動指數疲弱而面臨看跌壓力,但英鎊並沒有這樣的下跌驅動因素。

週四,EUR/USD 貨幣對在小時圖上校正至最近的支撐位1.1267。歐元下跌是由多個因素引起的。

週四,歐元/美元貨幣對走低,這可以被視為一般趨勢的一個例外。當天幾乎所有的宏觀經濟報告對歐元不利,而市場對美元則顯示出一些寬容。

英鎊/美元匯率在星期三維持其上升趨勢,這一動向已經持續了過去的兩週。回顧美國和中國削減互相關稅115%的消息引發了最近一次的美元強勢。

週三,歐元/美元貨幣對繼續保持著冷靜而穩定的上升趨勢。價格突破了之前多次未能超越的1.1267水平,並形成了一條新的上升趨勢線。

Your IP address shows that you are currently located in the USA. If you are a resident of the United States, you are prohibited from using the services of InstaFintech Group including online trading, online transfers, deposit/withdrawal of funds, etc.

If you think you are seeing this message by mistake and your location is not the US, kindly proceed to the website. Otherwise, you must leave the website in order to comply with government restrictions.

Why does your IP address show your location as the USA?

Please confirm whether you are a US resident or not by clicking the relevant button below. If you choose the wrong option, being a US resident, you will not be able to open an account with InstaTrade anyway.

We are sorry for any inconvenience caused by this message.